How to Kickstart Planetary Recovery:

Reaffirm the Constitution! Nationalize the Money!

By Steven Showen

Many people are hurting economically. They're in survival mode. The climate is in crisis, fires, droughts, floods, sea level rise. Species are going extinct before our very eyes. Students are burdened with a lifetime of debt. Youth are suing the government for stealing their future. The COVD pandemic lurks. Oppression, race, poverty and gender issues glare. Wars rage on. The latest devastating UN report on Climate Change warns the crisis is accelerating and we’re running out of time. Despite decades of alarm calls, inconvenient truths and people marching, we're in a planetary death spiral that nobody seems to be able to stop, and many have refused to acknowledge.

The Climate Report impels us “to act boldly and urgently”. What is needed is an immediate super massive investment in transformational solutions, totally displacing the death dealing legacy systems with planet friendly energy production, industry and agriculture. How can that happen with so much entrenched interests in the last gasp status quo? Where can such a massive infusion of life saving resources, guided by an inspiring vision for the future, come from?

Congress is ineffectual, belatedly debating a relief bill insufficient to the task of planetary recovery. The Congresses we’ve known are creatures of the voracious for-profit Wall Street juggernaut, which got us into this mess and is plowing full speed ahead into the flames, waving flags of sustainable green and bellowing free markets, freedom and democracy, whilst devouring people and planet and wrecking peace, and now censoring voices critical of totalitarian policies.

Take heart, friends! We the People CAN stop this doom machine in its tracks. We CAN build the bright future for people and planet we've always dreamt about, a movement that will shift the prevailing paradigm from greed to care.

The secret is in understanding the fundamental power that drives the machine's insatiable appetite, a power that demands it be fed till there is nothing left, a power stolen from We the People and turned on its head. Originally, the Constitution granted Congress the power to coin money and regulate its value, empowering it to “establish Justice, ensure domestic Tranquility,” and to “promote the general Welfare.” But Congress is now at the mercy of those who hijacked this sovereign right, the private banking cartel. Today the Lords of Wall Street virtually own Congress, and bend it to their sole purpose of generating profit, at the expense of all else of value.

Once heisted, this magical-like power to create and issue our own money, without incurring any debt whatsoever, was perverted by these private bankers. In their hands, money is created out of thin air and made available only by loaning it out at interest. And without borrowing, there’d be no money! So as loans are paid off, more must be made to maintain the money supply. And because money for the interest is not introduced into the system, the interest must come from someone else’s principle, which requires even more loans be made to maintain the money supply and pay the interest, which is the bankers’ fee for renting us their money. In bankers' hands, the money itself has become a form of debt, a black magic. They control the money spigot, who gets it and who doesn't, with the sole intent of returning a profit to the money lenders. Some goes to private development, some to corporate interests, some to war making, and some makes it into influential pockets, all connected with finance in a maze of interlocking directorates. Our electoral system is overrun with big money. The whole nation has become debt entrapped to these thieving Lords of Bling, and hostage to their accrued political power.

Congress these days can't even pretend to do something for the People without a debate about how it's going to be paid for, because after all, everybody knows we have to borrow that money, and there's only so much, or so we're told. This is completely bogus, especially when there's always enough for war, no questions asked. And then there's the national debt that just keeps piling up, which some say is just a myth. The debt principle keeps getting rolled over as associated interest payments, the lenders profits, climb to a half $trillion annually. The principle is not paid off because, as with all loans, to pay it off would extinguish that money, removing it from circulation. That much money extinguished would cause a depression. The only way to pay it off and avoid that is to pass sovereign monetary reform.

Our Constitution Article 1 Section 8 granted the people's Congress the power to coin money and regulate the value thereof, no strings attached. Unfortunately, Congress gave away its sovereign money power to the commercial banking cartel in the Federal Reserve Act of 1913, thus privatizing our monetary system. People, Planet and Peace have paid the price, and now we have our collective backs against the wall.

Recognizing that the Money Power is our birthright, it's our job to take it back. It's our job to elect a Congress of our own who will pass and implement the necessary legislation reinstating its control of the money and public policy, and to affect and protect a reaffirmation of the Constitution, Article I, Section 8.

