The Maternal Gift Economy

by Howard Switzer GPTN

Reviving Sacred Reciprocity

Among several efforts to educate and advocate for a paradigm shift to an equitable, stable, and just economy is a women led movement for a Maternal Gift Economy. It is about raising up the suppressed wisdom of women, and the traditions and ethics of Indigenous societies, a culture grounded in the values of nurturing and care rather than competition and greed.

I think this is significant and hearing of it was to me a hopeful sign for the future. First, I value all the gifts of my mother, certainly, however the Maternal Gift Economy to me referred to our Earth Mother whose gifts are what all life and human economy depends on. Unfortunately, the capitalist economy is all about exploiting those gifts in a wasteful linear system to maximize the personal gain of a few powerful men, the modern representatives of a patriarchy that long ago pushed the Great Mother Goddess out of the Temple, replacing her with an all-powerful male god. Of course, the people did not acquiesce immediately, and it required much murder, mayhem, kidnapping and torture to get our ancestors to forget their spiritual roots in the Earth and eliminate the Great Mother archetype from the civilized human psyche. Doing that made us less human. This is why there is such a gulf in understanding between indigenous and modern humans. The Great Mother represented love, abundance, generosity, sustenance, and money. The western psyche is lacking this vital architype having only its shadow characteristics of fear, greed, and scarcity.

In studying how humankind could create an egalitarian society, I learned egalitarian societies were always matrifocal, worshiping the divine feminine, the Great Mother Goddess, the nurturer, the giver of life. It is important to note that, although women were held with great respect, matrifocal societies were not matriarchal, that is societies where all power rested with the women. A matricentred society is not simply the reverse of patriarchy where public power does indeed rest only with men, it is instead an egalitarian society in which power is shared. Sharing is not a concept valued by patriarchy while domination is.

As I investigated what its proponents were saying, however, my enthusiasm cooled with concerns. There were two ideas being presented that I think are antithetical to a Maternal Gift Economy. There is a misconception of exchange and money, eschewing both as deeply rooted problems we need to get rid of rather than digging down into what the cause of those problems with exchange and money really are.

EXCHANGE

Exchange was and should be regarded as sacred. All life depends on exchange, nature is in constant exchange, life could not even exist without it. Life is cycles of constant exchange. Exchange is about reciprocity. We make an exchange with every breath we take just as the trees symbiotically exchange the C02 we exhale for the oxygen we inhale. The oceans and soil are in constant exchange with the atmosphere. As Vandana Shiva pointed out our economy today is an extraction economy, not one of exchange, it is linear. What does the Earth Mother get for her gifts in this economy? It’s a concept absent from our consciousness, reciprocity withheld.

MONEY

Money too originated as a sacred connection to the Earth Mother. Money was originated as sacred reciprocity for the gift of life from the Great Mother. I hire a native surveyor who prayerfully pays the Earth Mother for the things he will have to cut out of the way for his shots. Ov time it became an abstract social power embodied in custom and later law, as a payment system facilitating trade. This worked well for a very long time. As Penobscot native Sherri Mitchell said, “It was a mutually beneficial exchange,” and was considered sacred, the whole process from beginning to end is done in a sacred way. The animals they hunted too were considered a gift. As Sherri said, “… receiving the gift but also taking responsibility for giving back to that population.” It is sacred reciprocity.

Vandana Shiva said “Everything flows, and colonialism makes it all flow to money”, but money is supposed to flow with everything else, that is why it is currency, a current, a flow. When it doesn’t flow it becomes a problem. As she said, “We have gone way beyond exchange; we’ve gone into one-way extraction.” The patriarchal system (which is imperialist and colonialist) creates money as debt to divert that flow to itself, to the few at the top, extracting wealth from people and planet and it has been doing this intensely for over 400 years.

HISTORY

History holds significant lessons for us regarding money. Ancient Dynastic Egypt was a matrifocal society that worshipped the divine feminine in the form of Isis, symbolic of the Great mother, she was the goddess of love, motherhood, nurturing, healing, magic, and money. They enjoyed a legendary prosperity for 1600 years due largely to their agriculture-based money system. Farmers took their grain to the public granaries and were given clay receipts with the amount and date scratched in them. Those clay chips, ostrakas, circulated as money which slowly went down in value along with the wheat they represented, which over time a certain amount spoils or is lost to vermin. They would be turned in for wheat when the planting season began, and new money was created again at harvest. This system functioned as demurrage currency. However, at the level of trade with other nations, gold or silver was used for money, a commodity controlled by oligarchs.

The Ancient Greeks recognized that publicly issuing the money was the most vital prerogative of democratic self-governance. They understood that any government that did not control the money was controlled by those who do, which was the oligarchy. Lycurgus the Law Giver banned the oligarch’s gold as money instead issuing worthless pieces of brittle iron for money. As Aristotle noted, “Money exists not by nature but by law.” However, because it was not a demurrage currency vast accumulation of money could occur creating problems. Despite that the Greeks enjoyed 350 years of prosperity until the oligarch’s armies destroyed them. The system was copied by the Roman Republic who enjoyed 450 years of prosperity until the oligarch’s accumulated wealth gave them the power to reestablish gold as the money. Vastly accumulated money is the main problem with our economy today.

During the high Middle Ages, known as “the Real Renaissance,” a specific system of hierarchical, parceled sovereignty called Feudalism existed in Europe (1000-1300). While the poorly educated modern view is that it was a dark time of having no rights or property the truth is that happened later.

