How Greening the Dollar Impacts Social Justice

by Howard Switzer GPTN

Greens have determined as others have that it is the capitalist economy that is the problem destroying humanities ability to survive on the planet. Public policy is directed at maximizing profit and control. All that is facilitated by the private control of money creation. Some insist that since money is the problem we should get rid of all money but clearly, they don’t understand what an economy is or how it works.

We define an economy this way: An economy is a system for the exchange of goods and services (all coming from nature) facilitated by an exchange medium, money. An economy without money is severely handicapped with barter being the only means of exchange. Imagine buying a hamburger with gasoline, or visa versa. This problem is avoided they say by having a government provide everything everyone needs so money is superfluous.

Instead of making money a democratic debt-free medium of exchange, they insist on doing without and of course 'doing without' is the kind of austerity economy being imposed on us as it is. That kind of thinking is exactly what the rulers want us to accept, who needs money?

It should be obvious by now that poverty, homelessness, oppression, and war etc. are all public policy choices, and our public policy process is controlled by privately created money, mostly from the finance industry monopoly. It is an awesome power intentionally shrouded in mystery to protect the private interests who control it.

Greening the Dollar restores the proper function of money as a national exchange medium. It is a transition from a private system issuing all money as interest-bearing debt for personal gain to a system of publicly issued money as a permanently circulating asset for public purpose, which is what Greenbacks were.

When Greenbacks were issued debt in the economy began to disappear and interest rates went down. That is why the banks hated them so and did all they could get them out of circulation which was no easy matter. They offered gold for them and made it illegal to use as security or collateral for bank loans and other efforts to undermine the Greenbacks.

Publicly issued money is synonymous with democracy, in that the ancient Greeks realized three millennia ago that issuing the money was the most vital prerogative of democratic self-governance and banned the use of the oligarchs' gold for money. Money creation is the governing factor. Any government that doesn’t control the money is controlled by those who do.

Systems analyst Donella Meadows noted that a "Leverage point" is a point within a complex system (a corporation, a living body, an ecosystem or an economy) where a small shift in one thing will change the entire system. Money is the leverage point in our economic system and controls public policy. This is why we think it should be the focus of our political activism.

I have often heard it said that "We need an economy that works for all of us, not just the wealthy and powerful." True enough but how?

The wealthy and powerful control the economy by controlling the money required for it to function. Money is what makes them wealthy and powerful! Money is the governing factor. This is what makes Greening the Dollar such an important plank in the Green Party Platform.

BUDGETS: The Breakdown

by Rita Jacobs GPMI

The United States budget for FY-2023

(explained in simple English)

Here are the budget numbers simplified for easy understanding:

| Tax Revenue | $4,439,000,000,000 |

| Federal budget | $6,134,000,000,000 |

| New debt | $1,695,000,000,000 |

| National debt | $34,000,000,000,000 |

Recent budget cuts

(which some politicians are proud about) | $245,000,000,000 |

Now, let’s remove 8 zeros from these calculations to compare to a household budget:

| Annual family income | $44,390 |

| Money the family spent | $61,340 |

| New debt | $16,950 |

| Total family debt | $340,000 |

| Total budget cuts | $2,450 |

Although it’s interesting to make this comparison, critics tell us that government budgets are much different than household budgets, and a comparison should not be made.

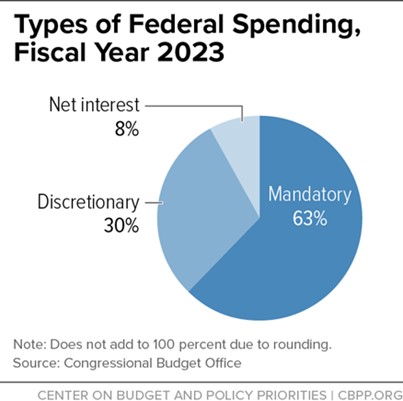

Let’s discuss the federal budget. Here’s a breakdown of the types of expenditures of the federal government:

Mandatory expenditures (e.g. social security, Medicare, and other expenditures from special tax programs) at 63% of the budget would be about $3.9 trillion. Interest expenses at 8% would total about $500 billion. These two items require almost the entire revenue in this budget. Discretionary spending at 30% (which includes military spending) would be about $1.8 trillion. It is clear that the government makes no attempt at balancing the budget.

