Why We Need Monetary Reform

By Kevin McCormick, GPTX

The Green Party of the United States platform calls for a fundamental shift in the economic landscape by advocating for monetary reform. The party's Banking and Monetary Reform Committee highlights the potential benefits of this approach to address economic inequities through more equitable taxation and the creation of public wealth.

There are three fundamental requirements of effective monetary reform: 1) require Congress to be the sole creator of all U.S. money as an asset, not a debt; 2) end the privilege of commercial banks to create what we use as money; and 3) transfer the operations of the Federal Reserve to the U.S. Treasury.

We must focus on how money is created and issued as well as on how money is spent. For our democracy to thrive, the public must have meaningful influence over all three facets of the monetary system.

This change in thinking will help to shift the monetary debate to a focus on fair and equitable issuance of money. Is it fair and equitable that a tiny Wall Street elite (the banking cartel) create and issue money based upon their opportunity for profit from debt? Is it fair and equitable that fluctuations in the credit cycle can bring the entire economy to its knees and distribute hardship throughout the population? Of course not—the status quo is neither fair nor equitable. The Federal Reserve System places the political power to create and issue money in the commercial banks, a group that is dominated by a few huge banks which presently are also in the process of absorbing smaller banks. Money should be created and issued by a Congress that is responsive to public needs and serves the public interest, with monetary institutions designed to serve the public.

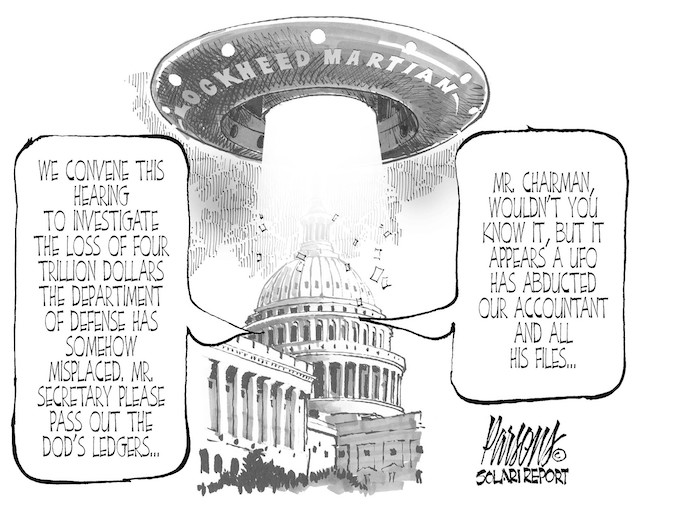

We have just witnessed a debate over the federal debt. While the U.S. Constitution grants Congress the power to coin money, we are instead forced to borrow money created by the banking cartel, This comes with the realization of a huge and growing interest expense and military-industrial complex costs coupled with inflation and reduced social and economic welfare for the public, Instead, Greens would re-frame the debate this way: Should Congress increase or decrease the money supply; and is an imperial military really more necessary than social programs and environmental protections?

Furthermore, the Green Party emphasizes the importance of shifting the focus from exclusive private wealth creation to the creation of public wealth. By investing in public infrastructure, social programs, and sustainable development, the Green Party aims to ensure that economic prosperity benefits all citizens, not just a privileged few.

The quality of our future depends on creating a sustainable society that functions in harmony with the natural world. We must have a monetary system that is appropriate for the future. Such a monetary system cannot be based upon debt. The Federal Reserve System depends on debt and interest payments. It is a system that must devour ever increasing amounts of resources and the environment to feed the exponential demands of interest and usury. The Green Party platform advocates a monetary system that does not rely on debt, that is democratic and responsive to public needs, and which supports a sustainable and just society.

The Green Party's Banking and Monetary Reform Committee invites citizens to explore their platform and learn more about the proposed reforms by visiting their official website at greensformonetaryreform.org. Additional information on the party's stance on economic justice and sustainability can be found at gp.org/economic_justice_and_sustainability#monetary-reform, while specific articles for monetary reform are available at gp.org/greenbacks_not_bailouts. To combat corruption and promote transparency, visit gp.org/combat_corruption_and_promote_transparency.

Texas Gold Money

Challenging the System?

By Howard Switzer GPTN

Is Texas unaware that Libya, the most advanced nation in Africa, was destroyed and Qaddafi murdered because he proposed a gold-backed money system for Africa? Challenges to the dominant monetary system are often met with overwhelming force. Fortunately the Constitution allows states to mint gold and silver coins, unclear is how a gold-backed digital currency will be regarded.