There's plenty of precedent that Americans themselves have pioneered. The power to create money is the central issue the American Revolution was fought over, and it was funded with publicly issued money. Our Continentals were the Revolution. Although the bankers prevailed in overcoming this monetary victory, it was President Lincoln who again showed it can be done, by issuing debt-free Greenbacks during the civil war, a critical factor in the North's victory, because the government had no money with which to protect the nation. The banks wanted to loan Lincoln their money at exorbitant rates, but he didn’t fall for their trap. Because the public money wasn’t sufficiently protected, the bankers once again overpowered it with their private money. That led to the progressive populist movements of the late 19th century, which demanded Greenbacks at the top of their platforms. It's time We the People get back our Greenbacks, and legally prevent their hostile take over once and for all.

This requires 3 reforms be made immediately and simultaneously:

-

Require Congress to be the sole creator of all U.S. money, debt-free, as authorized in the U.S Constitution

-

End the privilege of commercial banks to create money.

-

Make the entire Federal Reserve System accountable to the public by moving it into the US Treasury.

This suite of reforms was recommended as the solution to the Great Depression by 400 of the world's best economists in the 1930s, and developed into a bill that was introduced to Congress as The NEED Act in 2011 by Dennis Kucinich. It's called Greening the Dollar in the Green Party's platform Article IV, N. This is how we Nationalize our own money, while not nationalizing the banks.

By making money creation rightfully a public function, it restores our power to govern. It is a vital tool for democratic self-governance. We need a paradigm shift from greed to care, and a public money system is how we can do it. This is how our economy can be reoriented from facilitating the accumulation of power and profit to a few, to serving public purpose. We can have a caring, fair and just economy, stable, operated democratically, fully attuned to restoring the environment. Without borrowing a dime, our government can spend money directly into the economy for projects like the Green New Deal, creating new jobs building green infrastructure to reverse climate change, and provision every other public NEED, debt free. That includes absolving student debt, providing free education and universal healthcare, alleviating poverty, and building a future that youth can believe in, a future they can help create.

We can redirect the economy to meet the challenges ahead, including getting people back on the land, getting in touch with their life source and restoring the soil's capacity to absorb carbon, to grow food and fiber, and establish thousands of rural economies.

We need a Green New Dollar to pay for the Green New Deal! That's how we can recover our fortunes and our planet. We must act quickly.

We must reactivate our sense of interconnectedness with all life, with all people. We have to remember we are one humanity, part of one Earth. And whatever we do, we will not let this basic recognition divide us, either from the Earth or from each other. And together we are strong.

DIVIDE & RULE - The Plan of The 1% to Make You DISPOSABLE - Vandana Shiva

- - -

Check out: Greens for Monetary Reform, How We Pay For a Better World and Alliance for Just Money.

Economic Injustice

The main cause of economic injustice is the extraordinary grant of power and privilege by Congress to private banks to create money when making loans. Private banks create 97% of the money in circulation. They also choose the recipients of these loans. Great wealth has accumulated to the private banks and financial institution as a result of their collection of interest on what is basically the entire money supply in the US.

This wealth has been used by the banks and financial institutions to collectively acquire controlling interest in most of the largest corporations, and use their wealth to influence the election of politicians of their choice in order to gain control of the government and influence policies adopted by the government.

Government policy in creating unnecessary weapons of mass destruction, interference in foreign elections and carrying on a state of perpetual war – while ignoring climate change and destruction of the planet – can all be traced to the wealth, power and influence of the banks and financial institutions. This also results in extreme wealth inequality – not only in the US – but also globally.

Petition to Change the Money

By Howard Switzer

I’ve spent most of my career, save a couple years of farming, as an architect designing sustainable homes for people. I was also an adjunct instructor at the Ecovillage Training Center on an intentional community called The Farm, where I lived for 10 years, showing people how to build using pre-industrial building methods with earth and straw. But 15 years ago, noticing the unsustainable trajectory of our economy and realizing it required a political change I ran for office and began to look at the economic system. Going to the root economic mechanism, I began to study money.

I share Greens' concern for economic justice for working people and their families especially now that hedge funds are buying up the housing stock driving prices up and closing off the ability for 80% of the population to own a home. Buying a home is the first step for most families in accumulating any wealth at all. Meanwhile rents and building material costs are soaring. It is this systemic wealth disparity that the monetary system creates.

As the Princeton Study of 2014 made clear, the American public has zero influence on public policy in this nation. Congressional investigations in 1912 (Pujo Committee) and again in 1933 (Pecora Commission) indicate that a Cabal of banks control our national economy. This has been the case for more than 100 years.

