Understanding the Power of Money Creation and Control

By Rita Jacobs

This article is a simple plug for a very informative documentary by John Titus.

It is available on YouTube at https://www.youtube.com/watch?v=2gK3s5j7PgA

I will post below his introductory explanation of his documentary given under its title ("All the Plenary's Men"). It was published on his channel, Best Evidence, on April 28, 2017. As with all of John Titus' videos, it is very well documented. It exposes the sovereignty of banks as members of the Bank for International Settlements (BIS), which was established by international agreement in 1930. The bank has, of course, gone through many changes in structure and members since that time. The video explains why no bankers were prosecuted after the economic collapse in 2008. Explanations given by the US Department of Justice (DOJ) for not prosecuting bankers are simply false. The video gives a detailed description of the roadblocks encountered in prosecuting bankers. Watch the video to understand Titus' final remarks in the video:

"When the real sovereign power of a nation wages war against her from within, presidents get in line or get eliminated. What they don't do is risk hanging their masters, who keep the people at war with each other by keeping them in the dark."

Following is Titus' introduction:

“The King can do no wrong.”

—William Blackstone, Commentaries on the Laws of England

“When the president does it, that means that it is not illegal.”

—Ex-President Richard Nixon, interview with David Frost

The question at bar is why the U.S. Department of Justice has failed to prosecute any too-big-to-fail banks or—more importantly—their bankers, even for admitted crimes.

It’s a crucial question, because after eight straight years of unremitting prosecutorial failure, it looks very much as if a select group of top banks can, in fact, do no wrong. If that’s the case, then our constitutional republic isn’t merely in trouble. It's dead.

A person or group of people who satisfy Blackstone’s criterion for ultimate sovereign power—the power to commit crimes with impunity—can’t exist in a nation where the law reigns supreme. And yet here we are a decade after the financial crisis began in earnest, and not one TBTF bank executive has gone to jail.

Legally, the TBTF banks are indistinguishable from the King, since the power to commit crimes with impunity swallows all other sovereign powers; such a power isn’t even supposed to exist in the U.S., and yet it does.

Moreover, since there can’t be two kings in a kingdom, the entire U.S. government, from the president on down, is just one of the King’s men under this formulation of power. The real job of the U.S. government, then, isn’t to represent the will of the people at all, it’s to do the King’s bidding. A nation that isn’t governed by law is governed by instead by a king—it’s one or the other—and the president’s inferiority to such an above-the-law sovereign was confirmed over 40 years ago with Nixon’s ouster. The president, unlike the King, answers to the law (despite Nixon's opinion).

Now, you may say that while the TBTF banks might arguably have the de facto power of the King, that’s a far cry from wielding such power formally (i.e., having de jure criminal immunity).

The reply to that objection is set forth in this film, “All the Plenary’s Men,” which is a sequel to “The Veneer of Justice in a Kingdom of Crime.”

Another objection, raised by the DOJ itself, is that it HAS prosecuted TBTF bankers, citing cases like that of Raj Rajaratnam. These cases, however, in fact reveal the DOJ acting on behalf of the criminal global banking cartel.

On that score, the DOJ’s abysmal track record is by now so extensive and so thorough that it’s possible to spot legal patterns in the DOJ’s protracted miscarriage of justice, and, as you’re about to see, those patterns are very deeply disturbing indeed. What’s been going on cuts right past a garden variety constitutional crisis like Watergate straight to a crisis of sovereignty.

The backdrop for all of this is HSBC’s exoneration in December of 2012 for laundering money for drug dealers and terrorists, about which the House Financial Services Committee issued a report in July of 2016. Whether it was due to the political circus in town at the time, or to the Republican authorship of that report (albeit without dissent), it didn’t get nearly the scrutiny it deserved.

You see, prosecutors working on the HSBC case were actually going to indict the bank, but they got overruled, and HSBC and its team of criminals skated. The story of how exactly that reversal came about reveals, if not the King himself, then certainly many of the King’s top men.

