National Farmers Alliance

The truth is, the most enormous power known to man, or that can ever be his, lies in money — in the increase and decrease of its quantity. It is the tide of human affairs upon which all things must rise or sink. It is inevitable and cannot be resisted. This power has been obtained through the carelessness of the people, who have been and are now held in ignorance for that very purpose. So early as 1577 we find the keen and piercing intellect of Bodin saying the following: "For men have so well obscured the facts about money that the great part of the people do not see them at all. The moneyers do as the doctors do, who talk Latin before women, and use Greek characters, Arab words, and Latin abbreviations, fearing that if people understood their receipts they would not have much opinion of them.”

NELSON A. DUNNING, JOURNALIST AND AUTHOR FOR THE NATIONAL FARMERS ALLIANCE from The Philosophy of Price, and Its Relation to Domestic Currency, Second Edition

A Penny (Dollar) For Your Thoughts

by Kevin McCormick, GPTX

In another encroachment into Congressional power, President Donald Trump ordered the United States Mint to stop producing one cent coins—no more pennies!

For far too long the United States has minted pennies which literally cost us more than 2 cents. This is so wasteful! I have instructed my Secretary of the US Treasury to stop producing new pennies. Let's rip the waste out of our great nations budget, even if it's a penny at a time.

Donald Trump, Truth Social

It should be noted that Trump once again missed the mark, as the five cent coin, the nickel, costs 13.78 cents to produce.

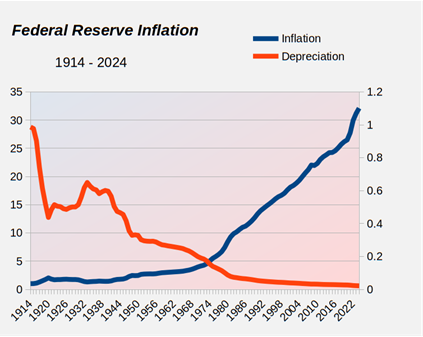

The underlying reason for the loss of seigniorage for these coins is the Federal Reserve monetary system and its constant inflation of the debt-based money supply. Inflation is necessary for debt payments and for the Federal Reserve system to continue. Since the creation of the Federal Reserve System in 1913, the value of one dollar has declined to approximately 2 cents relative to the 1913 value. Conversely, to match the value of one 1913 dollar, a person needs thirty-two dollars in 2024 Federal Reserve Notes. The chart, with data from inflationdata.com, based on the Consumer Price Index, shows the progress of dollar debasement under the Federal Reserve System.

Over the span of the Federal Reserve System, a financial royalty has grown and become ever more powerful. The means of enriching this oligarch class is monetary inflation and the unequal distribution of inflated money. The lower classes receive less than a proportionate share of inflated money, while the oligarch class receives a greater than proportionate share. The graph shows the relative changes in population, wages, and money supply since 1960. The U.S. population has grown from 179 million in 1960 to 339 million in 2024, an 89.4% increase. The average hourly wage of production and non-supervisory employees has grown from $2.50/hr in 1964 to $29.61 in 2024 an 1084% increase. The M2 money supply has grown from $312.4 billion in 1960 to $21,498.5 billion in 2024, an 6781% increase. (Data from FRED Federal Reserve Bank of St. Louis; series: POPTHM, M2NS, AHETPI)

If hourly wages had grown at the rate of the M2 money supply, adjusted for population growth, the 2024 average wage would be $89.70 per hour (2.5 * 67.81 / 1.89).

To paraphrase a quote from John Maynard Keynes:

By a continuing process of inflation, [the Federal Reserve Monetary System] can confiscate, secretly and unobserved, an important part of the wealth of … citizens. … The process … does it in a manner which not one man in a million is able to diagnose.

– John Maynard Keynes, The Economic Consequences of the Peace

The results of this continuing inflation appear in many, seemingly unrelated ways. For example, the United States has 1.9 million incarcerated prisoners, making the United States the world leader in both total prison population and incarceration rates per capita. As explained in the video Why America Solves Inequality with Prisons | John Clegg & Clara Mattei:

[M]ass incarceration and the prison-industrial complex aren't policy mistakes, they're how American capitalism protects wealth and manages inequality. Prisons become an austerity strategy: cheap for budgets and the wealthy, brutally costly for the poor and working class, who are kept scared, precarious, and easier to control. Fixing crime would mean taxing the rich and redistributing power and resources into real security and dignity — housing, healthcare, education, childcare, mental health care. Instead, the U.S. starves the safety net and uses prisons as the cheapest way to manage the fallout.