The high middle-ages were an extraordinarily prosperous time for the people, something we're not supposed to know or repeat, and the oligarchy clearly wants it that way as history is valued so little. Certainly, we would not want to examine why it was such a prosperous time, a time when the first universities were founded teaching abstract sciences such as mathematics. It was a time when the working class enjoyed favorable working conditions and a remarkable level of economic independence. Innovations in agriculture allowed the small landowners as a group to be much more productive than the Seignorial holdings for the first time. It was a time when hydro-powered manufacturing took off and production skyrocketed. There were more than 200,000 hydro-powered mills at the beginning of the 12th century in France alone. It was the beginning of the industrial revolution, 500 years before the capitalist's industrial revolution began.

It was a time when the average caloric intake was 3500-4000 per day, more than the average of 3000 in today's developed countries. Workers ate 3-4 meals per day with 3-4 courses and enjoyed 90-150 official holidays every year. The population of Europe doubled, and the average height was nearly 8 inches taller than today by the end of this 300-year period. Workers enjoyed 6-hour workdays and rebelled when the Dukes of Saxony tried to extend it to 8. It was a time when a thousand small towns across Europe built a thousand Great Cathedrals for themselves and their posterity, along with 300,000 churches, using the money issued to them by their feudal lords for an exchange medium which functioned as a demurrage currency due to its slow reduction in value that was restored annually. It was a time when women enjoyed greater freedom and position in society and the people worshiped the divine feminine represented by the Black Madonna.

It all ended when the patriarchal oligarchs, the money lenders, foreclosed on the feudal lord’s war debts and took control of their sovereignty, ending the local money systems which plunged Europe into such a deep depression that the plague took hold due to the squalor people were forced to live in. This reduced the population by more than a half.

There so much history that we have not been taught in our schools for selfish reasons. US history is full of stories about the monetary struggle, from the American Revolution and the Civil War to the Great Depression and 2008 crash, money played a major role.

The American colonists revolted and went to war against the Bank of England and its corporations who had outlawed the prosperous state sovereign money systems they had painstakingly established. This had plunged the nation into a deep depression precipitating the war. They won that war militarily, but they lost it monetarily in the post war power struggle between Jefferson and Hamilton over who would control the money system. Hamilton convinced the already corrupt Congress to turn it over to his friend’s private bank. As Salvador Allende would say 200 years later, “We won the revolution, but we did not win the power.”

Lincoln defied the banking establishment too by issuing debt-free sovereign money called Greenbacks to provide for the nation’s defense against an effort to dissolve it. Greenbacks were publicly issued money and had an immediate effect on the nation’s economy as debt began disappearing and interest rates went down, both of which are why the bankers hated them and Lincoln was assassinated for it.

The extractive money system we have is based on usury, the abuse of monetary authority for personal gain. It is the sin of sins, the progenitor of the seven deadly sins which Dante put in the lowest circle of Hades. He considered it the “Anti-art,” an extraordinarily efficient form of violence by which once does the most damage with the least effort. This brings us to the psychological consequences of monetary system design. A system based on usury is driven by fear, fear of there not being enough to go around. The psychological consequences have a devastating effect on society, alienation, loneliness, as well as greed and criminal behaviors. That system needs to be replaced with one where money is issued publicly exclusively for public needs which makes it a care based monetary system. This paradigm shift would reverse the negative psychological effects of usury.

Another psychological effect of money was demonstrated at least three times in history in monetary systems using a demurrage currency

. The most recent during the Great Depression was in Wörgl, Austria where $2.5 million in public works were accomplished issuing only $6000 due to the high velocity of circulation of the stamp scrip. It also had a profound psychological effect due to the dynamics of net present value. That is a mathematical equation that shows how the demurrage currency increases the value of things in the future. This shifted the thinking of people from short-term to long-term. Ancient Egypt and the High Middle Ages are two other examples. Of course, people were unaware of this equation and did not make such calculations in their heads, it was a subconscious psychological effect. Our most ancient ancestors, the indigenous people, practiced long-term thinking, considering the impacts of their actions on seven generations into the future. We have a tool to help get us there once people know what the task is.

Usury was only able to take hold and go viral because of the mechanistic view of the universe foisted on us for selfish reasons. This view too needs replaced by one that acknowledges, as Vandana said, “the intelligence of the plants and the microbes and the animals and the Earth as a living intelligent system and the universe as a living intelligent self-organized system.” I think by right action we can collectively create a new economy, one that sacralizes the Earth Mother from which all life and economy must flow, a Maternal Gift Economy.

The Unsustainable United States

by Rita Jacobs GPMI

I don’t know what else to call this country right now. I just watched a video that I had overlooked last year. I try to view all of John Titus’ videos and I must have missed one. It is a very important one. He discusses why our national debt is unsustainable, and what that means. You can watch the video that runs about 43 minutes, or read the following highlights and my explanation of why we have this mess.

In April of 2021, Jerome Powell, then acting chair of the Federal Reserve, made a statement that the public debt of the United States is unsustainable. Reports issued by the government back up his comment. The FY21 Financial Report of the US Government, issued in February 2022, highlighted under its Economic Trends its Unsustainable Fiscal Path. A sustainable fiscal policy is one where the ratio of debt held by the public to Gross Domestic Product (GDP) is stable or declining over the long term. This ratio was at about 100% in 2021, and a graph showing the future trajectory, has that ratio rising to a whopping 700% by 2090.

So what is the problem? My explanation for this is that a future unsustainable debt was baked into the Federal Reserve Act of 1913. It created an unsustainable system that requires the federal government to borrow all of its money except the coins it creates, and the taxes it collects from the debt-money in circulation. The law created a debt-based money system that allows the private banks to create all the money when it makes loans or buys government bonds. This small number of commercial money creators has become a parasitic class, requiring corporations, individuals, and the government to pay interest on all the money in circulation to the parasites that create it. The debt level in the country has reached its saturation point. The government is now borrowing money to pay the interest on its debt that has now reached $34 trillion. In the meantime, these parasites have acquired so much wealth that they direct public policy by deciding where to loan the money (billions to the fossil fuel corporations, for example). They also have acquired controlling interest in the largest corporations, and buy our government representatives by financing their campaigns. The government is their tool for enhancing their financial control over the world. Congress created this mess, and only Congress can fix it. But instead of fixing it, it continues to borrow money from the parasites. This is all happening despite the Constitutional provision in Article I, Section 8 that gave Congress the authority and responsibility to create money.