History shows us that when our electoral and legislative victories do not increase the ability of people to rule themselves, those changes are less meaningful and may not last. The ability to create and distribute debt-free, permanently circulating public money for public purposes rightfully belongs to our elected government not private profit-motivated commercial banks. This has led to enormous economic inequality and large amounts of money being kept out of circulation for speculation.

Under public control of the monetary system Congress could proceed with the necessary public spending into the productive economy without increasing the debt nor its associated interest payments and do so without inflation. Government could begin to pay down its debt as it comes due without creating hardships. There is legislation already written but a government that does not care about the people is not likely to pass it. The Green Party seeks to change this system and backs legislation that is already written to accomplish this. The American Monetary Reform Act, formerly The NEED Act, was introduced in 2011 and needs to be reintroduced again but with much more support.

Passing this legislation would allow adequate investments in the nation’s social as well as physical infrastructure. It would allow a large public investment in getting farmers back on the land to restore the soils capacity to absorb carbon, a critical strategy for ameliorating climate change. This would also revitalize the thousands of once thriving rural economies destroyed by Wall Street’s “go big or get out” campaign against the farmers. Farmers in India are now being driven off their land too at the behest of big capital players like Bill Gates, the largest owner of farmland in the US. Billionaires may realize that land is the source of most wealth but knowing nothing about farming are more likely to destroy its ability to produce.

This legislation empowers elected government to fulfil its responsibilities articulated in the first sentence of our Constitution’s Preamble. The money power was given to Congress to accomplish this task without incurring debt. As the Greeks learned 10 centuries before Christ, government control of the money is a vital prerogative of democratic self-governance because any government that does not control the money is controlled by those who do.

The BMRC intends to put out a petition to change the money system itself but for now the Alliance for Just Money is circulating a petition to change the system with the same 3 reforms that is our Greening the Dollar plank. We encourage everyone to sign it. Here is a link to the petition.

Monetary Reform vs Public Banking

By Joe Bongiovanni

In this exercise, many results must be gained and crossed, but the ultimate result provides the equivalence factor between “Public Money” seigniorage gain – being by the exercise of sovereign governmental authority under the American Monetary Reform Act of 2021(AMRA-2021), formerly the NEED Act – and “Public Banking” – earning profits or net income from public bank lending.

Stated differently — how much Public Bank Lending is required to provide equal revenue to AMRA’s financing provision?

IMPORTANT – Only one of the options being considered actually provides any direct benefit to the State to fund its people’s prosperity — the AMRA Option. It’s in the proposed law. While Public Banking laws are being promulgated anew, we should look for ANY connection between the bank-profits generated in the Bank’s Business Plan and a requirement that those profits be shared with the people’s government.

None exist in the model Sate Banking legislation I have seen. Over the years, BND has paid only a tiny fraction of its net income to State Coffers, for instance.

Public Banking Profits or Net Income — These will be estimated in future based upon the State jurisdiction granting the license for the Bank to operate, and thus difficult to “guess-timate” at this time. Based on the experience of the Bank of North Dakota, and their Annual Financial Reports, we can see the average interest paid to its depositors, and we can see the average interest gained on its loans. It is that interest differential that can be used to provide a means for financing State government.

Having said that, my back-of-the-envelope calculation based on the BND data show an interest ‘differential’ of 3.15 percent. The BND on average charges 3.15 percent more for its loans than it pays on deposits. On average.

So, for each State (city, etc) that contemplates its own Public Bank, we can estimate the total amount of lending that would be required in order to gain the income that is comparable to the State Income gained from the AMRA’s population-based revenue sharing. This is more straight-forward to estimate.

The estimated seigniorage-gain to each State jurisdiction — being based on two factors. One factor is the proportion share of the State population to the U.S. population (because the AMRA’s revenue-sharing provisions are per-capita based). And the other is the total Public Seigniorage gain available to the States from the exercise of sovereign money power.

We use the 2020 Census Data for the State Population estimates and the share of the revenue being provided by the AMRA provisions.

The monetary foundation for the national seigniorage gain figure is the amount of new money needed to accommodate the growth potential of the national economy — in any “next” given year. If the economy is forecast to grow by three percent next year, then we will need to have that three percent growth in monetary resources required to accommodate all the new transactions.

There are many estimates of the amount of new money needed each year — and this year is no different, perhaps excepting a wider band of estimates due to Pandemic uncertainties. The most common figure circulating around the Fed and financial circles these days is $700 Billion of possible money-economy expansion to our near $20 Trillion economy. Let’s say it’s an ordinary-year, all-else-being-equal estimate, and we’ll use $600 Billion as the money supply growth figure provided to Congress by the monetary authority.