It was during the Reagan administration in the 1980's that the neo-liberal agenda of the financial elite and the Federal Reserve banking cartel was implemented as a matter of policy. The regulations and usury limits governing America's financial sector and banking cartel were considerably reduced or eliminated. The Federal Reserve, under chairman Paul Volker, raised interest rates to extremely high levels to induce a recession and transfer income to the financial elite, manufacturing was transferred to low wage countries, and the working class was undermined in many ways. Note that, as shown in the graph above, the M2 money supply continued to inflate in the 1980's despite the claim that this austerity was needed to combat inflation.

While the working class lost ground under a multi pronged assault, the financial elites gained new privileges and were hugely enriched by monetary inflation directed into financial markets by the banking cartel. The data is presented in a 2020 RAND working paper, Trends in Income From 1975 to 2018. Through deliberate policies against the working class and the device of directing monetary inflation to securities markets and the elites, the Federal Reserve played a vital role in creating a generation of billionaire oligarchs from the stolen wages of the American working class. Through inflation everyone's incomes increase, but some increase much more than others. As John Maynard Keynes said, the distributive role of inflation by the Federal Reserve is imperceptible—the most damaging impacts take decades to play out. Rather than a dramatic injustice, it is more like a slow-moving disaster.

As I have argued in other articles, replacing the Federal Reserve monetary system with a public money system as described in the NEED Act and the Green Party platform is a foundational issue which should be incorporated into nearly every progressive cause. It is fundamentally essential for the public to gain democratic control over the monetary system — the creation, issuance, and circulation of money — in order to achieve a lasting transition to a more just and sustainable society.

Critical Thinking on the Money System

by Rita Jacobs, GPMI

Let's pose a specific question and analyze it using critical thinking: "Do banks have a significant effect on public policy in the United States?" We need to first of all to define what we mean by public policy: "Public policy can be generally defined as a system of laws, regulatory measures, courses of action, and funding priorities concerning a given topic promulgated by a governmental entity or its representatives." We should probably narrow our question to a specific topic within the public policies promoted by the government. Since "defense spending" appears to be high on the list of public policy priorities as displayed in the annual budget and ongoing legislation affecting "defense," it would make sense to narrow our question further and ask: "Do banks have a significant effect on the government policy of prioritizing spending on "defense?"

Let's start this discussion by looking at what is involved in critical thinking. Here is one rather short definition: "Critical thinking is that mode of thinking—about any subject, content, or problem—in which the thinker improves the quality of his or her thinking by skillfully taking charge of the structures inherent in thinking and imposing intellectual standards upon them." And as it is further explained:

"It entails the examination of those structures or elements of thought implicit in all reasoning: purpose, problem, or question-at-issue; assumptions; concepts; empirical grounding; reasoning leading to conclusions; implications and consequences; objections from alternative viewpoints; and frame of reference."

Let's start our critical thinking by listing some things we might already know that might be applicable to the question:

- Banks are the ultimate profiteers of the perpetual wars.

-

Candidates with the highest campaign spending win elections 90% of the time.

-

Banks are the largest contributors to candidates running in Congressional campaigns.

-

Public opinion has virtually no impact on public policy decisions.

-

In 2022 there were 25 members of Congress who owned stock in military contractors and also served on committees that oversee military expenditures; many other members of Congress also own stock in military contractors.

-

Elected officials spend 30-70% of their time in office fundraising for the next election.

-

At the end of 2023, 486 federal lobbyists were working on behalf of banks with $50 billion or more in assets and seven trade groups.

-

Commercial banks have the privilege of creating most of the money entering the economy when they make loans, and also determine where to make the loans (Federal Reserve Act of 1913).

-

Financial institutions are the majority of founders of the Corporate Program of the Council on Foreign Relations (CFR)*, and many past and present bankers are individual members of CFR. CFR is the most influential think tank that advises government officials on foreign policy.

-

Those elected officials who have performed well for the large contributors to their election campaigns, are often given lucrative positions as lobbyists when they leave Congress (the Revolving Door concept).