John Titus was not able to offer any solution to the problem. The banksters are already above the law and control the country like Mafia overlords. The parasitic class is too greedy to accept reform that doesn’t give them an unfair financial advantage. There is no rule of law except for the rule of the banksters. The U.S. will continue to be looted by the criminals and gangsters who are in charge. John Titus says the people are too hooked on Facebook, ball games, and minutia, to learn about the problem and do anything about it. In the meantime, as the shaky economic system falls apart, things could get very ugly.

Is the Private Creation of Money Unconstitutional?

by Janis Richards GPTX

The answer to this question is a resounding “No” for the reasons listed below, which list will probably be expanded in a growing volume over time, as more and more problems become exposed in the current system of money creation and control of the economy.

Does the U.S. Constitution allow U.S. money to be created and issued by entities solely in the private sector? The answer is no. The U.S. Constitution allows money to be created and issued only by the Congress of the United States. Article 1, Section 8, Paragraph 5 of the U.S. Constitution states, “The Congress shall have Power … To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures.” Paragraph 18 further states, “To make all laws which shall be necessary and proper for carrying into execution the foregoing powers.”

Since U.S. money is currently being created and circulated by the private sector, under the auspices of the Federal Reserve, this process is in violation of the Constitution. The Federal Reserve is not a government organization. It is a private cartel of 10 powerful private banks, each of which has the sole responsibility of earning a profit for its investors. The function of earning a profit interferes with the function of working on behalf of the public. Consequently, the U.S. is currently experiencing a pricing structure that harkens runaway inflation. There are no elected officials on the Federal Reserve who are responsible to the American public. The methodology of the Federal Reserve is opaque. It was originally created under fraudulent circumstances in 1913. (The Creature from Jekyll Island, entire story)

Historical precedent described from scholarly research verifies the unconstitutionality of private creation of U.S. money. Research methodology will consist of proof from numerous case studies which confirms the thesis. The conclusions will show that U.S. money can only be created and circulated by the Congressional branch of the U.S. Government. These conclusions will be discussed in the context of historical experience with current evidence of the danger of this private system of money creation to the American public and the world, as was evidenced in 2008.

Banking and money, as we in the United States understand it, existed in Europe from 1500 onwards. It took the form of representations based on gold because gold was heavy, cumbersome, and could not easily be traded in its metal form. Representations included paper notes, among other things. It was customary for blacksmiths to take gold metal for safekeeping and issue paper or other available material as a representation for it. By colonial times, paper scrip was in common use to represent value and be used to trade for goods and services. In the Pennsylvania colony, a Bank of Philadelphia was created during the time of Benjamin Franklin to handle commercial needs. Since no gold was available, the bank printed its own scrip and spent it into the economy to facilitate commercial transactions. The money freely circulated and put the Philadelphia colony in a prosperous position. The colonists paid no taxes during the time of this financial experiment because the system of spending money into the economy worked so well for them. (The Autobiography of Benjamin Franklin)

Later Alexander Hamilton created the concept of the Federal Government printing money and spending it into the economy of the new United States. Unfortunately, he was killed by Aaron Burr in a dual and did not have a chance to develop the first U.S. national bank into the institution he envisioned. It was presumed he wanted to copy the success of the Pennsylvania colony. (The Web of Debt)

When Abraham Lincoln was faced with the Civil War, he was offered loans from the Rothschild Bank of Europe at 30% interest. This same offer was made to the Confederacy. Lincoln declined, under the advice of his Secretary of the Treasury, Henry Carey, and his political ally and friend, Henry Clay. Lincoln chose to eliminate the bankers from the equation, pay no interest, and print the Greenback in his U.S. Treasury, with the support of Congress, as the Constitution dictated. He was successful in funding the North’s victory in the Civil Was and in building a transcontinental railroad using this method of financing. Unfortunately, he returned the railroad, paid for with Federal money, to the billionaire class of the day, so the public lost out on that great source of income and economic prosperity, while the Robber Baron class got its start, funded by Federal money.

After Lincoln was assassinated and his Greenback monetary system discontinued, there came a long string of bank and economic failures. By 1913, J. P. Morgan and John D. Rockefeller, with the political support of Senator Nelson Aldridge, began to conclude a plan they had been working on since at least 1911, or earlier. (The Creature from Jekyll Island) The top Robber Barons of the day met secretly on Jekyll Island, Georgia, to hatch a scheme to pass the future Federal Reserve so that money and oil could gain control of the American economy and money creation power. They were successful in doing this, passing the Federal Reserve Act in early December 1913, when Congress was about to break for Christmas.

William Jennings Bryan was absent, which was an important part of the plan to ram the Federal Reserve Act through Congress. Bryan was diametrically opposed to any form of private control of money creation. He is quoted as saying he would never have let that bill pass. (The Web of Debt) President Woodrow Wilson, an ally of Morgan and Rockefeller, approved the Federal Reserve Act, which became law. In addition, Federal Income Tax was passed, ostensibly to provide the money to pay the bankers the interest they would earn from the American economy for creating our money in the private sector.