Gold was the money of the oligarchs for millennia. We have a 300+ year old monetary system established along with the Bank of England in 1694 by the power elite, the executive arm of the ruling class. That system is usury, creating all money as interest bearing debt for power and profit. That is capitalism. While it was claimed to be backed by gold there has never been enough gold to back a monetary system.

People often think the problem is creating money by fiat, but all money is created by fiat, including gold when designated as money. As Aristotle said, "Money exists not by nature but by law." That should be obvious as Texas proposes a law to use gold as money. Money is an ancient human innovation that has been captured and perverted by the powerful.

In answering the question, “What is money?” Stanford University’s Encyclopedia of Philosophy says there are two competing theories of money, The Commodity Theory, where a commodity is used for money, and the Credit Theory where credit is used for money. Why is there no theory for using money as money? That is the secret that must be kept from the people. Money is supposed to be a publicly issued debt free permanently circulating medium of exchange issued into the productive economy at the bottom, as opposed to the speculative economy at the top, for the general welfare. This was kept secret for the last 100 years by a public incredulity inculcated by a captured schooling and media system but with the internet the truth is gaining some ground.

To be useful as money gold must be valued greater than the commodity, when not it was melted down and sold on the commodity market. Also, because all commodities today are privately owned and controlled it doesn’t solve the problem of elite control. The current system uses bank credit for money which is also privately owned and controlled. People think the government issues the money which only makes sense because money is the governing factor, but government only prints and mints the physical currency which it sells to the banks for their customers cash needs. Only 3 to 5% of the money supply circulates in cash at any one time.

Aristotle also pointed out that money plays two roles, one as a medium of economic exchange and two, as an instrument of power. The power function stems of the “store of value” function that facilitates the accumulation of money which can then be used to dominate a market, control an industry, or dictate public policy, start wars etc. all of which has gone on for a long time. Of course, in this system people need to accumulate some money to qualify for a loan to buy a car or a house, banks only lend money to people who have money. Even if you do have some money the banks may not lend to you if your ‘debt to income ratio’ is too high, even if you have a high credit rating due to your frugality.

The problem was best analyzed, and the solution developed by the merchant economist Silvio Gesell in the 1920s. The prominent economists of the 1930s, Maynard Keynes and Irving Fisher, both praised his work and yet few have ever heard of him, and schools carefully ignore his book, The Natural Economic Order, which provided the foundation of ecological economics. His money system was demonstrated by small towns in Germany and Austria, creating local prosperity in the depths of the depression. Wörgl, Austria accomplished $2.5 million in public works in 15 months while only issuing $6000 in currency. This was due to a demurrage fee which greatly increased the circulation velocity of the money but also there was a positive psychological affect. Because of the dynamics of Net Present Value, people began thinking long term instead of short term and began building for the future before the central bank-controlled government shut them all down, even in the US where hundreds of towns began to issue currency. Irving Fisher even wrote a manual on how to do it which is online at Chapter VI–A Stamp Scrip Manual for Localities

All that said, I appreciate Texas challenging the dominant system and hope it will help make people examine the privatized monetary system and the proposals to make it public and democratic.

Failure of the US Monetary System and the Solution

By Richard C. Cook

The debt-ceiling crisis that recently played out in Washington between budget-cutting Republicans and the further explosion of debt under the Biden administration highlights again the failure of the US monetary system to provide effective liquidity for the world’s largest economy.

After a brief period of balanced federal budgets during the last years of the Clinton administration, debt again began to skyrocket under the dual regime of war expenditures and tax cuts under George W. Bush and Dick Cheney.

Then came the 2007-2008 financial crisis and the Great Recession. President Barack Obama approved trillions of dollars in bailouts for the financial industry, while over six million American families lost their homes and 1.8 million businesses went under.

The crisis was largely caused by the deregulation of the banks, starting with the Depository Institutions Deregulation and Monetary Control Act of 1980 that repealed usury laws, authorized interest on checking accounts, and abolished interest rate ceilings. Later came repeal of Glass-Steagall, allowing commercial banks with their credit-creation privileges to enter the world of stock market speculation.

The catastrophe was completed with action by the Federal Reserve under chairman Alan Greenspan to allow bank lending to explode when it was backed by millions of “liars’ loans” and tranches of fraudulent mortgage security packages sold worldwide.

The Obama-era “recovery” that followed came about only when the Federal Reserve cut interest rates to zero under the regime of “Quantitative Easing.” But the cheap loans from the Fed to banks eroded the savings of retirees and people on fixed incomes and made Treasury bonds purchased by investors practically worthless.

