The Power of the Fed

The Federal Reserve Has Radically Changed from a Central Bank to a Bailout Kingpin. Americans Just Haven’t Paid Attention – Until Tonight. That was the title of an article on the Wall Street on Parade blog that brought our attention to a program that was to air that night on PBS Frontline titled The Power of the Fed. Thus several members of our committee tuned in to see what they had to say.

First and foremost it was good to see the PBS prime time program Frontline focus on the Fed's mysterious activities by bringing some of the hidden workings of the FED to public light. However, it did not make clear the fact that the Fed is privately owned and operated by the major banks. Nor did they point out that 97% of all dollars are digital, not coins or paper bills which are provided by the government at cost to service the banks customer’s cash needs.

In the program, Egyptian-American economist and businessman Mohamed el-Arien said:

“Don’t fight the FED. The FED is the one institution that has a printing press in its basement and there is no limits to how much it can use. That is what makes the FED such an influential player.”

While this is often said, the FED does not have a “printing press” in the basement. The FED is able to purchase bank loans (assets) with “reserves” that it creates. These are accounting entries rather that printed notes. The U.S. Bureau of Printing and Engraving prints the Federal Reserve Notes and then sells them to the Fedral Reserve for cost, according to currency print orders.

The documentary seem to talk around the “web of debt” that is the financial system. If one borrower cannot make the payments, then that creditor, which is itself a borrower, also cannot make its payments, and so on. The value of the debt is a function of the payments, so when the payments stop the financial asset has no value. The FED, through its programs, injects the “reserves” needed for the intermediaries to be able to make their payments, which props up the whole system. The result is a guarantee that financial elites (cronies) cannot lose; they cannot fall from their high position. The stipends of the aristocrats will be maintained whether or not they add anything to the system.

Federal Reserve Money

A monetary system requires the creation and the issuance of money. The Federal Reserve Open Market Committee does neither. The commercial banks do both, however, through the process of creating money to fund loans (creating debt and money). In fact, the commercial banks, while they have no “printing press,” create the spendable money supply by making loans. The loan amount is issued by adding it as a deposit in the borrower’s account or is spent on behalf of the buyer such as in a home mortgage closing, where the it goes to the seller’s account. Having a deposit balance entitles one to withdraw “cash” in the form of federal reserve notes, which are a printed form of our money. These fundamentals are not mentioned in the documentary.

The program blames the tea party republicans for preventing the FED from being able to balance the financial market inflation with the “real” economy inflation. We are left with the impression that the tea party republicans prevented the federal government from stimulating the economy. This is not the whole story. Obama and the democrats refused to bail out mortgage debtors. Money would not be distributed to workers or consumers.

What is implied in the documentary is the concept of a “balanced” inflation, where financial asset inflation is accompanied by real economic inflation. The idea is that the Gross Domestic Product (GDP) should increase in tandem with financial asset prices. This would avoid the cognitive dissonance of a booming stock market and a struggling real economy (unemployment, business losses, and low money velocity). What we have seen, in fact, is that financial markets can inflate at a greater rate than the real economy, widening the “wealth gap.” The real estate market may be somewhat of an intersection between financial markets and and the real economy and here we see a more immediate problem for ordinary people as real estate inflation makes housing increasingly unaffordable.

Federal Debt

The federal debt increases at an approximate rate of 8.5% per year, compounded. This has been true for decades and is not caused by QE or other FED actions to support the banking cartel. Instead, the relationship to finance is that federal debt is, in a way, the “money” of the financial markets. The federal deficit also transmits financial market inflation into the “real” economy by increasing deposits in bank accounts. But we are also reaching a situation where the interest payments on the federal debt are becoming the second largest spending item, disproportionately favoring the top economic classes.

Corporations issued bonds (debt) and used the money for stock buybacks. The insider executives and shareholders received huge gains, but the corporations did little or nothing to create jobs or “real wealth.” The documentary repeats the idea that banks “cannot find attractive loans to make” or corporations “don’t have profitable places to invest.” Low rates and easy money have created a golden age for wall street. The financial sector has grown from 3.5% to 8.5% of the economy.

The documentary is a collection of worries and complaints and does not present a coherent picture of the system and most importantly does not present any idea of an alternative. As BMRC member Eugene Woloszyn points out, it did not deal with 5 key issues that would have helped the audience realize why the monetary system needs to change as well as figuring out the next steps and where to apply pressure to change the system.