What policies of the government make it impossible to balance the budget? I’ll start with the most important of those policies. It is the policy of the U.S. government to allow private banks to create all the money that enters into circulation. The government needs to borrow money in order to spend any money at all. Not only that, but the tax revenue is paid from the same circulating money that is created by the banks. It is also the policy of the government to spend most of its discretionary spending (that must be borrowed) on military expenses in its quest to “colonize” the rest of the world. This is becoming exceedingly difficult for the government because the interest that it must pay on the $34 trillion in debts will soon exceed the amount it spends on the military budget. In its quest of colonizing the world, it scarcely cares about the needs of the citizens of its own country.

ARTICLE I, SECTION 8 OF THE CONSTITUTION, GIVES CONGRESS THE AUTHORITY TO CREATE MONEY

Let’s look at the numbers in the household comparison. How plausible would be for a family to have this kind of a financial situation? Let’s start with the annual family income. Considering that the minimum wage is $7.50 per hour, if the family was not able to find work in excess of the minimum wage, it would take three full time jobs to have a total family income of $44,390. And let’s look at the debt. If the accumulated debt of $340,000 was due to medical expenses (e.g. for an illness requiring expensive cancer treatment or long-term rehabilitation), it would not be that unusual. And with the meager family income, the cost of medical insurance would extend far beyond the family’s ability to afford it. Of course, bankruptcy is always an option for extinguishing medical debt. However, what if the debt is comprised of student debt that has been accumulating interest for several years. This may have started out as a much lower debt, but the addition of compounded interest and other charges (refinancing fees, late payment fees, etc.) may have caused this debt to spiral out of control (which is not unusual). Student debt cannot be eliminated by bankruptcy. So, it is possible for a household to be in the same dire straights as the government. However, the family is in dire straights not because of their own fault, but rather because of the policies set by the government.

The government carries on year after year as though it is important to continue to borrow this money. And Congress has internal disputes almost every year about the “debt ceiling.” They have either threatened to or actually shut down the government about 80 times because they cannot agree on how much more money to borrow.

The entire situation defies any kind of sensible logic. It’s like reading a children’s book of fairy tales.

Why We the People Need Greening the Dollar

by Howard Switzer GPTN

Greening the Dollar is sovereign monetary reform based on the three sound monetary principles identified by the American Monetary Institute.

-

Money is a social power embodied in law as an unconditional payment system.

-

Money is the governing factor, so must only be created and issued by government.

-

Money should only be created in amounts commensurate with our production capacity.

As Nobel laureate Frederick Soddy said of money, To allow it to become a source of revenue to private issuers is to create, first, a secret and illicit arm of the government and, last, a rival power strong enough ultimately to overthrow all other forms of government.

This is what has happened and why we need to change it if we want democracy. We have a privatized monetary system that has taken control of governments and industries world-around, and it directs all economic development.

This was revealed in a Princeton University study that found from 2009 to 2014, the 200 most politically active companies in the U.S., all controlled by the banking industry, spent $5.8 billion influencing our government with lobbying and campaign contributions. Those same companies got $4.4 trillion in taxpayer support — a 758% return on their investment.

Banks, as far back as the 1600s, learned that by far their most profitable investments were in governments. Using war debt, the banks gradually got governments to give them control of their monetary systems, giving up their sovereignty and the banks set up a central bank in each country for management purposes. The wars are all banker’s wars, have been for a long time. When you control a government you can send it to war, very profitable for the banks and the industries they control.

As with every system there is a point within it where one small change can change the entire system. Systems analysts call that point a “leverage point.” Money is the leverage point in our economic system and Congress is leveraged by money in every session. Money has more to do with power than it does economics and controls our nation’s public policy. This why Greens want to change the money system to one based on public care instead of private gain.

There are a great many other reasons why we need to change the monetary system:

-

It will soon not be possible for the government to continue paying interest on borrowed funds necessary for meaningful environmental changes — even if war expenditures are reduced. The current federal debt is $34.1 trillion with annual interest payments now at $1trillion. Total US debt is up to $95 trillion across all sectors while the entire US money supply is only around $21 trillion. The monetary system is a global system, and the global debt is now up to $307 trillion while the world money supply is only 82.5 trillion. In this system there is 4 times more debt than money. When all money is created as debt how can we get out of debt? Debt is a form of slavery. This is a global problem which is why there is an International Monetary Reform Movement (IMMR).