John Kenneth Galbraith reports, in many of the approximately fifty books he wrote on economics, that he was disappointed in the overall record of the Federal Reserve. Its purpose was to stabilize the economy. Within sixteen years of its inception, the Crash of 1929 occurred. Then, in the 1930s, the Great Depression followed. Bank failure after bank failure followed. 1989 saw the savings and loan collapse. 2008 saw the Great Recession, which nearly took down the world economies. Galbraith did not live to see the 2008 Great Recession, but if he had, he would not have been surprised. In 2004, the year of his death, he published his lant work, called “The Economics of Innocent Fraud”, in which he cleverly declares the Federal Reserve a complete failure in fulfilling its mission to stabilize the economy.

Our economy continues to suffer from the failure of the Federal Reserve. We are experiencing record prices. Our wages are said to have been stagnant since 1970. This was the year I was 20. My parents bought me a car for $2,000. In 1979, my husband and I bought a house for $53,000, $5,000 down and $500 per month house payment. This same house cannot be bought by an earner of the middle class today.

I propose that we go back to the Greenback, since it worked. An entire economic system must be rewritten to accommodate this beneficial monetary plan for the 99.9 percent of our population. I believe most people would support this measure.

Sources

-

Baker, Scott, America is Not Broke, Tayen Lane Publishing, San Francisco, Toronto, 2015.

-

Brands, H. W., Greenback Planet, University of Texas Press, Austin, 2011.

-

Brown, Ellen, The Web of Debt, Fifth Edition, Third Millenium Press, Baton Rouge, LA, 2012.

-

Chicago Federal Reserve, Modern Money Mechanics.

-

Emry, Sheldon, Billions for Bankers, Debts for the People, (Phoenix, Arizona: America’s Promise Broadcast, 1984), reproduced at www.libertydollar.org.

-

Franklin, Benjamin, The Autobiography of Benjamin Franklin, (Dover Thrift Edition, 1996).

-

Galbraith, John Kenneth, The Economics of Innocent Fraud, Houghton Miflin, New York, 2004.

-

Goodwin, Jason, Greenback, A John Macrae Book, Henry Holt and Company, New York, 2003.

-

Griffin, G. Edward, The Creature from Jekyll Island, Fifth Edition, American Media, Westlake Village, California, September 2010.

-

Keynes, John Maynard, The General Theory of Employment, Interest & Money, Wordsworth Classics of World Literature, Hertfordshire, Great Britain, 2017 (Original released in 1936).

-

Wasik, John F. Lincolnomics, Diversion Books, 2021

Thoughts on the NEED Act and its Revolving Fund

by Kevin McCormick GPTX

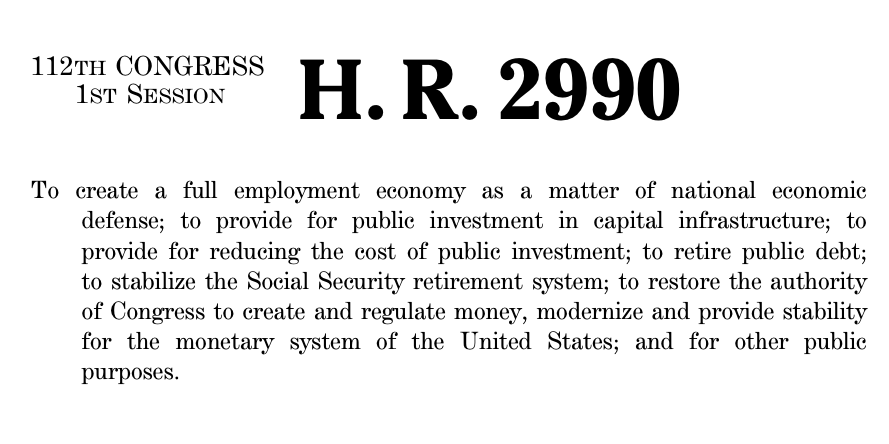

The NEED Act provides the outline of a monetary system that serves a sustainable and humane society. History shows us that a sustainable society requires a public money system designed to serve public purposes, in contrast to the present federal reserve monetary system which is based on bank-created debt and deposits and serves the political agenda and profit motive of the banking cartel. Control over the creation and issuance of money is the heart of banking cartel and corporate power. The NEED Act takes this money power from the banking cartel and places it in the government, under the Congress as provided in the U. S. Constitution. Despite the exploitative nature of the federal reserve system, available credit is necessary to the functioning of society. The NEED Act includes a system for supplying credit which is based on the concept of a revolving fund.

A revolving fund is a money balance from which money is borrowed and then returned so that it can be borrowed again. Individuals use a revolving fund concept with their credit card available credit, although the interest rates are exorbitant. The revolving fund concept is used by the Community Development Revolving Loan Fund of the National Credit Union Association

The NEED Act provides that, as bank loans are repaid, the banks will transfer those payments to the newly created revolving fund. Instead of debt payments being an accounting entry – subtracted from deposit accounts and from loan balances (which extinguishes their existence as money), the amount is transferred to the revolving fund where it will serve as part of the credit supply.

SEC. 403. ESTABLISHMENT OF FEDERAL REVOLVING FUND.

(a) REVOLVING LOAN FUND.—Subject to provision in advance in an appropriation Act, there is hereby established a revolving loan fund in the Treasury of the United States where amounts received from depository institutions under terms specified in section 402 of this Act shall be deposited and made available for relending to banking institutions and for other purposes.

Banks would be able to lend their own money without relying on the revolving fund, but I expect that to be a minor source of credit. The design of the revolving fund implies that the amount of available credit in the future will be roughly equal to the amount of existing credit at the time the NEED Act goes into effect. Also implied is that the amount of available credit will stay the same over time. When a bank wishes to make loan, the bank would receive the money that is to be lent from the revolving fund. As the loan is repaid, the principal would be returned to the revolving fund, while the interest on the loan will be income for the bank.

