OWNING NATURE?

By Rita Jacobs

The Banking and Monetary Reform Committee urges everyone to pay close attention to the rise of the new type of investment listed on the New York Stock Exchange (NYSE) called the Natural Asset Company (NAC). This new asset class was developed by the Intrinsic Exchange Group (IEG), whose three investors are the Inter-American Development Bank (IADB), the Rockefeller Foundation and Aberdare Ventures. The mission of the IEG focuses on “pioneering a new asset class based on natural assets and the mechanism to convert them to financial capital.” IEG describes the assets to be held by the NACs to include "biological systems that provide clean air, water, foods, medicines, a stable climate, human health and societal potential." In other words, privatizing the entire Commons. Asset classes unlocked by NACs are valued by IEG at $4 quadrillion ($4,000 trillion). IEG collaborates with natural asset owners (governments and private individuals and entities) to create Natural Asset Companies and bring them to the public capital markets.

It is interesting that corporations have had little or no interest in providing reparations or remedies for the damage they have already done to farmland, oceans, ecosystems, drinking water, and air. Their main interest now is re-establishing ecosystems or engaging in regenerative farming and other investments for the purpose of profiting from the damage they have done. It seems that the banks and their billionaire associates have loads of money that need to be invested and apparently are not particularly fond of the new digital assets like non-fungible tokens. The idea of forming the NACs was developed over the last two years while the world was overtaken by a pandemic that dominated the mainstream media. The establishment of these NAC's was first announced at COP26 in November.

While specific projects undertaken by NAC's are not described on IEG's website, it is not difficult to make the leap to understanding why billionaires and corporations are buying up large swathes of land around the globe. Predatory Wall Street banks and financial institutions will have the ability to dominate more of the natural world.

BMRC predicts that the banks and financial institutions will control these companies much the same as they currently control most of the largest corporations – by using their collective wealth to gain controlling shares and having their officers serve on corporate boards. The banks will also use their special privilege of creating money to decide which companies will receive loans for their projects. What we don't fully understand is how these NAC's will earn their profits. Do they intend to sell clean water on the open market? Does it mean that they will use regenerative agriculture to monopolize food production in the world?

Critics of the development of these new investment vehicles have pointed out the likely problems to be caused by these companies. If the current trend for ending the use of fossil fuel continues, vast increases in lithium, copper, nickel and cobalt are necessary for the transition to electric cars and equipment necessary for renewable energy. New mining will most likely occur in the poorest countries, and most likely in areas of indigenous populations. The Inter-American Development Bank, one of the investors in IEG, is described in Wikipedia as "the largest source of development financing for Latin America and the Caribbean." Established in 1959, the IDB supports Latin American and Caribbean economic development, social development and regional integration by lending to governments and government agencies, including State corporations." Some critics have pointed out that "debt-trap diplomacy" is used when Latin American countries owe large sums of money, and allow land use in return for debt forgiveness. IEG is running a pilot program in Costa Rica.

In the expectation that corporations will now own all valuable natural resources, Whitney Webb, an independent journalist who investigates these Wall Street asset classes has referred to the development of the NAC's as a "financial swindle" and "the final battle." She also states that the owners of these natural assets "will ultimately have the right, in this system, to dictate who gets access to clean water, to clean air, to nature itself and at what cost." Looking Behind the COP26 Propaganda with Cory Morningstar & Iain Davis

As always, the BMRC promotes monetary reform that will take away the special privilege and power of banks to create money and bestow this Constitutional right and responsibility on Congress where it belongs. The Green Party Platform calls for a sovereign money system, where all money to be issued would be authorized by the Congress debt-free. Direct funding by the government of infrastructure, education, and other government programs would assure that wealth is redirected for the many, not just for the few.

Monetary Reform: Catalyst for Saving the World

The Potent Gem Greens Should Know Is In Their Platform

A letter by Steven Showen

Thanks again, Ginger for your thoughtful response to my post about the work of the Green Party's Banking and Monetary Reform Committee (BMRC). To continue the conversation addressing some of your points:

I hear your concern that you felt the BMRC discussed only one thing, the private money system, and that therefore you did not find a place to contribute in the areas of your academic background, international development and financial policy. It is true the BMRC is fully focused on one thing: taking away from private banks the power to create the nation's money as debt for private profit. (Check out this short 5 minute video explaining it well, referring to the U.K. system, which works like ours.) This singular odious fact underlies all our problems, yet has been crowded out of the public eye. Raising awareness and energy to win debt free money for the public good is our mission.

But you can see from the number of topics covered in our newsletter that there is plenty of room for addressing related financial topics. It may be true that the committee "never once (in any of the meetings I've attended) discussed actual fiscal or monetary policy that we would enact if a Green were to hold office," … or made "suggestions (for) regulation and monetary policy which would make this country more in alignment with GP values." While our business is crafting timely messages about public money that can puncture the smokescreens, we would certainly welcome your bringing up those topics.