Then came the COVID lockdown, throwing almost ten million out of work, according to the Bureau of Labor Statistics, with twenty-two percent of businesses closing their doors permanently. Even the two trillion dollars intended for individual and family relief and loans to small businesses were inadequate. But big corporations that received billions during the pandemic cut thousands of jobs and gave their CEOs millions of dollars in bonuses.

As the pandemic eased, with supply chains devastated, inflation and corporate profiteering now began to soar, with the Federal Reserve unable to act except by raising interest rates, adding the higher costs of borrowing to already accelerating business expenses, now threatening to trigger recession.

We need to stop putting band-aids on band-aids and realize that we have a failed financial system.

With over $100 billion now being spent on the Biden administration’s war in Ukraine, the federal deficit has climbed even higher, with federal debt now at $31.7 trillion, over 123 percent of GDP and growing, and no relief in sight.

Federal Reserve interest rate policy makes servicing this debt more expensive with every rate increase.

If the purpose is to reduce inflation, as the Federal Reserve claims, it only does so by making every financial transaction more costly and penalizing those least able to pay to put food on the table and support the skyrocketing cost of buying or renting a home.

The Federal Reserve claims to have several purposes. One is to eliminate or mitigate the damage from businesses cycles, but historically it has never succeeded in doing this, with the Great Recession and today’s continuing crisis with a new round of bank failures as examples.

Another claim has been to keep inflation under control, but again the Federal Reserve has failed. Since the Federal Reserve was established a century ago, the US dollar has steadily lost value to the point where in terms of purchasing power today it is almost worthless.

Another has been to reduce unemployment, but while employment levels have gone up or down according to general economic conditions, even when unemployment is relatively low, as it has been in recent months, the Fed always maintains sufficient unemployment to keep wages down. And what happens when the cost of living is going through the roof while wages continue to be insufficient for people and families to lead decent lives?

Meanwhile, the Biden administration has lost control of immigration, where millions of people enter the country without jobs or means of support yet still drive up costs for food, housing, and other necessities. Yet even with the influx of new cheap labor, the construction and real estate industries are building almost no new affordable housing.

Finally, there’s the fact that in order to sell the Treasury bonds required to fuel the out-of-control deficit, the US must market them to foreign nations on a gigantic scale simply for our government to stay afloat. Selling these bonds becomes more difficult by the day, with foreign holdings of Treasury debt now falling sharply, particularly as the dollar becomes ever less attractive as a world reserve currency.

In fact, the Biden administration’s war in Ukraine is causing significant erosion in the value of the dollar abroad as countries like Russia, China, Indian, Brazil, and many others, turn to their own national currencies in trade. According to the Responsible Statecraft think tank, the share of global reserves held in US dollars has declined from seventy-three percent in 2001 to fifty-eight percent in 2023.

One reason the US is so overextended in our commitments abroad, with over 800 foreign military bases and facilities and a compulsion to meddle in every conflict that presents itself, is our need to force every other nation, not just friends and allies, to purchase our debt. To enforce this need, the US has imposed financial sanctions on almost thirty percent of all nations.

The government is afraid that if our ability to coerce other nations into buying our debt collapses, so will our public finances and our domestic economy. But this is only because we have bought into a system overseen by the Federal Reserve where constantly-growing debt is the only way to create a circulating currency.

There were times in our nation’s history where the government was not totally reliant on taxes and borrowing to pay its bills.