The AMRA includes the same revenue-sharing formula contained in the AMI-Kucinich NEED Act of 2011, meaning that each year, the Secretary is instructed by the Congress and Monetary Authority to spread one-quarter of the authorized monetary growth directly to the states for them to spend as they wish — on a population-based equity formula.

Opinion – This is an extremely important provision of the AMRA for permanently democratizing and reforming the money system as the primary means for democratizing the whole economy. The States gave up their monetary rights to the Federal government all these years, and now the federal government Is paying some back as best we can.

More importantly, the nation needs a brand-new federal-state relationship, and it can be advanced to greater public equity and success best, if not only, when the States are strengthened in their economic endeavors.

Given that the estimated national seigniorage gain total is $600 Billion and given further that the law requires that Twenty-Five Percent (25%) of that gain be transferred (distributed) to the States, our revenue sharing formula for the States is based on $150 Billion in total revenue-sharing going to the States. Here are some of the estimated State Revenues from Public Money Administration.

-

Minnesota would receive $2,554,725,045 – over $2.5 Billion annually.

-

Michigan would receive $4,511,493,378 – over $4.5 Billion each year.

-

Illinois would gain some $5,735,997,458 – over $5.7 Billion annually.

The annual revenue gain to the State of Wisconsin is estimated on this as $2,638,542,857. I will use the Public Bank of Wisconsin for a related comparison between Public Money and Public Banking.

In order for Wisconsin, or any State, to earn from its Public Bank Borrowers a similar revenue balance from its Banking Operations, what is necessary is to determine the size of the lending portfolio that is required - given its earning a net interest income of 3.15 percent – in order to produce the equivalent $2.64 Billion in annual income from that Portfolio.

We will have to leave that as an open question for the Public Banking advocates to determine because we don’t know. How big would the Wisconsin State Bank’s loan portfolio have to be to provide an equivalent public benefit – again, TO THE BANK - to that available from the American Monetary Reform Act? In layman’s terms, then: huge!

Opinion – Separately, though primarily important in this discussion — passage of the American Monetary Reform Act, once introduced — would make fractional-reserve banking itself illegal. For anyone. Including all Public Banks still envisioned by the PBI. Fractional-reserve banking is itself the problem — as far as banking goes. There have been numerous books pointing that out.

At 3.1% net interest, each Million Dollars of Loans would gain $31,000 to the Bank. In my estimation, a Wisconsin State Bank with an $85.1 Billion loan portfolio that is earning an average ‘net’ interest of 3.1 % would generate the $2,638,542,857 – to the Bank.

Now, to make a comparison, the people and the Public Bank just have to guess-timate how much of THAT profit can be expeditiously forwarded to the people. The Public Bank of Wisconsin would need have a loan Portfolio of $85.1 BILLION to earn the $2.638 Billion in equivalence. How long do you suppose that might take?

"You don’t solve a problem with more of the problem. This scheme for states to go into the banking business would only ‘serve to protect’ the status quo. The ‘proposal’ completely fails to confront the main problem identified by all serious monetary reforms: ‘fractional reserve’ banking. Instead, it actually endorses and sanctions this vicious and destructive process, by suggesting that State governments engage in it …" Jamie Walton - American Monetary Institute

Simply Put

The fatal blind-spot that most thinkers have — be they left, center, or right — when it comes to money and banking, is that they assume that banks lend savers' deposits to borrowers, when in fact this never happens, and so the banks not only lend the money, they create the money by adding numbers to their ledgers, and thus make the whole economy (and polity) entirely dependent on them.

They have "the upper hand" over everyone else; industrialists, unionists, media, and politicians. It is a hidden hand too, because of the general ignorance of the basic fact that banks create money when they make loans and destroy it when loans are repaid. Thus, the entire money supply is rented from the banks; they're the ultimate rentiers, not landlords, not industrialists. The landlords and industrialists are all in debt to the banks too.

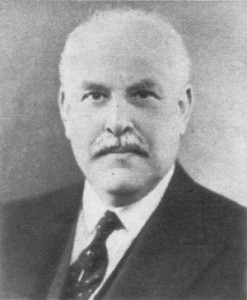

The most valuable history is the history we don't know.

Josiah Stamp (1880 - 1941)

"Banking was conceived in iniquity and was born in sin. The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again. However, take away from them the power to create money and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money."