Make the coffee extra strong before viewing. Lots of ground gets covered, quickly.

And don’t mothball those pitchforks and torches just yet.

PART 10 THE MONEY MATRIX:

Bankers Take Control of AT&T and Mass Communications, 1900-1939

By Sue Peters

This article will describe how J.P. Morgan and its banking allies took control of the American Telephone & Telegraph Company (AT&T), and thus control of the telephone utility. The same telephone utility lines were used to transmit national radio broadcasts (beginning 1920’s) and TV (beginning 1940’s).

Introduction

“When a commercial bank makes a loan contract with a borrower, the bank CREATES the deposit in the borrower’s account.” Have you repeated this fact 15,000 times yet? Private banks CREATE what we use as money.

This ‘money power’ can also be called Finance Capitalism or Wall Street. The ‘money power’ controls the entire society, since they decide who gets ‘loans’ – new bankmoney. They give it to their friends, to weapons manufacturers, to multinational corporations. The private creation of bank credit (bankmoney) concentrates wealth in elites and destroys our republican form of government.

In the U.S. Constitution, this power was given to Congress to issue sovereign money, like the old gold and silver coins from the U.S. Treasury and the Greenbacks of Abraham Lincoln. When the Congress authorizes and spends sovereign money as an asset, wealth is more fairly distributed to the citizens. The nation does not go into debt. Here is Edward Kellogg in 1883: “The most fundamental law in any nation is that which institutes money; for money governs the distribution of property, and thus affects in a thousand ways the relations of man to man.” (1)

Background: The “Money Trust” and the Pujo Committee, 1912

Towards the end of the 19th century, wealthy elites took over control of the economy, by creating financial-industrial cartels. Bankers and industrialists like J.P. Morgan, John D. Rockefeller, Andrew Carnegie, etc., used the ‘money power’ to do this — the private banking system CREATING bankmoney in the account of a borrower.

In 1912 the House Committee on Banking and Currency was authorized to “investigate the concentration of control of money and credit.” It was called the Pujo Committee (2), after its chairman, Congressman Arsene Pujo of Louisiana. The committee did not find a single money trust that would be unlawful under the Sherman Act, but they did find a dangerous concentration of money and credits in the hands of a few men of great power in the financial world, especially in New York. The most powerful was J.P. Morgan.

The Mechanisms of Control

To understand the mechanisms of control, one must understand the difference between investment banks and commercial banks. Investment banks, such as J.P. Morgan & Co., are private partnerships, and do not have the power to CREATE bankmoney when ‘making loans’. Commercial Banks, such as National City Bank of New York (today’s CITIBANK), are private corporations that have a government charter with this power of CREATING bankmoney when ‘making loans.’ The investment banks, by either controlling the commercial banks or working in tandem with them, create the ’Money Trust’.

A major conclusion of the Pujo Committee was:

Large corporations — such as insurance companies, railroads, producing and trading corporations, and public utility corporations — are heavily influenced by their dependence on the investment banks to buy their new issues of stocks and bonds, needed by the corporation to expand and grow. This dependency gives the bankers influence over the corporation. (3) In addition, the committee identified a coterie of investment and commercial banks — around J.P. Morgan & Co. in New York — creating a monopoly over the buying/selling of securities of the large corporations. (4)

Banking Syndicates to Buy/Sell Stocks and Bonds

The investment and commercial banks join together in ‘syndicates’. The investment bank gets a loan from the commercial bank. With this loan money, the investment banker buys the corporation’s stocks or bonds. They are bought cheap. The investment bank sells, at a high price, to other investment banks and commercial banks, in the syndicate. With this sale, the investment bank repays its loan to the commercial bank, and makes a nice tidy profit.

There may be multiple levels in the syndicate, each rung selling to the next lower rung at a higher price (to make their profit). At the bottom will be the selling of the securities to the public – at the highest price.