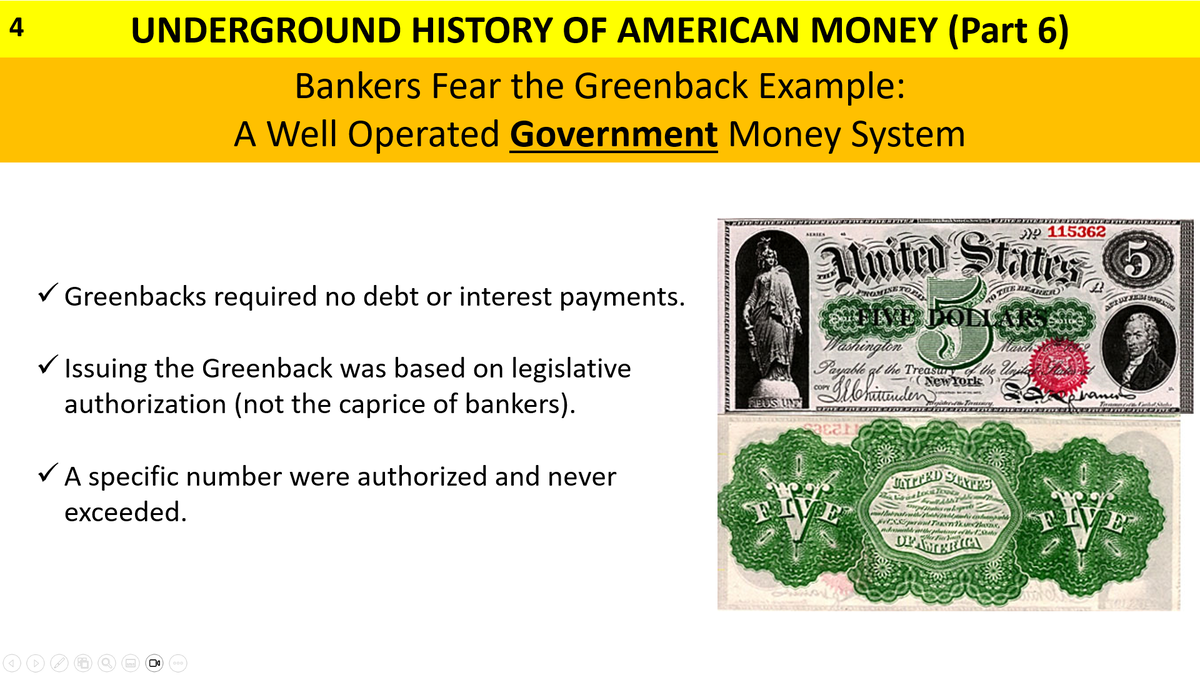

The most notable example was during the Civil War, when Congress passed legislation to implement the Greenbacks. These were United States notes introduced as direct payments to individuals and businesses to meet government obligations at time of war.

President Lincoln called the Greenbacks “the peoples’ currency.” They stayed in circulation into the 20th century, until legislation for a Federal Reserve system was enacted, turning public finance over to the private banking industry. The Federal Reserve is the instrument of its member banks, not accountable to the American public.

When the Federal Reserve took over in 1913, except for distribution by the Treasury of silver dollars and other coinage, our money derived almost entirely from loans issued by the banks. This is what is meant by a debt-based currency. The Federal Reserve is owned by its member banks, led by the giant Wall Street banking institutions of New York.

Thus, while credit should be a public utility, as provided by our Constitution which gives Congress the right to create money and regulate its value, the Federal Reserve system makes credit a money-making instrument of the private banking system.

We entered the Great Depression in 1929 when the Federal Reserve stood by and watched the banks raise interest rates to allow much of our gold to be shipped to Europe. After the economy crashed due to a shortage of a circulating medium of exchange, Congress again authorized the executive branch to issue Greenbacks, though it never did. Dozens of communities introduced scrip currency to survive.

But World War II was used to bring the economy and employment back again.

The economy weakened again late in the 1950s, causing President John F. Kennedy to take a number of significant steps to restore prosperity, including applying pressure to the Federal Reserve to keep interest rates low, along with other measure to stimulate the economy to a higher level of productivity.

Kennedy also sought to engender similar measures in Latin America through the Alliance for Progress.

After President Kennedy’s assassination, both the federal budget and trade deficits began to take off in a fatal trajectory that continues today. Both skyrocketed under the Reagan and Bush I administrations, slowed a bit under Clinton, but soared again with the Bush II-Cheney wars and the Obama bail-outs mentioned previously.

Meanwhile, people are starting to take matters into their own hands with the creation of citizens’ currencies like Bitcoin, and the growth of barter networks, as with the International Reciprocal Payments Association. But while these efforts are laudable, they are not nearly enough.

So what do we do today?

It is time for the government to end the Federal Reserve and take control of the nation’s monetary future by the creation of a new Greenback mechanism for direct payment of government obligations. There are a number of groups that are doing the theoretical work.

I would refer you to the American Monetary Institute, founded by the pioneer monetary reformer, the late Stephen Zarlenga.

I would refer you to the Alliance for Just Money, which has a petition in circulation for a “Resolution on the Establishment of a National Commission of Inquiry Into the Monetary System of the United States of America.”

I would refer you to the work being done by Christine Desan of Harvard University, who has started an academic movement described at JustMoney.org for the distribution of “direct-issue dollars.”

I would refer you to Ellen Brown and the Public Banking Institute on the need to create a national infrastructure bank to utilize public funds as a base for infrastructure development.

Finally, I would refer you to The National Emergency Employment Defense–NEED–Act introduced in Congress in 2011 by Congressman Dennis Kucinich. It was and remains the most important piece of monetary legislation since the Federal Reserve Act of 1913 and the most comprehensive piece of monetary reform legislation in US history.