We can anticipate several issues with this structure. The obvious and likely least important issue is government regulation of loan availability. The NEED Act continues the banking system’s role of metering out money by extending credit. Banks will continue to evaluate loans according to the creditworthiness of borrowers and will continue to lend against assets such as real estate and automobiles. Bank lending is highly regulated under the federal reserve system, so the most likely difference in regulation would be a change in the regulatory agenda — from banking cartel power and profits to economic stability and fair allocation of credit. This will be manifested in bank solvency requirements and in regulations to prevent bank creation of credit-money, for example: overdraft privileges for deposit account checks, which surreptitiously create extra credit in the payment system.

A more subtle issue will be the inflationary or deflationary effects of bank lending practices. The present federal reserve system requires constant inflation to enable payment of compounding interest. Historical data demonstrates that bank assets (loans, credit, or debt) overall increase at a compound rate of between 6% and 8% annually. With the revolving fund system, the available credit will not increase unless the fund is increased. But we can expect the revolving fund to slowly decrease over time because some loans will not be fully repaid and that amount of principal will not be returned to the revolving fund. There are too many variables to permit a prediction of the importance or outcome of this issue. However, if overall debt is reduced and members of the public become more financially secure, one can expect a variety of controversies to arise as the financiers push back against the public escaping their debt traps.

A third issue is whether the revolving fund will begin with an appropriate size. Is it necessary or desirable to maintain the present level of credit? I believe it is possible that the revolving fund would initially be too large — that there would be too much credit available. If real estate and consumer price inflation are reduced to levels near zero, then the present amount of credit could easily exceed the necessary amounts for the future. If the revolving fund is initially too large and banks seek to lend all available credit, it is possible for unsound loans to be made resulting in losses and instability in the banking system. This could also result in the public holding more money overall and having less need of credit in the future.

Contrary to statements that a government-issued public money would be inflationary, my belief is that the NEED Act system would be somewhat deflationary. The NEED Act places the responsibility for the monetary system squarely on Congress. Monetary instability, i.e. inflation or deflation, will be strongly opposed and members of Congress will not be able to deny responsibility. The NEED Act system will have great inertia and be quite difficult for special interests to manipulate in their favor and against the public. Additionally, inflation is truly the enemy of working families, as we see so clearly today with unaffordable housing, medical care, transportation, food, and education.

As was written by Frederic Soddy in 1934 in The Role of Money (p58):

What the public want is a constant price-index, so that the value of money remains stable in goods and services. That they cannot have, as we shall see, without destroying "banking" as now understood. Here, as always, one has to distinguish very sharply between the interests of the public and those of their real rulers; and so far democracy has never had a government that could trust itself to rule independently of the money-power.

The challenge before us is to master the monetary system — to turn this sovereign power to serve the public instead of an elite financial royalty. The NEED Act provides the outline of the most practical plan to accomplish this. The revolving fund and the credit supply it creates will be of great importance in a monetary system that serves the public.

System Change Not Climate Change!

The Crucial Demand of Our Time!

Degrowing from Chaos to a Steady-State Economy

by Steve Showen GPFL

ECOLOGICAL ECONOMICS

TO CHANGE THE SYSTEM, CHANGE THE MONEY!

PARITY ECONOMY

JUST TRANSITION

MAKE CARBON OUR FRIEND NOT OUR FOE

People get it. The realization that we are in the midst of a climate emergency has galvanized youth, keenly aware their futures are at risk. The largest public demonstration since covid was held in the streets at Climate Week NYC, displaying signs demanding system change, not climate change. Having made virtually no progress in climate goals since the first Earth Day fifty plus years ago, the system is the obvious culprit, devouring Earth's resources to feed an avaricious profit-making machine that's never satisfied with enough, wreaking havoc and spewing carbon in its wake. Our growth-driven economic system has pushed us to the limits of our finite planet's ability to sustain us, to the brink of environmental collapse and climate catastrophe. It is imperative that humans transform the way we live upon the Earth and relate to the web of life on which we depend, lest we cross a catastrophic tipping point.

Rachel Jetel of World Resources Institute lays out our challenge:

"And yet to limit global temperature rise, conserve nature, and build a fairer economy that benefits everyone, we will need deep change across every aspect of our economies at a pace and scale we have not yet seen.

“The latest science tells us that we must limit warming to 1.5 degrees C (2.7 degrees F) to prevent increasingly dangerous and irreversible climate change impacts. It also tells us that we must protect, sustainably manage, and restore ecosystems, among other actions, to halt biodiversity loss as soon as possible. To achieve all this, we need fundamental change across nearly all major systems by 2030 — power, buildings, industry, transport, forests and land, and food and agriculture. Cross-cutting transformations of political, social, and economic systems must also occur to enable this and ensure the change is socially inclusive with equitable outcomes for all."

ECOLOGICAL ECONOMICS

In accord with these criteria, the imperative for fundamental change necessitates stopping the runaway growth train and downsizing and reconfiguring our economy and its subsystems to operate within the carrying capacity of the Earth. This entails progressing through a phase of "degrowth" until a "steady-state economy" has been achieved, so that we and the planet may thrive with a stable economy, justly and sustainably, into the foreseeable future.

Degrowth and steady-state economy are related fields within ecological economics, pioneered by the late Herman Daly. Unlike mainstream neoclassical economics and environmental economics, ecological economics recognizes that our economy is an open subsystem within Earth's finite ecosystem. For example, to mitigate the climate emergency directly, we clearly want to phase out fossil fuels and adopt some form of truly renewable energy. However, the immediate priority is to massively draw down atmospheric carbon and sequester it wisely in the soil, avoiding the costly farce of corporate carbon capture schemes. The expense of effective and realistic mitigation measures in relation to economic restructuring must be prefigured to prevent a continuation of the growth-based system, greenwashed in the guise of "green growth" or even "green degrowth," to ensure we're not still headed for disaster, and Sustainable Climate Goals (SCG's) can actually be met.