Thank you for your compliment and comment that you "love how focused on this issue, passionate, and innovative everyone on the BMRC is, but I question how feasible this one idea would be to implement in the real world." And: "I fear none of the members of this committee understand the extreme measures it would take to completely overhaul the entire financial system in such a way."

I would answer that with a few other questions: How feasible do you think it is to stop climate change and prevent environmental collapse before it's too late? How feasible is it to achieve the system change that would be required to accomplish that … in this eleventh hour?

Or for that matter, how feasible is it for Congress to pass The Green New Deal, or even pass universal healthcare, … or pass any number of programs the majority of Americans support, in this supposed democracy?

We're talking about a democratic revolutionary agenda, so what is the revolutionary strategy?

Your point is well taken that the time is for action. And yet, as you so poignantly noted earlier: "Sadly, we still do not hold any power in government or politics. Our only power is as the public voice of opposition to the corporate oligarchy."

As a political party, that's where we're at. That's what we have to work with. At the minimum, we must lay out the Green Agenda before the world, our platform, our statements, and our candidates … presenting an agenda that most Americans agree with, as it happens. Greens may continue to be helpful on the local level. How to pull off the needed broader revolutionary change at this critical moment is the big question. BMRC is putting a brave and necessary, historically proven program on the table. Broad public education about monetary reform is required to inform and inspire a movement that, when the opportunity arises or is triggered, has at hand a program ready for implementation. The opportunity to rebuild a new system must come with the consciousness about what went wrong in the first place, otherwise, we're doomed to repeat the same error all over again.

The groundwork must be laid, the idea conveyed broadly that a fundamental influence on human organization is whether the money system is intrinsically distributive or self concentrating. This affects everything down the line, from racism, patriarchy, classism, environmental plunder, wealth inequality, warfare, etc. When people come to understand the necessity of a democratic, distributive system explicitly for the ‘common good,’ they have something truly life changing to fight for, and will be prepared to implement it when the moment arrives.

For Greens, the uncomfortable truth is we’ll not get the big Green agenda items unless we pass monetary reform. Enacting monetary reform (MR), or democratizing the money system, is a prerequisite to achieving our program. This renders monetary reform a fundamental plank in our platform, called Greening the Dollar. As such, monetary reform has revolutionary import, being a catalyst for regenerating people and planet and fostering peace.

Yet surprisingly, Congress originally was granted the money power in the Constitution, Article One Section Eight. Unfortunately, Congress surrendered that vital power to the private banking cartel when it passed the Federal Reserve Act of 1913. The money power is our birthright! We the People are called upon to recover what belongs to us and future generations. Unifying and organizing ourselves to elect a Congress who will reaffirm this key Constitutional power and enact monetary reform is the supreme challenge of our age.

A growing MR movement could employ a number of tactics in bringing that about. For example, it might generate a loud public outcry to apply pressure to the powers, calling for the sane, distributive money system that Greens propose. That would surely enrage the fire spitting ogre of private credit, having surreptitiously acted as money for millennia, springing forth unmasked in a desperate showdown with We the People.

In the meantime, Greens must continue to put forth our program, (just so the Democrats can co-opt it and water it down:), building popular confidence in the GP as the only remaining forward looking independent political party out there. Election reforms, chiefly Ranked Choice Voting, help empower people and facilitate building popular critical mass to support political action. Monetary Reform should absolutely be a fundamental part of the conversation right now, because few people know about it, not even most greens! I invite you to take a deeper look into our Greening the Dollar plank, and reconsider joining us in spreading the word and building the movement. The private money power is what got us in this mess. Our taking it back is essential to restoring people, planet and peace.

The most valuable history is the history we don't know

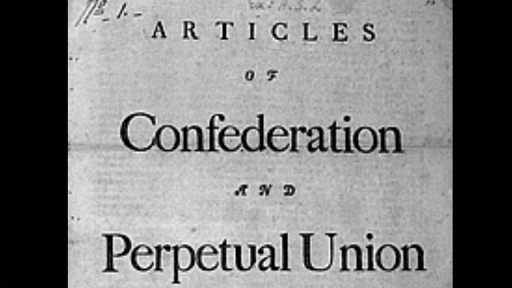

1781 – RATIFICATION OF ARTICLES OF CONFEDERATION, THE FIRST US CONSTITUTION

By Howard Switzer

The Articles of Confederation and Perpetual Union” of the thirteen States was ratified and in force on this date (February 2, 1781). The Articles was the first Constitution of the United States, preceding our current constitution by several years. The Articles granted the Federal Government the authority to issue money and determine its value if nine states agreed. The colonies did and $250 million in Continentals were issued to pay for the war. And pay for the war they did, but over that five and a half years the Continental lost its value.

This was because the big foreign bankers behind the Bank of England knew how to make monetary war — the British printing presses ran around the clock printing hundreds of millions of counterfeited Continentals to flood the colonial economies and devalue the currency. While the counterfeiting operation was successful, it was too late as the war was won militarily by the revolutionaries. But in the post war power struggle between Jefferson the farmer and Hamilton the banker, the big foreign bankers soon won the monetary battle. Which, as they later discovered, was a much better way than military methods to control the new nation.