Less is More

New money for a new economy

by Mary Sanderson, GPWI

Jason Hickel uses the growth imperative as the frame for our dilemma; the violent history of it in Europe, then everywhere, leading to today's social & environmental crises. Of course I wish he'd said 'bank credit' instead of 'capitalism' at least half the times he used that word,

He emphasizes artificial scarcity, debunks capitalist tech 'solutions' and eases into the money problem via Jubilee. The book is surging in popularity after being lost in the covid years. After the short but accurate money moment, he lays out some solid starting points for IMAGINING healing futures!!!! He connects the need for true democracy in several places, and gives us an accessible tour of the mindset/heartset choices we face (control vs reciprocity).

Hugely helpful for me is Hickel's balanced but accurate inclusion of the debt money factor at the root of the growth imperative (brave) within the great big picture! We monetary reformers need this. Maybe we over-react to the total absence or twisted, confounding presentations of bank credit, and end up looking fanatic. Hickel helpful, even though I wish he'd been more explicit about bank credit system at the root of growth.

I have heard MR people discount Hickel because of some previous MMT essay, but that might be a mistake. In LESS IS MORE he has really given us something to work with. Eager for your thoughts.

Here is the sub chapter on money.

New money for a new economy

But debt cancellation is just a one-off fix; it doesn't really get to the root of the problem. There's a deeper issue we need to address.

The main reason our economy is so loaded with debt is because it runs on a money system that is itself debt. When you walk into a bank to take out a loan, you might assume that the bank is lending you money it has in its reserve, collected from other people's deposits and stored in a basement vault somewhere. But that's not how it works. Banks are only required to hold reserves worth about 10% of the money they lend out, or even less. This is known as ”fractional reserve banking”. In other words, banks lend out about ten times more money than they actually have. So where does that extra money come from, if it doesn&aps;t actually exist? Banks create it out of thin air when they credit your account. They literally loan it into existence. More than 90% of the money that’s presently circulating in our economy is created in this manner. In other words, almost every single dollar that passes through our hands represents somebody’s debt. And this debt has to be paid back with interest — with more work, more extraction and more production.

This is extraordinary, when you think about it. It means that banks effectively sell a product (money) that they produce out of nothing, for free, and then require people to go out into the real world and extract and produce real value to pay for it. It is so outlandish as to offend common sense. People have a difficult time believing it could possibly be true. As Henry Ford put it in the 1930s: ‘It is perhaps well enough that the people of the nation do not know or understand our banking and monetary system, for if they did I believe there would be a revolution before tomorrow morning.’

Now, here’s the problem. Banks create the principal for all the loans they give, but they don’t create the money needed to pay the interest. There is always a deficit, always a scarcity. This scarcity creates intense competition, forcing everyone to scramble to find ways to get the money to pay back their debts, including by taking out yet more debt. If you’ve ever watched a game of musical chairs, you have an idea of how this plays out. Each round of the game ramps up the scarcity of chairs, and players have to fight each other to get to one of the few that are left. It’s chaos. Now imagine we up the stakes. Instead of just getting knocked out of the game, you lose your home, your kids go hungry, and you can’t pay for medicines. Think about what such a game would look like – the desperate measures people would take to get to a chair – and you have a rough picture of how our economy works.

Casual observers of capitalist societies might conclude — as many economists have done — that vicious competition, maximization and self-interested behavior are hard-wired into human nature. But is it really human nature that makes us behave this way? Or is it just the rules of the game?

Over the past decade ecological economists have concluded that a money system based on compound interest is incompatible with sustaining life on a delicately balanced living planet. As for what to do about it, there are several ideas floating around. One group argues that all we need to do is switch from the existing compound interest system, where debt grows exponentially, to a simple interest system, where it grows linearly—adding the same increment each year. Over time this would put a huge dent in total debt levels, bring our money system back in line with ecology, and allow us to shift to a post-growth economy without causing a financial crisis.