This might be an adequate list of factors to consider. This is a judgment call. It might change as we deliberate about our question. Our next step would be to evaluate the information we do have, and see if that information comes from sources that are unbiased and reliable. This is another judgment call. Reliable sources might be university studies and publications, documented articles from authors known to be reliable, and authors who are likely to be knowledgeable about the subject matter, and have no known reason to be biased.

After assessing the reliability of the information we have, does that information answer our question: Do banks have a significant effect on the government policy of prioritizing spending on "defense?" What can we deduce from the information we have? First of all, it is an indisputable fact that a priority of banks is to earn profits for their investors. I have quotes around the word defense, since it is pretty much a given fact that what our government terms "defense spending" is money actually spent on wars of aggression under the guise of spreading democracy to the countries that are the victims of the aggression. The wars are a great source of profits that keep on giving, since the products produced by the military contractors are products that are often destroyed when used in actual combat or become obsolete because of development of more sophisticated weapons and equipment. Military weapons are the biggest export item in the U.S. This can be opportunity for supplying both sides of a conflict. Given these additional facts, coupled with the amount of money banks spend on lobbying, it would be reasonable to deduce that the banks have would have reasons and the ability to affect the priority of the government in spending on "defense."

This mental exercise also reveals corruption in the government system, including the creation of a climate where democracy has little meaning. When public opinion has no impact on policy-making decisions, there is really no democracy at work.

* "Founded in 1953 with twenty-five corporate members, the Corporate Program has since expanded to include more than 120 global member companies from sectors ranging from financial services to health care and manufacturing. Through CFR's unmatched convening power, the program links private-sector leaders with decision-makers from government, media, nongovernmental organizations, and academia to discuss issues at the intersection of business and foreign policy."

Is AI Too Big to Fail?

by Eugene Woloszyn, GPFL

OpenAI's Finance Chief May Have Said the Quiet Part Out Loud

I was shocked recently when JPMorgan Bank estimated US AI investments were to be $1.2 Trillion. This is about 80% of growth in GDP in 2025 & is driving the stock market. But this article says the BUBBLE is much greater & might need a "guarantee" OR "government BACKSTOP". Only one AI Corp(OPEN AI) "has made about $1.5 Trillion in spending commitments against current annual revenue of $13 Billion".

When crypto or AI blows up, as in 2008 & 2020, taxpayers will hear pleas (& then DEMANDS) for BAILOUTS to "rescue the entire financial system", although we had no part in such Frenzied Recklessness.

In January 2025, China Corp. DEEPSEEK has shown that using cheap computer chips & a small budget, a successful open source AI system can be created. We on this committee have used DEEPSEEK & were impressed. People around the world can freely use DEEPSEEK because it is open source & they can build more sophisticated applications on top of it. The US AI companies are all strictly proprietary with secret software & each is making similar huge investments with no overall coordination or master plan to subdivide tasks for a cheaper result. This has EXPENSIVE BUBBLE written all over it.

Big Body Medicine

by Howard Switzer, GPNC

Shrinking the Corporate Tumor

My friend David Kubiak put forth a theory called Big Body Theory, "a strategic subset of living systems thinking that recognizes large hierarchical human organizations as emergent new life forms, and examines their evolution, anatomy, behavior and eco-social impact." He argues that the problem inflicting the world is the massive scale of these systems, the corporate conglomerates, whose interests coincide around extracting and accumulating the wealth of the earth for personal gain. Also, the response by people who care, the activists, has been inadequate because they don't recognize them as a whole living systems and are thus fragmented into kind of first responder single issue groups. This is better explained by David himself in this 2012 interview he did with Graham Hancock.

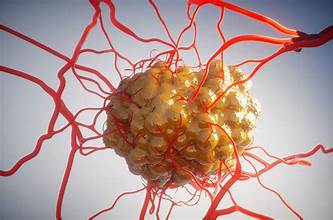

Business and political leaders have hailed the advent of these mega corporations as a welcome and even inevitable evolutionary advance into efficient global economic integration while many indigenous and activist thinkers abhor these bodies' inhuman scale, unprecedented power and aggressive growth agendas. They often characterize them as monstrous parasites or liken them to an alien invasive species, but most frequently as malignant cancers growing in the body of the world, overwhelming the immune response.