In a steady-state economy, for example, a stable size of population and material wealth are sustained by a stable flow of natural resources, with low resource throughput and low emissions, not overshooting the ability of the earth to replenish human consumption and absorb waste.

In this report of the Steady State Economy Conference, a steady-state economy is defined as:

"an economy where the goal is enough instead of more. … It is an economy where energy and resource use are reduced to levels that are within ecological limits, and where the goal of maximizing economic output is replaced by the goal of maximizing quality of life … And an emphasis on high quality of life means that economic growth takes a backseat to things that really matter to people, like health, well-being, secure employment, leisure time, strong communities, and economic stability."

The introduction to the Green Party U.S. platform Article IV. Economic Justice and Sustainability begins with: “Green economics is rooted in ecological economics.” Here follows selected excerpts from Article IV, which extends from Sections A. through N., comprising numerous policy proposals.

Our economy should serve us and our planet. Our economy should reflect and respect the diverse, delicate ecosystems of our planet.

Green economic policy places value not just on material wealth, but on the things which truly make life worth living — our health, our relationships, our communities, our environment, and building peace and justice throughout our nation and the world. We aim to maximize our quality of life with a minimum of consumption. We aspire to less "stuff" but more happiness. We propose a shift away from materialism to help people live more meaningful lives as we save the planet from climate change and ever-larger mountains of waste. We need to acquire the ability to distinguish between need and greed.

From Section A. Ecological Economics: Recognition of limits is central to this system. The drive to accumulate power and wealth is a pernicious characteristic of a civilization headed in a pathological direction.

From Section B. Measuring Economic Health: From 1: The steady-state economy has become a more appropriate goal than economic growth in the United States and other large, wealthy economies. From 3: Ultimately, however, the global ecosystem will not be able to support further economic growth. Therefore, an equitable distribution of wealth among nations is required to maintain a global steady-state economy.

A circular economy (CE) is a separate field with a similar sounding name that's a source of confusion. CE aims "to tackle global challenges such as climate change, biodiversity loss, waste and pollution" … by "sharing, leasing, reusing, repairing, refurbishing and recycling existing materials and products as long as possible." CE is lauded by proponents "as a facilitator of long-term growth." While Herman Daly agrees such circular or closed loop processes are all good policies, he observes they are "destined to fall short of their goal of 'sustainable growth'." Recycling is limited, costing energy, material and equipment, and passing through a limited number of cycles before metals become more dispersed and inaccessible, according to the law of entropy. Sustainable growth is an oxymoron. "There is always a scale limit to a sustainable economic subsystem, beyond which growth, even in a 'circular' economy, breaks down, and sustainability requires a steady state economy." Daly emphasizes: "The basic issue of limits to growth that the Club of Rome did so much to emphasize in the early 1970's needs to remain front and center."

TO CHANGE THE SYSTEM, CHANGE THE MONEY!

To initiate the transition, we must derail the engine that drives the growth train: our privatized monetary system. Contrary to popular belief, commercial banks create our money from nothing when they make loans, at interest. Our money is a form of interest-bearing debt, driving economic growth, inflation, instability, inequality, endless war profiteering, and generating a debt based economy that funnels wealth and power to the top. Banks own our money system, which grants them immense power, determining who gets money and who doesn't. They own controlling interest in the major corporations, back fossil fuel companies, and manipulate our political process. Our economy is overburdened by speculative finance. “On an average we pay about 50% capital costs [interest] in the prices of our goods and services.”

Opening the political space to create and fund public policy for overhauling our economic system begins with ending the banks’ money creation privilege. We can then proceed to enact the Green New Deal, "which “is really about the transition to a steady state economy. At least, that’s what it must be about, to be truly green and new,” asserts Brian Czech, executive director of the Center for the Advancement of a Steady State Economy (CASSE). Daly and CASSE hold that money creation and allocation as a public utility is an essential feature of a steady-state economy. Thus a truly Green New Deal will be funded by a democratic sovereign public money system, established by a true peoples’ Congress that has recovered its money creation power to spend on the general welfare, debt free, as granted in the American Constitution, Article I, Section 8. Previously, a bought-and-paid-for Congress had surrendered its money power to the banking cartel with the Federal Reserve Act of 1913.

The U.S. Green Party's Banking and Monetary Reform Committee (BMRC) educates about "Greening the Dollar," a critical initiative found in the party's platform Article IV., Section N., outlining a program to democratize the money and restore Congress's constitutional authority over currency creation, based on the NEED Act, introduced into Congress by Dennis Kucinich in 2011. Its core principles are:

-

End bank creation of money.

-

Restore to Congress the exclusive authority to create and spend money, free from debt, for the general welfare.

-

Integrate the Federal Reserve into the Treasury, making all remaining operations of the Federal Reserve System accountable to the public.

This makes our money system a public utility, able to fund the Green New Deal debt free, and reshape our economy to run in balance with the Earth's ability to sustain us.

An historic example of the success of public money was when President Lincoln issued debt free government Greenbacks during the civil war, which were a major factor spurring the economy and retaining the union. There was also a diminution of debt and interest rates during that period, before the banking cartel overcame the Greenbacks.

The BMRC collaborates with other monetary reform organizations. In the U.S. this includes the Alliance for Just Money (AFJM), and the American Monetary Institute (AMI). AMI issued this urgent statement to COP28 regarding "The Monetary Dimension of Environmental Degradation," inviting signatures from individuals and groups:

"We, the undersigned, believe there exists a significant correlation between the current, dysfunctional debt-based monetary system and environmental degradation, and we strongly believe that sovereign monetary reform will allow a substantial contribution to climate [solution] finance."