The NEED Act would abolish the Federal Reserve and replace it with a Monetary Authority within the US Department of Treasury. The Monetary Authority would serve as a depository for federal funds and a point of origin for direct issuance of US currency—a government—owned central bank. The accounting functions of the Federal Reserve system could be redesigned to provide needed services to the financial industry. But the Federal Reserve itself would no longer be allowed to manipulate systemwide discount rates as a usury-based mechanism whose main purpose is to prop up Wall Street.

The NEED Act would restore to Constitutional government the sovereign power to create money. The private banking system could only lend money beyond its deposit base by borrowing it first from the Monetary Authority according to established guidelines. Bank loans would be in US currency, not Federal Reserve notes.

The NEED Act is not socialism. Instead, it would remove the burden of excessive debt on free enterprise, allowing it to thrive.

Through the NEED Act, the federal government would provide direct funding for infrastructure projects, for paying down the national debt, and for interest-free loans to state governments. Eventually the national debt could be retired, removing the need to coerce other nations to purchase Treasury bonds to keep our government solvent.

The NEED Act has achieved political recognition. It is now part of the platform of the Green Party. Kucinich himself is now campaign manager for presidential candidate Robert F. Kennedy, Jr.

Reform in this vital area of public policy is urgent. Our country has wandered into a morass of conflict with countries around to world due to our stubborn insistence on propping up a system of public finance that long ago betrayed its ostensible purposes. We cannot continue to rely on other countries to prop up our own indebtedness, and we certainly cannot continue to try to force dollar hegemony down their throats in a world where so much else is changing.

We must learn to live in harmony with other nations, other power centers, and other regional blocs. We can’t do that as long as we feel compelled to be the world’s bully in order to prop up our failed financial system.

We owe it to our own citizens to have a monetary system that is fair, equitable, and rewarding of hard work and spiritual values.

Reclaiming the people’s monetary system should be at the top of our political agenda.

Copyright 2023 by Richard C. Cook. Howard Switzer and Fadi Lama contributed to this article. Richard C. Cook is a retired US government analyst and a former whistleblower. His new book, Our Country, Then and Now will soon be published by Clarity Press. Our Country, Then and Now. He may be reached at monetaryreform@gmail.com

Ending the Supreme Immorality of Capitalism

By Howard Switzer, GPTN

This is an article from another of my favorite writers on Medium, D.K Blaire. As she notes, it is a rant on the immoral human behavior of our corporate masters. She writes:

“Democracy in these freedom-loving, liberal-touting states is merely theatrical. Having been hijacked by kleptocrats who shape public policy and discard regulations meant to protect the vulnerable, politics itself is an unabashed charade—one that often turns exhausted, weary populations against each other in a desperate bid to vent frustration.”

Frustration, I would argue, from trying and survive in this intentionally unjust economy. I have to laugh at those carrying on about Russia being a kleptocracy now without any awareness that they themselves live in one. It is the nature of profit-motivated rulers and I am not referring to what we call “our government,” which is the thuggish minion of global capital. The governing factor is money, it has been pointed out many times and yet people will talk all around it never hitting the nail on the head. Money controls what happens and those who control the money control what happens, they control public and corporate policy.

The Princeton Study by Gilens and Page nailed it finding that from 2009 to 2014, the 200 most politically active companies in the U.S. spent $5.8 billion influencing our government with lobbying and campaign contributions. Those same companies got $4.4 trillion in taxpayer support — a 750% return on their investment.

In fact, the banks learned long ago, as far back as the 1600s, that by far their most profitable investments were in governments. Using war debt, the banks gradually got governments to give them control of their monetary systems, giving up their sovereignty. They set up a central bank for each country for management purposes. The wars are all banker’s wars, have been for a long time. When you control a government you can send it to war, very profitable for the banks.

A conspiracy? Not at all, they are merely pursuing their economic interests which is maximizing profits and they are ruthless in their pursuit of power which makes them dangerous. But in protecting and extending this power, there have been many conspiracies. Money is more about power than it is economics.

So, what is the root of the immoral human behavior of our corporate masters? This has also been revealed through research on the psychological consequences of money, referring to the usury-money we all use, the privately controlled monetary system that has been in place for over 300 years. One of the most revealing experiments was one in which two classrooms of students were given a quiz full of ambiguous questions. On the wall of one classroom was a picture of a Federal Reserve Note, a dollar bill. In the other classroom was a photo of a Cowrie shell, a seashell. In the room with the dollar bill, they found students with heads down diligently taking the quiz, did not ask for help and were unfriendly if asked for help and stayed far apart. In the other classroom they found students had moved closer together and were laughing and discussing the quiz questions.