-

The banking cartel is controlled by the power elite, the executive arm of the ruling class, and has amassed enough wealth to maintain control of the largest global corporations as well as public policy and will continue to make corporate decisions based only on maximizing their profits and power. Thus we are ruled by an unelected government that has usurped the power of our elected government. This is what Greens want to reverse and change.

-

Financial institutions and large corporations will continue to buy the legislators with their wealth in order to prevent legislation that regulates their ability to amass more wealth

-

Financial institutions will continue to lobby Congress for legislation that is favorable for profits without regard to other needs.

-

The bank funded military contractors will continue to lobby for increases in their budgets because arms manufacturing is very profitable especially when it is possible to arm both sides of the conflict.

-

Innovation in all beneficial sectors will remain stunted while the military industrial complex bloats. There are no meaningful programs that will end the reliance on fossil fuel in the near future because the gas and oil industry is too profitable.

-

The system is already planning on using the remaining natural resources available to control the distribution of clean water, agricultural products and nontoxic environments by turning necessary natural resources into commodities to be used for profit by Natural Asset Companies.

-

Private money creation centralizes food distribution and energy systems making them vulnerable to attack and being shut down.

-

Private money creation centralizes populations making them more vulnerable in an attack.

-

Private money creation precludes democratic decision-making leaving the people vulnerable to elite interests.

-

The elite interests that control private money creation use 'national security' as a justification to advance its interests in maximizing profits and control for war profiteering. They also fund the mass media system now dominated by intelligence community propaganda to cover up or promote other state activities in other sectors. State censorship has made a dramatic rise shutting down critics of public policy across all sectors.

-

Last but not least, Monetary systems are influences on human psychology and behavior. It is currently based on the abuse of monetary authority for personal gain, which is usury, and has powerful negative psychological consequences which is why it was once banned by all religions.

How Money Should Be Created:

The famous economist diplomat, John Kenneth Galbraith said, The process by which banks create money is so simple that the mind is repelled.