A second group argues that we need to go further, and abolish debt-based currency altogether. Instead of letting commercial banks create credit money, we could have the state create it — free of debt — and then spend it into the economy instead of lending it into the economy. The responsibility for money creation could be placed with an independent agency that is democratic, accountable and transparent, with a mandate to balance human well-being with ecological stability. Banks would still be able to lend money, of course, but they would have to back it with 100% reserves, dollar for dollar.

This is not a fringe idea. It was first proposed by economists at the University of Chicago in the 1930s, as a solution to the debt crisis of the Great Depression. It made headlines again in 2012 when it was promoted by some progressive IMF economists as a way of reducing debt and making the global economy more stable. In the United Kingdom, a campaigning group called Positive Money has built a movement around the idea, and now it’s being picked up as another possible step towards a more ecological economy. What’s powerful about this approach isn’t just that it reduces debt, but that a public money system would enable us to fund things like universal healthcare, a job guarantee, ecological regeneration and energy transition directly, without having to chase GDP growth in order to generate revenues.

Hickel, Jason. Less is More (pp. 238-240). Random House

The Federal Reserve System

The Monetary Growth Imperative

by Kevin McCormick, GPTX

People who understand the climate and ecological crisis realize that transformative change of the economy is necessary. One very necessary transformation is from a growth-oriented economic system to an ecologically sustainable system. We are familiar with the observation that infinite growth on a finite planet is impossible. Despite this simple and obvious truth, the political establishment continues to strive for what is called “economic growth.” The establishment — political, media, corporate, etc. — does not operate in the context of nature, rather it operates in the context of the political and economic hierarchy, which is centered around the banking cartel and its control of the monetary system. The Federal Reserve Monetary System enables a small elite to amass enormous wealth, but this system also creates ever increasing debt for the vast majority of the population.

The vital element of the Federal Reserve Monetary system is the political privilege of banks to create debt and deposits. Commercial bank loans are created and funded by account entries — the loan as a bank asset, the deposit as a bank liability. The money creation privilege is such that commercial banks have strong incentives to create new loans, but few penalties for excessive or misdirected lending. Profits accrue to the bankers, while harms are externalized and fall on the public or the environment. There are, as well, strong incentives for borrowers to borrow additional funds — such as to obtain money to make payments on existing debt. The consumer debt that banks create often is for consumption of necessities, housing, or depreciating automobiles, and does not increase the borrower’s ability to make payments. The inescapable result is monetary inflation – new debt – becomes a source of money for payments on existing debt — the monetary growth imperative. The increase of federal government debt and the distributive spending of government payments is a source of private deposit funds that is vital to borrower credit-worthiness and is the subject of a previous article.

This system requires that borrowers can actually make consistent payments for loan interest and principal. The newly created loan and deposit amounts do not include the interest that is required to be paid by the borrower, so there is an immediate mismatch in obligations. For example, the total of payments on a home mortgage may be as much as three times the purchase price — in other words, the interest cost could be double the loan amount. When a borrower receives a bank loan, the loan proceeds (the deposit balance) are distributed to other economic participants. The borrower no longer possesses the money to entirely repay the loan, but is required to make installment payments and the borrower must have income to pay debt service as well as necessities.

If credit money is removed in any way from the flows available for debt payments, then some debt payments cannot be made unless credit money (new debt) is increased. The accumulation of large cash hoards by corporations, of vast fortunes by the elite, and of savings by ordinary people, all effectively remove money from the debt repayment flows. New credit creation is needed to provide the funds for debt payments and is a significant cause of monetary inflation and the exponential growth of debt. These considerations are discussed in Monetary Adaptation to Planetary Emergency: addressing the monetary growth imperative, where the point is made that “… if the debtors in aggregate are not able to earn enough money to service their debt (over and above securing their livelihood), then aggregate debt must increase.”