Note that both the dollar bill and the cowrie shell have been used as money, as an exchange medium. The difference is in how, by whom, and for what, they are issued. Are they issued for the benefit of free economic exchange or are they issued for private profit and control? That is the difference. And it reveals that we can change the world in a positive way pretty fast if we were to change the money system. In fact the legislation required to change the system has already been written and was introduced to Congress in 2011. Now we need to elect a government dedicated to the public interest that will pass this legislation and begin to restore our ecology and heal our society, all of which is possible. All we lack is the broad-based understanding of the problem/solution and the agreement that we must change the system.

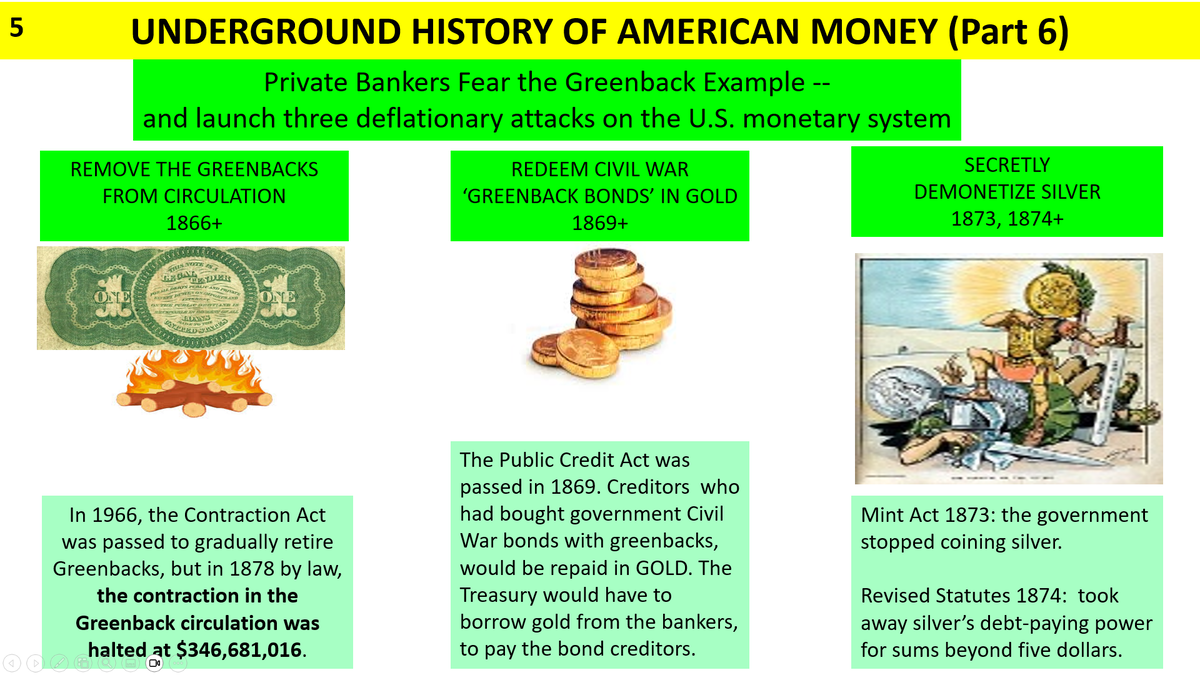

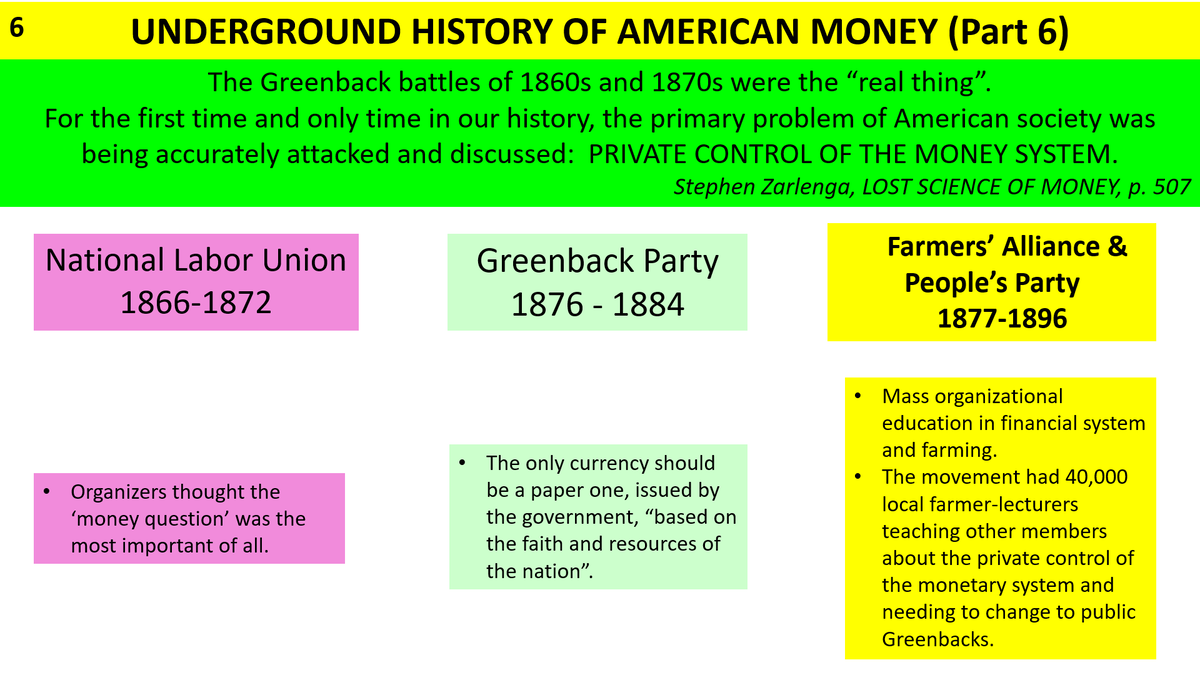

The Underground History of American Money Series Part 6:

Bankers Deflate the Money Supply 1860s – 1890s

By Sue Peters, GPNY

Has Modernity Expired?

By Howard Switzer, GPTN

Jeremy Lent, Author of The Patterning Instinct and The Web of Meaning, recently writes that modernity has expired, and asks, what comes next? Wait, are we no longer modern?

Modernity means “a modern way of thinking” so it seems because thinking would change with the times so would modernity. Some thoughts, beliefs however, may not change so readily with the times. So, if the notion of modernity began in the 17th century can it still be considered modern? What was the ‘modern’ thinking at the time?

While the 15th and 16th century Renaissance period in European history is considered the transition from the Middle Ages to modernity characterized by an effort to revive and surpass ideas and achievements of classical antiquity it’s not true. The advancements such as forming universities, developing mathematics and other abstract sciences, the development of hydropower etc. occurred in what scholars call the “High Renaissance”, or “The First Modernization,” 1040-1290, a period of tremendous prosperity, well before the so-called era of “modernity.”