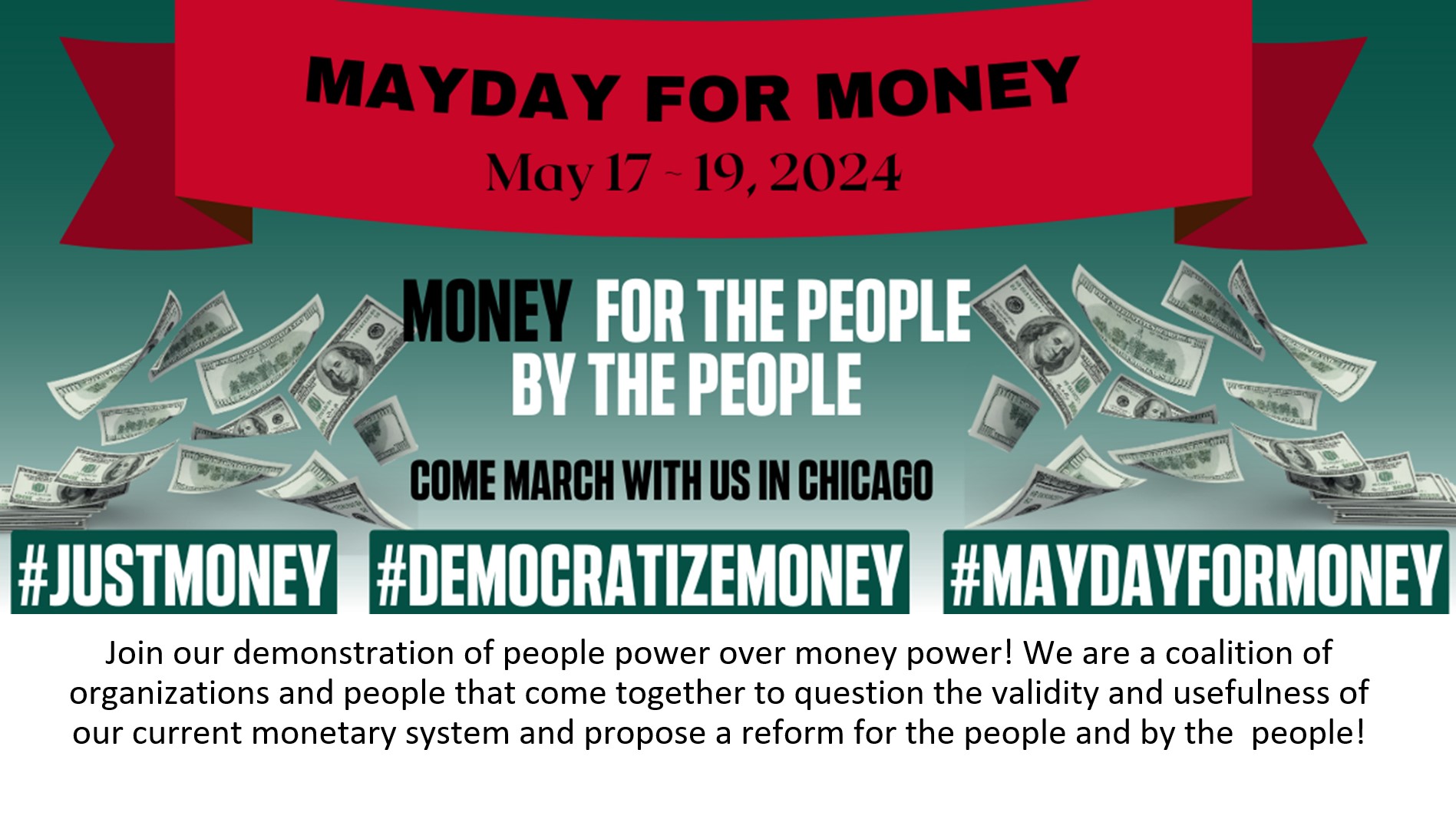

AFJM is organizing a Mayday for Money rally and march in front of the Chicago Fed in 2024, reminiscent of Occupy Wall Street, but with a more informed, focused and transformative objective, to take back our money creation power from the banking cartel, via the NEED Act.

PARITY ECONOMY

Facilitated by monetary reform and applicable within a steady-state economy is a parity (pricing) economy, which is founded on economic research begun during the first decades of the 20th century, establishing raw materials production to be the foundation of the national (income) economy, thus confirming the maxim of natural law that “All wealth comes from the Earth.” It was discovered that raw materials production had to be priced fairly (parity pricing) or the national income (which includes all sectors of the economy) would be impaired. The Raw Materials National Council educated all the State Commissioners of Agriculture about how our NATIONAL INCOME (our economy) depends on the production of raw materials. Its successor in the study of the economic record, the National Organization for Raw Materials (NORM), explains:

“When raw materials enter trade channels at prices in balance with the prices of labor and capital in the rest of the economy, THE ENTIRE COUNTRY can operate on an earned-income basis with no buildup of public and private debt. Conversely, when raw materials enter trade channels at less than parity prices with labor and capital, the economy lacks sufficient dollars to operate on a debt-free basis, therefore, public and private debt accumulates.”

Prompted by the necessity of providing for the nation during WWII, and educated by the Raw Materials Council, Congress passed a parity bill in April 1942, allowing the entire economy to function without debt. However, after 1952 federal farm policy was controlled by international traders and corporations aligned with the banking power, who slowly eroded prices placed to support our major raw material producer, the farmer. Since then we've lost a million and a half family farms to agribusiness. Rural communities have been impoverished.