Occupy Wall Street was seen as a hopeful coming together of these many groups and while each made their bids to the group on their issues, their egos got in the way of forming a cohesive whole capable of formulating a strategy to shrink the Big Bodies at the root of every issue. While they organized on Wall Street recognizing the economic injustice of it all they did not see or understand the common tool wielded as a weapon to accomplish their goals, which is the credit form of money that is the life blood of these big bodies. Without that they could not operate, they could not grow. Without that they could never have gained such a powerful influence as getting the courts to grant them human rights.

Most people have an aversion to these Big Body systems because the scale that is difficult to comprehend and most would love not to be ruled by the super-rich but to instead have a real, not fake, democracy with no very rich and no very poor. Most people have no problem with those who work harder, longer or smarter having more, rather it is those having more who contribute nothing to the betterment of the community that people resent.

The world has gotten so chaotic now that it seems the time has come to recognize these monstrous living systems and begin to organize an effort to rob them of their life's blood through sovereign monetary reform. I have joined with others in that effort thinking it was education about their monetary system and sovereign monetary reform that was the key to turning on the lights in people's minds. We've formed organizations that see that as a critical element to organizing an effective movement for change. Despite that, the groups seem to bog down in the minutia of monetary theory details. It has also been a frustrating exercise as we rarely elicit the enthusiastic response necessary from the politicians, activist organizations and other people we've contacted. The experience has brought me to the realization that the question is how do we get people to set aside their egos enough to form an anti-body powerful enough to shrink these corporate tumors?

There is a growing awareness that partisan politics is getting us nowhere and that the mass media is not telling the truth about a range of important topics. That being the case, people might be interested in a post-partisan discussion about the common threats to their collective wellbeing and what can be done to address them. One solution might be what Nicole Negowetti calls "post-partisan practice."

She writes,

I see potential for this in the widening rift between the MAHA movement and the public-health community. Their disagreements are real—about evidence, institutional trust, bodily autonomy, and collective responsibility. Yet while they prepare to battle each other, pharmaceutical and food-industry profits rise, chronic disease remains widespread, and communities stay disempowered. Post-partisan practice doesn't ask these groups to agree or even to debate their deepest beliefs. It asks a simpler, more strategic question: Where could collaboration increase our shared power to challenge the forces harming us all?

Pharmaceutical and food industry accountability. Regulatory independence. Community control over local health decisions. Transparent, independent research.

You can work with someone on corporate capture while opposing their stance on vaccines. You can collaborate on local food systems while disagreeing with federal nutrition policy. This isn't about harmony; it's about power and discernment. Who benefits when MAHA and public-health advocates exhaust themselves fighting each other instead of organizing together against systems that serve neither? The question is who benefits? This is where post-partisan practice begins.

Polarization is not a failure of communication; it's a business model. Media platforms, political actors, and algorithms profit from outrage. Simplification sells; nuance doesn't. The system doesn't need everyone to be polarized, only enough of us distracted. While we argue over ideology, concentrated power deepens its hold. Binary thinking offers comfort from certainty, identity, and clear enemies. Mainstream media rewards it, institutions depend on it, and our nervous systems default to it under stress. Yet that comfort is costly. While we debate whether to trust institutions or defend autonomy, children grow sicker, ecosystems unravel, and corporate power tightens its grip.

Post-partisan practice could reposition conflict and help us discern which battles are worth our energy and who we can stand beside, even in disagreement. Sometimes that means opposition; sometimes, unlikely alliances. Always it means asking: Who benefits from how this is structured, and what would it take to shift that balance of power?

Of course, to shift the balance of power one must know how power is derived.

In the example above it is clear that corporate power is the problem. It is also easy to make the connection between the depressed economy and numerous other issues with corporate power. Once that is acknowledged it is easy to make the case that corporate power is money power. There is plenty of evidence and everyone knows money is what corruption runs on. Without money they would not have such power over the government and the economy. Money is so important, one must wonder why we weren't taught where it comes from in school? Such a discussion could lead to people seeing a common thread running through all the issues they are struggling with.

To allow money to become a source of revenue to private issuers is to create, first, a secret and illicit arm of the government and, last, a rival power strong enough ultimately to overthrow all other forms of government.

– Frederick Soddy

- Our current monetary system is institutionalized usury.

-

- Usury:

- The abuse of monetary authority for personal gain.

- The great religions and philosophers condemned usury.

-

Dante described it as

An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.