This was a period when farm ownership and agriculture production took off and with the average calory intake of 3500-4000 per day the people grew taller than the average European is today. The population of Europe doubled during this time. It was the period when all the great cathedrals were built, 1000 cathedrals and over 300,000 churches, by the people without financing help from the church or government due to the monetary system provided for the people at the time. Women enjoyed expanded rights, and position in society. This was the period when a female deity was worshipped by the people, often represented by the Black Madonna, a depiction of the Virgin Mary with dark skin, found in Catholic Churches all over Europe.

The monetary unit used for trade between nations was gold, but the people were issued different money for their day-to-day economic exchanges. These essentially demurrage monetary systems provided for the people during this period created unprecedented prosperity and due to the dynamics of Net Present Value, people began thinking long term. This is why the Great Cathedrals were built to seat 3 times the population of the villages building them. They were built to attract future pilgrims for the economic benefit of the community, and it is still working today.

This period ended with what can be described as a violent reassertion of patriarchy and the wildly successful monetary systems were abolished plunging Europe into a deep depression with people living in such squalor that the Black Death took hold killing half of Europe’s population. The so-called Renaissance that followed saw around 40,000 to 60,000 killed, mostly burned at the stake, 80% of them women, due to suspicion that they were practicing witchcraft. However, there was no concept of demonic witchcraft during the fourteenth century, only later did a unified concept combine the ideas of “noxious magic, a pact with the Devil and an assembly of witches for Satanic worship,” into one category of crime.

There was no “witchcraft.” It was men and women holding on to ancient indigenous ways, natural herbal medicines and ritual healing methods that offended the wealthy patriarchal priesthood who saw it as a threat to their positions of authority and so sought to eliminate such knowledge and practices by charging them with witchcraft. Kind of like imprisoning Julian Assange for journalism but charging him with espionage. Torture, murders, the taking of one’s children away were all employed toward this end.