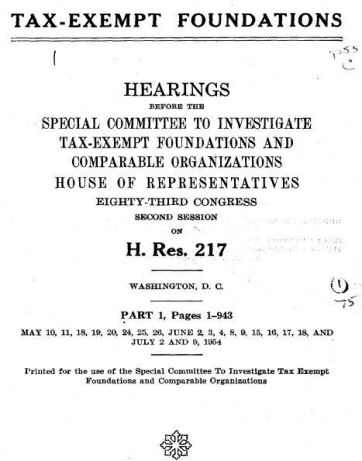

- The FED was created in 1913 along with the US income tax and legal means for the super rich to avoid taxes by creation of billion dollar foundations. Wall Street lobbied for 6 years and paid off politicians to create the FED’s complicated structure so Wall Street could control the FED and profit enormously. For instance, the 12 Fed regional banks are all owned by giant privately-owned banks. The most important, the New York FED is 50% owned by JP Morgan Chase and protects Wall Street from any serious investigations and punishments, while regularly bailing out Wall Street.

- The FED rationale was it would prevent economic crashes. But it has been a total failure, neither predicting nor preventing earth shaking crashes in 1929, 2000, 2008, and 2020. That’s three crashes in 20 years. END THE FED and return the US to the Constitution, which states that only “Congress shall have power to coin money and regulate the value thereof, …” An elected Congress, not a Wall Street controlled FED, should be in charge of our monetary system.

- The FED has painted itself into a box, with zero percent interest for Wall Street, while we pay 3%-6% interest on home loans, 7.5% or more on college loans, an average of 17% on credit cards, and 26% on balances at Amazon and Home Depot. This is usury. Thirty years ago the maximum interest in many states was 6%. This shows you the power of Wall Street over state laws, the FED and the federal government. As Frontline states, the “FINANCIAL INDUSTRY” has increased its share of our economy from 3.5% to 8.5% in the last 40 years, bleeding us dry with endless debt. The FED programs only offer more debt and INEQUALITY.

- Higher interest rates would allow small savers to safely gain a return on their savings. As this document shows, when the FED tries to taper away from subsidies to Wall Street, Stocks and Bonds partially crash through manipulation by Wall Street. Then the FED gets terrified and returns to QE and zero interest rates, which continue spikes in large scale asset prices and more inequality.

- The heart of the Wall Street smokescreen is that the 97% of dollars in circulation (that are not coins or paper bills) are created by banks when they make loans by entering digits in our bank accounts. Thereafter, we are forced to pay back the principal plus interest, which can go on for years or decades. Banks are the only corporations who can LEGALLY create such loans out of thin air and force us to repay, usually with usurious compound interest. Note that this money power enables banks to choose who gets loans and for what purpose. Giant Banks make loans for speculation on commodities, fracking, private prisons, war planning and equipment, methane to single use plastics, etc.

Economic Injustice

The main cause of economic injustice is the extraordinary grant of power and privilege by Congress to private banks to create money when making loans. Private banks create 97% of the money in circulation. They also choose the recipients of these loans. Great wealth has accumulated to the private banks and financial institution as a result of their collection of interest on what is basically the entire money supply in the US.

This wealth has been used by the banks and financial institutions to collectively acquire controlling interest in most of the largest corporations, and use their wealth to influence the election of politicians of their choice in order to gain control of the government and influence policies adopted by the government.

Government policy in creating unnecessary weapons of mass destruction, interference in foreign elections and carrying on a state of perpetual war — while ignoring climate change and destruction of the planet — can all be traced to the wealth, power and influence of the banks and financial institutions. This also results in extreme wealth inequality — not only in the US — but also globally.

So what is the PLAN OF ACTION?

Study the NEED ACT submitted in 2011 by Representatives Dennis Kucinich and John Conyers. This has been updated by the Alliance for Just Money now as The American Monetary Reform Act of 2021. There will soon be a petition to sign for pushing this change forward. We need a US Sovereign money system, controlled by an elected Congress, not controlled by Wall Street or its puppet, the FED. This legislation would do that.

Simply Put

The fatal blind-spot that most thinkers have — be they left, center, or right — when it comes to money and banking, is that they assume that banks lend savers' deposits to borrowers, when in fact this never happens, and so the banks not only lend the money, they create the money by adding numbers to their ledgers, and thus make the whole economy (and polity) entirely dependent on them.

They have "the upper hand" over everyone else: industrialists, unionists, media, and politicians. It is a hidden hand too, because of the general ignorance of the basic fact that banks create money when they make loans and destroy it when loans are repaid. Thus, the entire money supply is rented from the banks; they're the ultimate rentiers, not landlords, not industrialists. The landlords and industrialists are all in debt to the banks too.