The Money Matrix Part 1

by Sue Peters

Private commercial banks create what we all use as ‘money’. This fundamental fact is not taught in our schools. Why? The answer: because it is the power supply to the ruling elites of our American society.

U.S. history can be viewed as a power struggle between public control and private control of money.(1) Beginning with the signing into law of the U.S. Constitution, the Congress used its constitutional power to issue money, but, at the same time, states chartered private commercial banks to issue bank credit (‘bankmoney’). Congress created the money for public needs. Banks created bankmoney for private profit and power.

Sovereign money.

Money issued by a government through its legal authority is called sovereign money.(2) The legal power of Congress to issue money is found in our U.S. Constitution: Article I, Section 8 -- “Congress shall have Power … to coin Money, regulate the Value thereof, and of foreign Coin.” Back in 1789, the word ‘coin’ meant any form of money, such as metal coins, paper money, written ledger entries, etc. There was no debt associated with sovereign money. Nobody paid interest on its use. The government spent it into circulation, and it passed from person to person until collected back as national taxes. Today, coins are the only sovereign money issued by government—a miniscule part of our money supply.

Bankmoney.

By contrast, bankmoney is issued by commercial banks, chartered by national and state governments. Whenever a commercial bank makes a loan contract with a borrower, the bank CREATES bankmoney in the loan account of the borrower in the form of a deposit. The borrower spends this deposit into the economy, and it circulates between checking accounts in the banking system. Therefore, the bank has CREATED what we all use as money. But—this bankmoney is debt, and interest must be paid on it to the bank! Bankmoney is usury! Today, 97% of our money supply is bankmoney.

For example, I am a borrower of JPMorgan Chase. I sign a loan contract with JPMorgan Chase, and the bank CREATES a deposit in my JPMorgan Chase bank account for the loan amount, say $10,000. Of course, the loan contract says that I will repay $11,000—the additional $1,000 being the interest to the bank. Note: the bankmoney for the interest is never created by the bank. This means there is never enough money to pay off all the bank debts. Some borrowers will have to default, and the bank will get their collateral. Today, the 1% has used the bankmoney system to concentrate most of the wealth of the world.

Say this 15,000 times: “The bank makes a loan and CREATES the deposit in the borrower’s account.”

And the dollar bills we get from the bank for their bankmoney? Isn’t that sovereign money? No. Dollar bills are issued and sold by the twelve private Federal Reserve Banks to its member commercial banks (who own all shares in the Federal Reserve Banks). According to the Federal Reserve Act, dollar bills are the DEBT of the U.S. government.

We Americans have grown up in a matrix created by our manipulators, the financiers of the Federal Reserve and Wall Street. We are led to believe the battle is between the Democrats and the Republicans, but this is part of the matrix cinema on TV. As Greens, we know that there is no difference between the two parties.

We Greens turn our sights to the power of the multinational corporations. Again, this is part of the matrix cinema. Most of the multinational corporations are dependent on loans from Wall Street banks, renewed over and over, year after year, with a constant stream of interest flowing to the banks.

If you have the power to create what everyone uses as money, you will eventually own the world … and the 1% is almost there.(3) Obscene economic inequality. Starving of the real economy where we all live, and shamelessly inflating the speculative financial markets.

Today the Money Matrix rules the world, but it can be overturned(4). To begin this fight, its secrets must be exposed.

NOTES:

Please follow the Money Matrix in future newsletters. To come, the Money Matrix and:

- Part 2 – War and Military

- Part 3 – Education

- Part 4 – Media

- Part 5 - Medicine

- Part 6 - Telecom Industry

- Part 7 – U.S. Intelligence Agencies

What Can We Learn from the U.S. Debt Clock?

by Rita Jacobs

Wow!! Look at those big numbers!!!