The most powerful syndicates are found around the J.P. Morgan banking house.

J.P. Morgan and AT&T

According to the Pujo Report (5), J.P. Morgan has participated in syndicates between 1906 and 1912 that market the securities of the public utility, AT&T and its subsidiaries. The total dollar value was in excess of $300,000,000. AT&T’s total capital stock and funded debt was $621,000,000. These dollar figures point out the great influence the Morgan firm has over this utility.

The following account is from the book, The Master Switch by Tim Wu: (6)

Theodore Vail had been the manager of the Bell Company back in the 1880’s. Vail pushed centralization and top-down control of the company, but the owners did not agree. Vail left and went to South America for business. “Sometime in the early 1900s”, Vail received a phone call from J.P. Morgan to meet on Jekyll Island, South Carolina, where Morgan spent his ‘free time’ in his private clubhouse. Morgan told Vail on this visit or shortly afterward that “he and a group of other financiers aimed to gain control of the Bell company, wishing not only to reestablish its former dominance but to build the greatest wire monopoly the world had ever seen. And he wanted Vail in charge.” (7) Vail agreed.

In February, 1906, a Morgan banking syndicate underwrote $100,000,000 of AT&T bonds and began the reorganizing of the company on a “national scale” (8). “After 1906 the house of Morgan served as principal banker to AT&T.” (9) Vail was made president of American Telephone & Telegraph (AT&T), the current holding company for the entire Bell system, and began immediately to build a monopoly. Vail’s new slogan for the utility was: ONE SYSTEM, ONE POLICY, UNIVERSAL SERVICE. Meaning, monopoly.

Money, An Academic Blindspot?

By Howard Switzer

The question of what money is has been debated in academia for over a century. One would think something so ubiquitous in society it would be studied and well known and yet it is not really taught in schools and universities. However, I did find a mention of it in The Stanford Encyclopedia of Philosophy.

The Stanford Encyclopedia of Philosophy notes that there are two competing theories of money.

-

The Commodity Theory where a commodity is used for money, or to back money.

-

The Credit Theory where credit, in the form of bank debt, is used for money.

So, commodity money is controlled by those who control the commodity and credit money is controlled by those who control the credit. Because of the power of wealth these could be controlled by the same interests. Because both are privately owned and controlled systems, there is no way either of these can make for a stable and just monetary system. The proof is historical and all around us.

Problem

My question is, why is there no "Money Theory of Money?" A system where money is created, issued, and used for money?

As Aristotle said, "money exists not by nature but by law." This just refers to the fact that money is embodied by law regardless of whatever currency or currencies it designates to be used.

Thus, coins, paper and electronic currency as used today need not change. The question is do we want a commodity, credit, or money to be used as money?

The Constitution gives the power to create money to Congress, not to any bank, central or otherwise. And it certainly was not intended to become a private for-profit business, or the Constitution would never have been ratified.

We the People formed a government in Order to form a more perfect Union, establish Justice, ensure domestic Tranquility, provide for the common defense, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity.

If our government doesn't control the money, how can it do any of these things? Instead, we have a privately controlled money system whose only interest is in making profits and manipulating the laws of the land in their favor, has assured us we will attain none of those things.

The Solution

The platform of the Green Party of the United States proposes a new monetary system consistent with Article 1, Section 8, Clause 5 of the United States Constitution to serve the general welfare and commerce of society. Our proposal requires government to be the sole creator of all U.S. money, ending the privilege of commercial banks to create money, and transfers all remaining operations and resources of the Fed to the U.S. Treasury.

Most people believe that the government already creates the money and that banks lend existing money from deposits. None of this is true. but it should be. The nation’s monetary system should not be run as a private for-profit business but should instead function as a public utility. Instead of commercial banks issuing the nation’s money as interest bearing debt, government would issue permanently circulating public asset money as a share in the nation’s equity. Congress would no longer have to borrow bank-created money to fund the deficit, increasing the debt and annual interest payments, already up over a half trillion dollars.