Policy tools would somehow be needed not just to control the aggregate amount of spending, but to ensure the sales volume of every debtor was within parameters that enabled their debt to be serviced but did not encourage them to borrow more. It is hardly imaginable that this kind of macro- and microeconomic management could take place in a capitalist economy. Therefore, in a capitalist debt-money economy, the ‘withdrawal from circulation’ mechanism will structurally generate spending shortfalls, thus locking in future growth: this is the MGI (monetary growth imperative). (page 16)

While the policy tools imagined above are designed to exactly balance debts and payment ability, a real-life example of “policy tools” used to manage credit money is provided by the Desenrola Brasil, a credit management program, which, as the article notes, “… seems to be a functional strategy that supports mass consumption via indebtedness for the purposes of rentier accumulation.” As Brazil pursues fiscal austerity, limiting government debt and spending, the Desenrola Brazil policy creates “… a nation where debt rollover is part of the struggle for survival …”

After a decade of expanding consumer debt in Brazil, the default rate on consumer debts rose as high as 44%. The M2 money supply for Brazil, created by bank credit, has increased by about 18% per year from 2020 to 2024, from 3.04 billion to 5.33 billion. This monetary inflation is necessitated by the indebtedness of the Brazilian consumer and supports the conclusion from Monetary Adaptation to Planetary Emergency that when debtors cannot obtain enough money to make debt payments, then aggregate debt must increase.

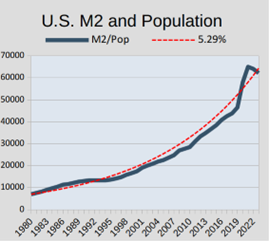

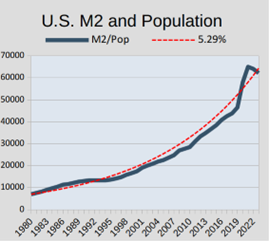

Experience in the United States also demonstrates the monetary growth imperative. The graph shows the U.S. M2 money supply divided by the population for each year from 1980 to 2023. The M2 money supply per person has increased by approximately 5.29% annually. The population has increased by approximately 0.9% annually. The population in 1980 was 229 million, and the M2 money supply was 1.6 trillion, or about $7,000 per person. In 2023, the population was 336 million and M2 was 20.8 trillion — about $62,000 per person — 8.2 times higher than in 1980. Despite such a huge increase in money, no one would argue that the average American was 8.2 times better off in 2023 than in 1980. Over this time span the U.S. middle income share of aggregate income has declined from 60% to 42%, indicating that inflation of the money supply has been distributed very unequally across the population. The debt oppression and monetary inflation experience in the United States is perhaps less dramatic than the experience in Brazil, but the facts of inadequate income, increased consumer debt, and increased financial accumulation by the elite in both countries show there is indeed a monetary growth imperative in debt-money financial systems.

The debt-money system of the banking cartel, the Federal Reserve Monetary System, creates a self-reinforcing system of debt expansion which is often described as “economic growth,” but which is more accurately described as the monetary growth imperative. The debt-money system operates without constraints from “externalities” and cannot be adapted to the requirements of an ecologically sustainable economy — not in Brazil, not in the United States, and not anywhere else — as is made clear in Escaping Growth Dependency, a publication of the monetary reform advocacy group Positive Money, .

The Green Party platform Greening the Dollar proposal, which provides the solution to the present dysfunctional monetary arrangement, has three essential parts:

-

Require Congress to be the sole creator of all U.S. money debt-free;

-

End the privilege of commercial banks to create money.

-

Transfer all operations of the Federal Reserve to the U.S. Treasury.

Unlike the Federal Reserve System, a sovereign money system does not create a monetary growth imperative. With a democratic government, creation of money by the government is constrained by the public opposition to inflation and will also be constrained by the reduction of debt and elimination of the monetary growth imperative. The NEED Act (HR-2990) contains a plan for the transition to a sovereign monetary system which does not rely on debt creation and provides an escape from the monetary growth imperative. Replacing the Federal Reserve Monetary System with a system such as provided in the NEED Act will allow the government to be a positive force in addressing the environmental crisis and the social crisis brought on by excessive debt. Adopting a sovereign monetary system where money creation and issuance does not create debt, such as provided in the NEED Act, is an essential part of the transformative change we need.