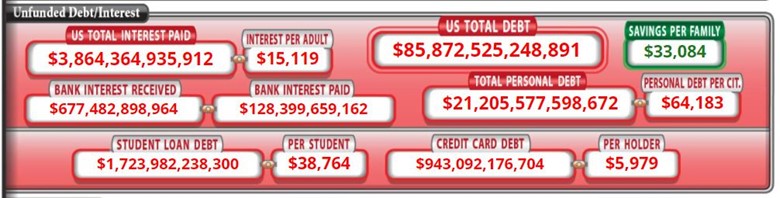

If you've never seen the online US Debt Clock, you should take a look at. It records in real time many statistics that relate to our economy. Above is a screen shot that I made of one part of the clock on April 9, 2021. If your mind gets boggled with those big numbers, let me break down for you some significant numbers on the clock.

US total debt is shown at about $85.9 trillion. If you mouse over the number, a description of what is included in that number and the source of the information appears at the top of the page replacing the logo and site name. It shows that US total debt includes debt from households, business, state and local governments, financial institutions and the federal government. It gives the source as the Federal Reserve.

Personal debt on the site is listed at about $21.2 trillion. The description of what is included in that amount lists all personal obligations – mortgage and consumer debt, which includes car loans and short-term revolving credit card debt.

Underneath the box shown above is this box:

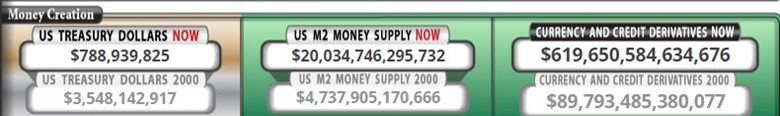

Notice the M2 money supply — now at about $20 trillion. This includes cash, checking accounts, savings accounts, small denomination time deposits, individual retirement accounts (IRA) and Keogh balances at depository institutions, and balances in retail market mutual funds. The explanation may be a bit confusing, but includes what we generally call certificates of deposits and money market funds.

If you compare total debt with the money supply, it is readily apparent that there just ain't enough money available to pay all those debts which continue to accumulate interest. So how can the money supply be increased so the debts can eventually be paid off?

There are two ways that new money enters the economy. The first way is by the government creating bonds and treasury notes, which it sells at auction to primary dealers (banks) for resale. The primary dealers create money out of thin air as electronic or bank money when they purchase the bonds and treasury notes. This credit money is then placed in the government account to be spent into the economy for recurring expenses or for whatever new purpose for which Congress may appropriate money. The government bonds and treasury notes are debt instruments that represent an amount owed by the government to the holders of the bonds and notes.

The second way new money comes into existence is through loans made by commercial banks. These can be mortgage loans, car loans, credit card purchases, student loans, and other household and business loans. The bank creates the money for the loan by simply crediting the account of the borrower, or by issuing a check in the amount of the loan.

So what is happening when new money is created? A new debt is created every time new money enters the economy. So how is it possible to pay off the debts when the existing amount of debt rises in an amount equal to the new money entering the economy? Unfortunately, there is no additional money created to make money available to pay the interest on the loan.

So what happens over time in the economy with this debt-based money system? Here is an interesting graph that illustrates what has happened over the last 60 years:

Credit: Workableeconomics.com

Note that the total debt level (which includes household, business and government debt in this illustration) grows at a much faster pace than the M2 money supply. So do you think that all these debts will ever be paid? Do you understand why there seems to be so much problem in the economy with people trying to pay their debts? Does it make you wonder why we have this system in the first place? Do you wonder why someone created this debt clock? There is a real physical debt clock in New York City. There is an interesting YouTube video that shows the history behind the creation of the debt clock in New York City.

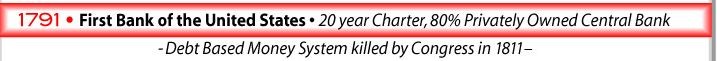

There are many other interesting features on the website of the U.S. Debt Clock. If you mouse around with the clock you may find the link to the History of Money and Banking. This is a short summary of the history from 1100 to 1999. Here's an example of what you might find:

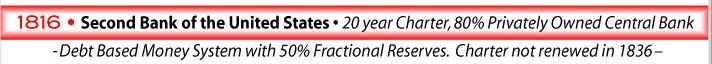

Unfortunately, the debt-based money system killed by Congress in 1811 came back to life:

Here's where we are now:

If you have more interest in learning about money and banking, you can visit the Banking and Monetary Reform Committee website. I hope this article helps you to understand why we need monetary reform.