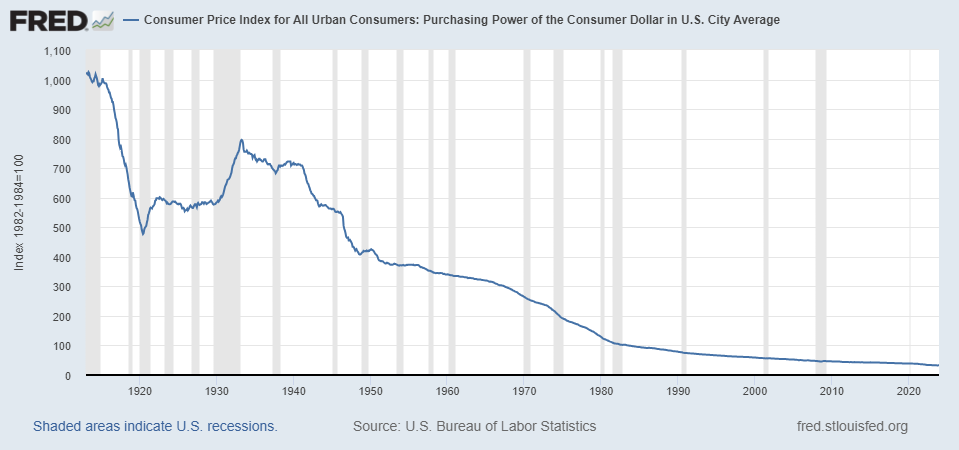

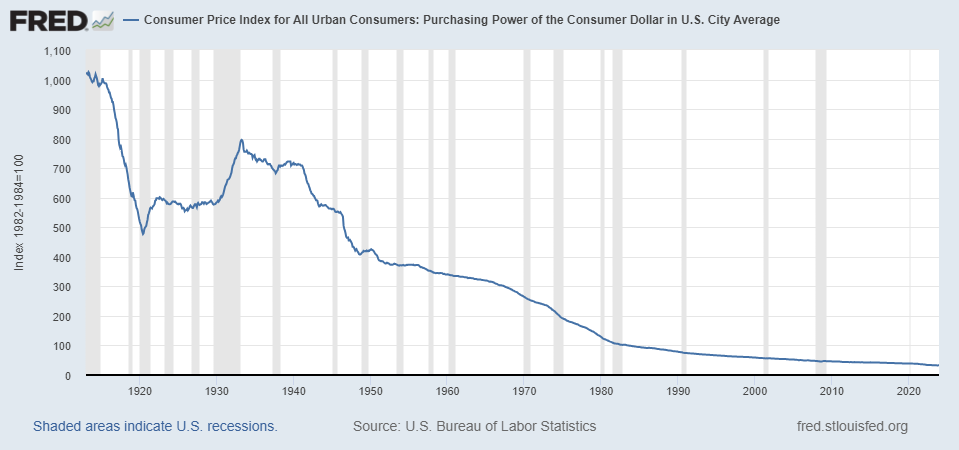

Money, regardless of what nation’s currency we are talking about, is created by a bank making a loan. When the loan is made the bank creates a deposit in the borrowers account in the amount of the principal of the loan simply by typing the numbers into their ledger, creating money. As the loan payments are made those numbers come back down, extinguishing that money. However, interest is also part of the debt so the money to pay the interest must come from the principal of someone else’s loan. This creates a systemic growth imperative as people compete to pay the interest on their debts. Also, when loan payments (money destroyed) exceed loans being made (money created) the system crashes due to a lack of money. When this happens people begin to default on their loans and those with large accumulations of money can pick up the real wealth collateral that secured those loans for pennies on the dollar. Every recession depression is a transfer of wealth from the many to the few. In 2008 it was millions of homes and businesses as well as the assets of 400 banks. Today this happens every 10 years or so. When money was on the gold standard it happed much more often. The economic graphs published by FRED (St. Louis Fed) have gray bands on them to indicate the recessions and depressions.

Purchasing Power of the Consumer Dollar in U.S. City Average

The banks have been successful in making the word usury taboo, but that is exactly what the banks are engaged in. However, anyone using the word risks being charged with antisemitism, not by anyone who knows the history, but by those ignorant of it or by those who don’t want it examined, especially regarding their activities. Usury is the abuse of monetary authority for personal gain. It was once banned by every religion not just for its direct economic injustice but for the psychological consequences as well. It is the sin of sins the progenitor of the seven deadly sins, which is why Dante put usurers in the deepest 7th circle of hell. He characterized usury as the anti-art because it produces nothing of value and worse, it is an extraordinarily efficient form of violence by which one does the most damage with the least effort. This is an apt description of capitalism which is a debt parasite on the back of free enterprise.

How Money should be Created

As mentioned at the beginning, the “Green Dollar” is sovereign money. This means created and issued by the government and, money being the governing factor, this only makes sense because any government that does not control the creation of money is controlled by those who do. Creating the money is the most vital prerogative of democratic self-governance which was recognized by the ancient Greeks ten centuries before the Common Era.

Greening the Dollar was a response to the 2008 banking debacle and consists of three reforms that must be made simultaneously to create and protect a public money system.

-

Require Congress to exercise its Constitutional power to be the sole creator of all U.S. money, issued debt-free, and to establish a transparent and independent public monetary authority to determine the amount of new money the Treasury will disperse under authority of Congress.

-

End the privilege of commercial banks to create and issue what we use as money.

-

Transfer ownership of the 12 Federal Reserve Banks, and all remaining operations of the Federal Reserve System, to the U.S. Treasury.

These reforms were in the legislation introduced to Congress in 2011 by Dennis Kucinich, The NEED Act H.R.2990. So, the legislation to change the system and to change power relations to serving the public interest has been written, it will take an informed movement to get it passed and implemented.

The Most Important History is the History We Don't Know

THOMAS EDISON

By Howard Switzer, GPTN

In a 1921 the famous American inventor was interviewed by the New York Times. They published the interview in which Thomas Edison said:

If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good, makes the bill good also. The difference between the bond and the bill is that the bond lets the money brokers collect twice the amount of the bond and an additional 20 percent, whereas the currency pays nobody but those who contribute directly to Muscle Shoals in some useful way...

It is absurd to say that our country can issue $30 million in bonds and not $30 million in currency. Both are promises to pay, but one fattens the usurers and the other helps the people. If the currency issued by the Government was no good, then the bonds would be no good either. It is a terrible situation when the Government, to increase the national wealth, must go into debt and submit to ruinous interest charges at the hands of men who control the fictitious value of gold.