Instead, all new money created would be spent, lent, or granted into the economy for the general welfare the nation as its first use and the current debt to bond holders will be paid off as they come due. This would eliminate the boom/bust cycle stabilizing the economy for the first time in the nation’s history. It would also empower Congress to at long last fulfil its Constitutional mandate; to form a more perfect Union, establish Justice, ensure domestic Tranquility, provide for the common defense, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity.

The current financial system is in crisis offering us an opportunity to intervene before the Fed takes control of the financial resources of ordinary citizens with central bank digital currency (CBDC). Greens have an opportunity to organize the considerable opposition to this. Greening the Dollar changes the economic system from a private for-profit system to a public for-care system, the ONLY sustainable way to fund the needs of the people and planet. Awareness of the money issue is growing, and Greens can step into a leadership role by bringing this long-deferred solution into the light.

The most valuable history is the history we don't know

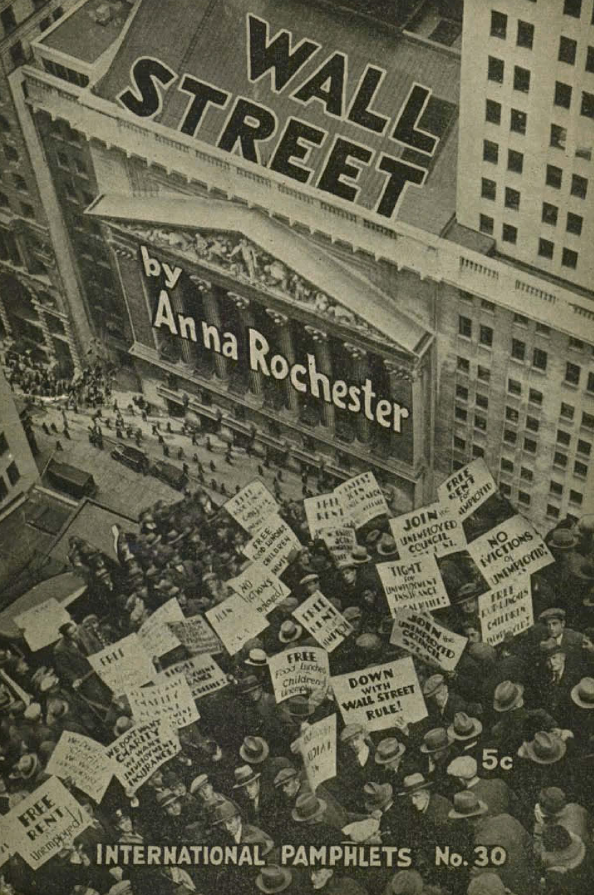

Anna Rochester

By Howard Switzer

Labor reformer and communist intellectual Anna Rochester was born in New York City in 1880. From 1912 until 1915, she wrote and edited for the National Labor Child Committee and from 1922-1926, she was the editor of a pacifist magazine, The World Tomorrow.

Rochester spent much of her life striving for the rights of children, women and the working class. She was most revered for her literature, which brought ideas to the surface that were new and unusual even among well-read people. The most well known of her books are Labor and Coal, Lenin and the Agrarian Question, The Populist Movement in the United States, Why Farmers are Poor, Capitalism and Progress and the one having the largest impact, Rulers of America. Besides monographs, Anna wrote many articles and pamphlets concerning the labor movement and the impact of capitalism.

One of those pamphlets was called Wall Street where she calls out the capitalists for their activities.

"The purpose of the Wall Street rulers is always the same: to shape financial, industrial, national, and international policies in such a way as to add to their own immediate profits. To this end they control the government: indirectly through the doping and bribing of public opinion and directly through a firm grip on the national machinery of both the old capitalist parties."