Women – Democratizing Our Money!

By Marybeth Gardam

Talk to anyone about the Federal Reserve System and watch their eyes glaze over. Tell them we need to dismantle the Fed and democratize our money and they may write you off as a hopeless nutter.

But no, we’re not wearing tin foil hats when we share these ideas! More and more economists are agreeing that our money system is corrupt and built on oppressive debt that keeps us chained. The WILPF US Women, Money & Democracy Committee has been studying these realities and joining with allies on possible solutions.

How the Federal Reserve System Works

Most people believe that the Federal Reserve is a government agency that keeps all the money they print in a vault at Fort Knox, and when we borrow money or our banks do, that money gets somehow transferred to where it’s needed for investment, capital expense spending, or government program expenses (like all that pricey weaponry and unusable nuclear weapons we maintain at a cost of billions each year). It’s what we’ve been told since we were children. My dad worked for the Federal Reserve, and that’s what I thought they did!

Well, the truth is a lot more interesting, and as usual it’s important to ‘follow the money.’ But the money doesn’t lead to Fort Knox like you thought!

The Federal Reserve System is made up of twelve branch banks, the most powerful by far being the New York Federal Reserve. New York is also where all those wolves of Wall Street live and work, and where the New York Stock Exchange rules the economic world. Even though its presidential appointments help it to pose as a government entity, the Fed is independent, owned by the largest and most powerful transnational banks and investment firms. (See also These Are the Banks that Own the New York Fed). Their interest is entirely in profits … theirs, not yours or our government’s.

While your dollar features signatures of the US Treasury Secretary, up top in small print it says: A Federal Reserve Note. So the US Treasury and the US Mint don’t issue ‘our money.’ ‘Our money’ is not stored at Fort Knox. Our money is created by a simple bank credit accounting keystroke that only happens when someone borrows money.

All those student loans, the mortgage on your house, the business loan that kept your employer competitive, or the insurance company that borrows against its policy payments to advertise … all those loans and trillions more create dollars more efficiently than the printers ever could. When you borrow money, it becomes a liability for you, but it is an asset for the financial corporation that made the loan to you. THAT is how the majority of our ‘currency’ comes into existence. No one works for it. But everyone pays for it.

Creative Solutions for Democratizing Our Money

The Alliance for Just Money (AJM) is campaigning hard to reform (“democratize”) our money system and they have some pretty creative ideas about how it might work. Watch a short video called "A Solution to the Crisis - Just Money Now!"

A lot of those ideas are gaining traction with major economists, including Joseph Huber and Michael Kumhof.

The WILPF US Women, Money & Democracy Committee (W$D) has been studying the AJM materials and learning how money really is created out of thin air. The government creates money by borrowing from those ‘too-big-to-fail’ transnational banks, thanks to a law passed in 1913. These are the kind of entangling alliances and pay-to-play dynamics that are at work whenever our government decides to repeatedly bail out those big banks and investment bully boys. But is this really the way we want our government to work? Is it the way we want our money controlled?

If you are interested in learning more about the work of Women, Money & Democracy Committee, contact us to be invited to our monthly Zoom calls. We’re talking about policy and how it affects the lives of women like you and your families. Public banking is one solution we’re working on, but we’re also examining a lot more.

You can view some of the amazing hopeful solutions women are creating to counter the injustice of our current economic system by watching the recordings of the "Zooms of Our Own” webinars that W$D co-sponsors with An Economy of Our Own.

As chair of the W$D committee, I put it this way:

We’re trying to normalize the idea that money doesn’t have to be built on debt, and that money needn’t be scarce or so divisive.