Reference citations:

Arnsperger, Christian, Bendell, Jem ORCID: https://orcid.org/0000-0003-0765-4413 and Slater, Matthew (2021) Monetary adaptation to planetary emergency: addressing the monetary growth imperative. Institute for Leadership and Sustainability (IFLAS) Occasional Papers Volume 8. University of Cumbria, Ambleside, UK.. (Unpublished) Downloaded from: insight.cumbria.ac.uk/id/eprint/5993 ]

Board of Governors of the Federal Reserve System (US), M2 [M2NS], retrieved from FRED, Federal Reserve Bank of St. Louis; fred.stlouisfed.org/series/M2NS , March 27, 2024.

U.S. Bureau of Economic Analysis, Population [POPTHM], retrieved from FRED, Federal Reserve Bank of St. Louis; fred.stlouisfed.org/series/POPTHM, March 29, 2024.

Economic Growth

Perpetuates the Cancer in our Money System

by Rita Jacobs, GPMI

As you hear news reports about our economy, you probably notice that “growth” always seems to be an important part of the report. Generally, our economy is only described as “healthy” if it has “grown.” Why is that so important?

Gross domestic product (GDP) is the usual tool used to measure economic growth. GDP consists of the total goods and services produced for sale in the market, and also some spending by the government, including defense spending, and other spending on services. It does not include social security payments, and other payments that were included in GDP in a previous year. It is also adjusted for inflation, so it is designed to be an indication of whether there was an actual increase in the “output” in the economy over an earlier period. GDP is usually computed quarterly and annually.

In order to keep the economy “growing” it is necessary for the big corporations to constantly produce new products to replace those that may already be in existence. Creation of advertising for these new products is itself a big business. And the big corporations continually make products that cause their earlier products to become obsolete. This has been especially noticeable in the development of all the technical “necessities” that continue to grow — such as computers, printers, scanners, and cell phones. The internet gave rise to the need for more and more technical appliances. Before many of these items are perfected, they are placed on the market, only to be replaced in two or three years due to obsolescence. The modern world has come to rely more and more on new technology that has become a necessity to function in today’s society.

Growth in the economy is necessary when profits are the main measure of decisions to produce new products. This obsession with profits and new products has also resulted in much destruction of the earth’s ecosystems and changes in the climate. There are no meaningful changes being made to stop the climate crisis because they would not be profitable.

So why do we have this constant growth that has resulted in the societal problems that we have today? The short answer is that the growth is required because of a flaw in the money (monetary) system that we have. A monetary system refers to the way in which money is introduced into circulation in any society. Our present monetary system was created by the Federal Reserve Act in 1913. Although Congress was given authority to create money in Article I Section 8 of the Constitution, Congress delegated this authority to private commercial banks. About 97% of the money in circulation is digital bank money that exists in banks and investment accounts. The remainder is paper money and coins. Private banks create money when they make loans. As loans are paid off, the principal of the loans is extinguished in the banks’ bookkeeping, and is removed from circulation. Interest is being charged on the entire money supply. The problem is that no additional money is created for payment of interest. This is the fatal flaw in the system. In order for interest to be paid, the money in circulation that is used to pay interest must come from money created by a loan to someone else. Over time, debt grows to a level that is many times the amount of money in circulation. On a graph this debt continues to grow on a trajectory that approaches infinity. A graph of interest on the debt also grows on a trajectory approaching infinity.

We have seen in the last few decades, new loan instruments in the form of credit cards, payday loans, and student loans. We have also witnessed a gradual rise in the legal rates of interest on various forms of debt. Just as the national debt has now risen to $34.8 trillion, personal debt is $25.5 trillion; and corporate debt is $13.7 trillion. The US money supply in circulation is $20.9 trillion. It is obvious that it is not possible for the debts to be paid off under the current system unless the hamster wheel of new loans keeps spinning.

Debt is what I refer to as the cancer growing in the system. Debt levels have increased to a point where they can never be paid, and more and more money in the economy is spent on interest payments to the already wealthy class in society. This constant “growth” requirement adds to their wealth. And the bankruptcy filing rate per capita has increased to 80 times the rate in 1920.

Money should be created debt-free by the government to be used as a medium of exchange. The current method of creating money as debt has been around for centuries, and does nothing but create chaos. As Napoleon Bonaparte so aptly stated: “Terrorism, War and Bankruptcy are caused by the privatization of money, issued as a debt and compounded by interest.”