Modernity is a self-definition by a society about its own technological innovation, governance, and socioeconomics being better, more modern than others, especially its predecessors. To support the illusion, of course, the negative aspects are not to be mentioned. It was this modern assault on traditional wisdom and practice that caused the split between humankind and the natural world.

The split between mind and body at odds with the natural world and other people is driving us toward catastrophe and like the success of the High Middle-ages, was also accomplished with a monetary system, this one based on usury, which emerged as capitalism, (capital = money) + (ism = system) = money system. It is the monetary system we use today much to our own detriment.

These two examples, and there are more, show the psychological effects monetary systems can have depending on their design. Research has shown the negative psychological influences of our institutionalized usury, that is, our debt-based, for-profit monetary system to be alienation/loneliness, non-cooperative hyper-individualism, and unethical and criminal behaviors. These characteristics are setting the stage for a violent mass formation psychosis potentially world-around which we would be wise to do all we can to avoid.

Reed Kinney, author of Ideology of Decentralized Civilization and Egalitarian Community wrote that “the type of culture and the behaviors of the people are determined by their civilization’s economic exchange system.” As the great monetary expert, Bernard Lietaer said, “Since the dawn of times, monetary systems have been shaping the flows of human activity in every realm of endeavor; food production, education, health, business etc., by determining how we value, apply, and exchange our creativity, and the fruits of our labor. It is for this reason the most influential of all human-made systems.”

By changing the monetary system from a private for-profit system issuing money as debt to a system where money is issued publicly as a permanently circulating asset, like the Greenbacks, whose first use is to be spent, lent, or given into the productive economy for the general welfare of society. This would empower Congress to fulfill its Constitutional mandate as articulated in the first sentence of the preamble. This would soon transition the economics of greed into the economics of care due to the reversal of the psychological effects. Money is the governing factor, which is why it must be public.

The 300+ year old privately controlled system we have must change but it is firmly entrenched having made the world dependent on it, and because money is power the power to create it is violently defended. The natural world can be violent too in a myriad of ways and as with any animal whose life is being threatened, can respond to that threat violently.

We speak of doom and gloom so often because that is the direction we are being dragged, not the direction we want to go. So, we need to get to the steering wheel of this bus, and the brake, because who ever is at the wheel now must be blind and crazy. Money is the governing factor, and it is also the “leverage point” in the system, the point where a small change can change the entire system. What comes next is up to us.

The Most Important History is the History We Don't Know

By Howard Switzer, GPTN

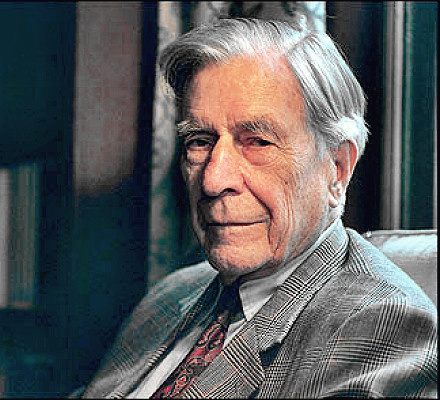

John Kenneth Galbraith

John Kenneth Galbraith was a Canadian-American economist, diplomat, public official, and intellectual. His books on economic topics were bestsellers from the 1950s through the 2000s. As an economist, he leaned toward post-Keynesian economics from an institutionalist perspective.

Here are some quotes to give you some idea about his work.

“The problem of the modern economy is not a failure of a knowledge of economics; it's a failure of a knowledge of history. Do not be alarmed by simplification, complexity is often a device for claiming sophistication, or for evading simple truths. There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have insight to appreciate the incredible wonders of the present. Faced with the choice between changing one's mind and proving that there is no need to do so, economists get busy on the proof. Their conventional view serves to protect us from the painful job of thinking.”

“The study of money, above all other fields in economics, is one in which complexity, often a device for claiming sophistication, is used to disguise or to evade truth, not to reveal it. "

“The process by which banks create money is so simple that the mind is repelled.”

"Smoking dope and hanging up Che's picture is no more a commitment than drinking milk and collecting postage stamps. A revolution in consciousness is an empty high without a revolution in the distribution of power."

"The modern conservative is engaged in one of man's oldest exercises in moral philosophy; that is, the search for a superior moral justification for selfishness."

"In economics, the majority is always wrong."

"In any great organization it is far, far safer to be wrong with the majority than to be right alone."

"All successful revolutions are the kicking in of a rotten door."

John Kenneth Galbraith

- Our current monetary system is institutionalized usury.

-

- Usury:

- The abuse of monetary authority for personal gain.

- The great religions and philosophers condemned usury.

-

Dante described it as

An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.