I also want to stress how important these issues are for women. Women are at the heart of economics, but we often get left out of the decisions that most affect our lives and our financial futures. In W$D and working with An Economy of Our Own, we’re learning together how to make sense of it all, and what kinds of reforms could transform the economy into one where the things and values we care most about have real substantive value.

THE MOST IMPORTANT HISTORY IS THE HISTORY YOU DON’T KNOW:

Alfred Owen Crozier

By Howard Switzer

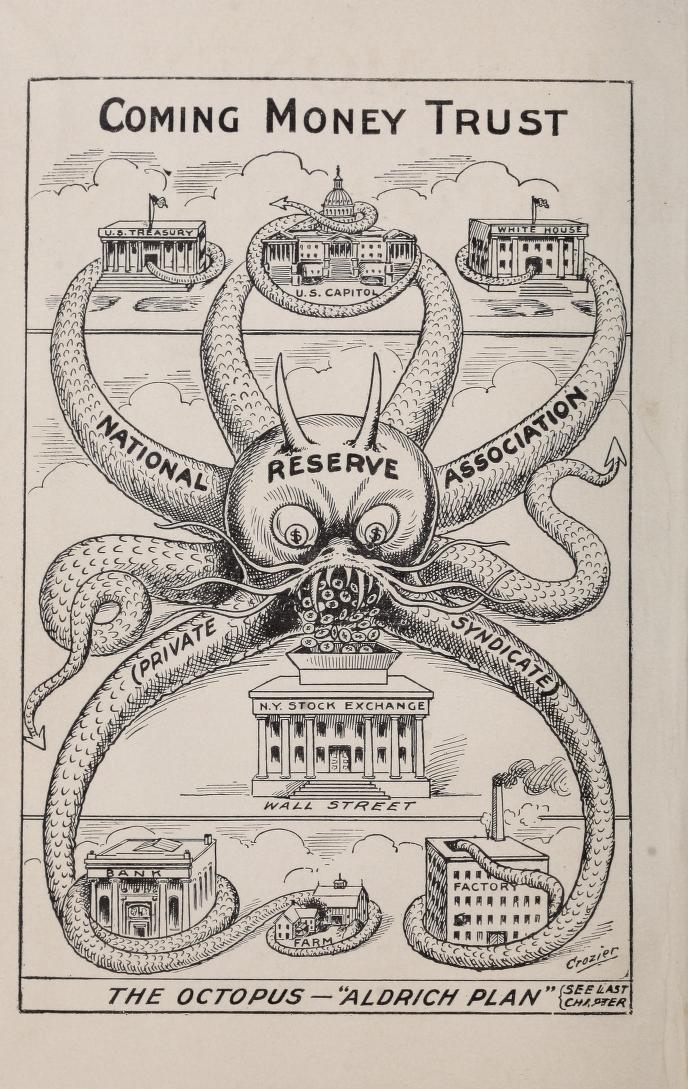

Alfred Owen Crozier was an attorney from Ohio who wrote eight books on the political, legal, and monetary problems of the United States. He is best known for his work US Money Vs Corporation Currency, "Aldrich Plan," Wall Street Confessions! Great Bank Combine (1912), which argues against the formation of The Federal Reserve. He feared national banking, but he feared private control of the United States money system even more. It was a time prefaced by years of farmers and workers organizing and educating themselves about money and supporting Greenback parties but the bankers maintained the upper hand, "the hidden hand." The bankers crashed the economy in 1907 to pressure Congress into passing their central banking bill hatched in a secret meeting of the big bankers at Jekyll Island.

In an interview, Alfred Crozier has been quoted as saying that there was no fundamental difference between the Federal Reserve Act and the Aldrich Plan. The banking cartel had pulled a fast one, simply renaming the bill and had put Wilson into the Presidency to sign the bill. With the stroke of a pen the power to create the entire money supply of the nation (the people's money) was transferred to the newly created international banking cartel.

- Our current monetary system is institutionalized usury.

-

- Usury:

- The abuse of monetary authority for personal gain.

- The great religions and philosophers condemned usury.

-

Dante described it as

An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.