Getting more farmers back on the land to grow healthy fertile soil while they produce food and fiber is the best way to reduce carbon in the atmosphere and rebuild rural communities, potentially becoming part of relatively self-sustaining bioregions.

Today, with the control of federal economic policy in the hands of the financial sector, money flows to financial elites. They understand that a parity economy feeds the real economy with goods and services for the population, and that the same parity economy would cut them off. They serve only their own interests and not those of our country.

Parity policy is not strictly for agriculture. It is for the ENTIRE ECONOMY — an economy where farmers can keep their farm without losing it to debt, where industrial businesses can pay solid wages and run a profitable business, where retailers can have customers that have money in their pockets to buy what they need for a decent life. A Parity Economy allows all citizens to stay out of debt to the private commercial banks, earn enough money to get their needs met, and support the local communities in our nation.

JUST TRANSITION

The IPCC defines "just transition … as a set of principles, processes and practices that aim to ensure that no people, workers, places, sectors, countries or regions are left behind in the transition from a high-carbon to a low carbon economy."

While the transition to a steady-state economy must be socially just, that does not necessarily mean transitioning to a “low carbon economy” as defined by the IPCC, permitting carbon credits and such. True, we want to get to low or net-zero carbon emissions. But what we really want is net negative carbon emitting industries that remove or capture more CO2 from the atmosphere than they emit, and cycle it eventually to the soil. This would be an instrumental feature of a steady-state economy, which can be done by utilizing carbon to our benefit, by reversing its role from nemesis to benefactor, as we shall see in a moment.

To achieve a just transition to a steady-state economy, a Report of the Steady State Economy Conference calls for global co-operation to be improved:

"Many nations need to increase their consumption of resources to alleviate poverty and allow people to meet their basic needs. These nations stand in stark contrast to wealthy countries like the UK where the benefits of growth have already been realized. The UK and other wealthy countries must stabilize, if not degrow, their economies in order to provide the ecological space needed for poorer nations to grow."

The fact is "we would need 5.1 Earths if everyone lived like Americans," and roughly three Earth's if everyone lived like Europeans. Quality of life is not determined by GDP, which is criticized for being more of an indicator of "illth" than wealth or health. Indices more suited to measuring development and social well-being include the Human Development Index (HDI) and the Genuine Progress Indicator (GPI). Notably, growth is not the same as development. It follows that there is both a necessity and potential for every nation to creatively develop comfortable novel lifestyles and innovative means of production that require far fewer resources to avoid overshooting the one Earthship we have. For example, here is an inspiring proposal:

MAKE CARBON OUR FRIEND NOT OUR FOE

In their book Burn: Using Fire to Cool the Earth, Albert Bates and Kathleen Draper introduce a revolutionary approach to mitigating our climate crisis that would profoundly change our relationship to carbon by “transitioning carbon from a wasted resource to a (CO2) drawdown super hero.” Building upon ancient methods of “transforming impoverished soils into fertile black earth by converting organic materials into long lasting carbon, or biochar, … we can go from spending carbon to banking it.”

“This stable form of carbon can pass through many useful stages as food, filter, fodder, or building materials before returning to the part of the (carbon) cycle where the story began, the soil. During its transformation, useful services like heating, cooling, and power can also be generated. It can restore degraded lands and rebuild biodiversity. It can mitigate the effect of changing climate and ease or enable adaptation.”

“It contains the seeds of a new, circular economy in which energy, natural resources, and human ingenuity enter a virtuous cycle of improvement with bold new solutions that can begin right now.”

SYSTEM CHANGE NOT CLIMATE CHANGE!

An overarching structural change of system is immediately imperative to enable the "deep change across every aspect of our economies at a pace and scale we have not yet seen, ...that ensures the change is socially inclusive with equitable outcomes for all."

This is the existential challenge of our lives. We know what must be done. Let's do it!

The Most Important History is the History We Don't Know

Stephen Zarlenga

(1941 – 2017)

by Howard Switzer GPTN

He worked in the fields of mutual fund investing, commodity trading, real estate, and insurance. In 1996, he founded the American Monetary Institute, established as a 4947(a)(1) trust, dedicated to the "independent study of monetary history, theory and reform." He authored numerous articles and books, and gave lectures, participated in conferences and gave testimony to government committees, on "monetary reform."

He served as director of the American Monetary Institute (AMI) until his death.

In 1996, Stephen Zarlenga founded the American Monetary Institute (AMI), which promotes the independent study of monetary history, theory, and reform and has been its director since then. He is the author of the groundbreaking book The Lost Science of Money subtitled The Mythology of Money — The Story of Power in which he calls into question and challenges the basis, and Achilles’ heel, of American Capitalism: the private control and resulting misdirection of the nation’s monetary system. This book started the modern movement for monetary reform in America. Based on this research, the American Monetary Act was developed to reform our nation’s money system. In this process the Institute sponsored six annual monetary reform conferences in Chicago (the seventh scheduled from September 29th to October 2nd 2011).

Zarlenga also authored the Refutation of Menger’s Theory of the Origin of Money, dispelling misconceptions on the nature of money embraced by the Austrian School of Economics, which Carl Menger founded.

In 1976 Zarlenga served as a trustee and executive committee member of the American Institute for Economic Research (AIER) of Great Barrington, Massachusetts, helping get it through a difficult period in its history. More biography details are at the Lost Science of Money section of the AMI homepage, www.monetary.org. Zarlenga stresses that the crises presents a rare opportunity, which must be used to achieve meaningful reform, and not be dissipated on diversions.

- Our current monetary system is institutionalized usury.

-

- Usury:

- The abuse of monetary authority for personal gain.

- The great religions and philosophers condemned usury.

-

Dante described it as

An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.