Editors note:

This article was criticized by some Greens as dismissing the huge End Fossil Fuels march in NYC. The author's intention, however, was not to diminish the movement but to add a dimension to it.

We Called for Climade Action at The UN . . . . KUDOS!

Now There's More We Can and Must Do!

by Steve Showen, GPFL

The world has witnessed the largest climate mobilization since the pandemic as concerned citizens came together to demand presidential action to phase out fossil fuels and address environmental injustice. Kudos to the thousands who turned out, and to the many Greens who participated, led by The Green Party's Eco Action Committee. Visibly present were Jasmine Sherman and Dr. Cornel West, who are seeking the Green Party's nomination for presidential candidate 2024. Protests have been historically impactful, and continue to be indispensable in raising awareness of the climate crisis and demanding action from our leaders. We also recognize that protest alone is not enough. Relying solely on politicians entrenched in the existing system, beholden to corporate interests, and hoping they will enact meaningful climate policies is not a viable strategy. They've done virtually nothing since the first Earth Day in 1970 to thwart global warming, which has evolved into a climate emergency. Greenpeace International noted that at the UN Climate Ambition Summit that "ambition [was] shamefully missing," and that "we remain at full speed on the highway to climate hell."

SYSTEM CHANGE NOT CLIMATE CHANGE!

A number of hand-held signs were seen at the NYC march calling for "System Change Not Climate Change!" While folks may have differing ideas on what that entails, and myriad movement efforts collectively contribute to system change, it is essential to perceive the root cause of the climate emergency. It is a profit-driven system that prioritizes financial gain over environmental well-being and social equality. It is incapable of rectifying the mess it has created, even as it touts green capitalist technologies as solutions.

So, what is to be done to dismantle this profit driven system impelling the climate crisis?

To change the profit-driven system requires understanding the fundamental structural mechanism that empowers it. Unbeknownst to most of us, that is our privatized money system, a process whereby private banks create money as a form of interest-bearing debt, by way of making loans. At a recent webinar produced by Swedish monetary reform group Positiva Pengar, Greenpeace International's Carl Schlyter (min. 50) emphasized that the private bank creation of money is a flaw in the system. This system has driven our planet to the brink of catastrophe. The logical response is to bring money creation back under public control, as was specified in the Constitution. The Green Party's platform features a critical initiative called "Greening the Dollar," which outlines how to do that. We are the only political party to have a plank on monetary reform.

The Constitution granted Congress the power to create money, debt-free, to spend on the general welfare (Article 1, Section 8). However, in 1913 The Federal Reserve Act transferred this power to private banks, enabling them to create money out of thin air through interest-bearing loans. "Our" money is a form of interest-bearing debt. This grants banks immense power.

Banks decide who gets money and who doesn’t. They own controlling interests in corporations, serve on their boards, setting up a debt-based economy, driving wealth and power to the top, and controlling the political system. The bankers' private debt-money is the dynamo that energizes the profit motive to plunder the planet, oppress people and wage war.

Shutting down the bankers' planet-killing profit machine requires returning the power of money creation to public control, as per the Constitution. That would be a transformational event. As Nobel Prize winner Frederick Soddy once remarked: “Ten centuries before Christ the ancient Greeks recognized that the most vital prerogative of democratic self-governance was to create the money.”

PUBLIC MONEY FOR THE PUBLIC GOOD!

"Greening the Dollar" is a critical initiative found in the Green Party's platform which outlines a program to democratize the money and restore Congress's constitutional authority over currency creation. The NEED Act, already introduced into Congress in 2011, serves as the basis for this initiative. Its core principles are:

-

Ending bank creation of money.

-

Granting Congress the exclusive authority to create and spend money, free from debt, for the general welfare.

-

Integrating the Federal Reserve into the Treasury.

It falls upon We the People to elect a Congress that will pass the NEED Act. While not the end in and of itself, Monetary Reform would both break up the profit driven system and provide the tool we need to make public policy for the common good, to do the things we need to do.

The Green Party's Banking and Monetary Reform Committee (BMRC) plays a role in educating and inspiring Greens and the public to accelerate this democratic transition. By collaborating with our valued movement partners, who are all doing necessary parallel work, we aim to shift from a burning world ruled by psychopathic oligarchs to a brighter future founded on mutual care for people, planet, and peace.

Achieving climate recovery demands a united effort from individuals across the political spectrum who share a common interest in our collective survival.

The choice is clear — either we unite for systemic change or we face oblivion.

The Unsustainable Monetary System of the U.S.

by Rita Jacobs, GPMI

The monetary system is unsustainable. The system was wired at its birth with a scheme of ever-increasing control and wealth by the already wealthy bankers who devised it. The creation of endless debt and compound interest was intended to constantly grow to infinity, with no plan to contain its ultimate demise. One must wonder what these devious bankers had in mind for its end. Maybe we are beginning to find out.

We have reached the stage where the wealthy control the very thoughts of the people. The monetary system has allowed the bankers and wealthy elites who joined their ranks to control the government, large corporations, the media, and education. Banks are also in the business of selecting cabinet members for the president. This results in agency capture whereby the banks are able to influence the regulations enforced by the agencies.

It is becoming more and more obvious that the banks have a very cozy relationship with the Department of Defense. I am speculating here that it results from the pressure put on Congress by the banks and the weapons manufacturers they control to constantly increase the budgeted amount for the Department of Defense (DOD). Military weapons and equipment are the biggest export business in the US. The think tanks that provide recommendations and information to the State Dept. and the DOD are staffed with retired military, bankers, former State Dept. officers, and others. These are not elected people. It is interesting that the marketing and distribution of the Covid vaccine, as well as recommendations for the treatment and prevention of spreading of the virus was handled by the DOD. The main benefits from this arrangement went to the pharmaceutical companies.

The crash of the economy in 2008 is a good example of the control by the banks over the government and corporations. This was the biggest example of widespread fraud in the financial industries and banks in the history of the world. The control of the bankers can be very well illustrated by the fact that no bankers went to prison — except perhaps one who was sacrificed by their employer bank that brought the fraud to the attention of the Department of Justice. It is not hard to understand why the banks had de facto immunity from prosecution when one discovers that the Attorney General position and other officers in the Obama administration were filled with lawyers from the law firm that represents all of the largest Wall Street banks. This is a prime example of agency capture.

I would like to follow up on a quote by Napoleon: “Terrorism, War and Bankruptcy are caused by the privatization of money, issued as a debt and compounded by interest.”

We are certainly witnessing war and terrorism through the forever wars that the US is engaged in, and the use of economic sanctions against dozens of countries, as well as the domestic police brutality against those who rally and protest government actions and policies. We are subjected to increasing censorship by the government. Our rights are being slowly eroded as the bankers and their controlled corporations gain more power and autonomy. With regard to bankruptcies — as of 2004, the filing rate for bankruptcies per capita was more than four times the 1980 rate and nearly 80 times the 1920 rate.

Education of the public on this issue is becoming more and more difficult because people simply cannot grasp that the government allows banks to create our money supply and then borrows that money to fund its spending. It makes one truly wonder what was going on that has allowed this situation to exist for more than 100 years. No one seems to ask how the government got $32 trillion in debt.

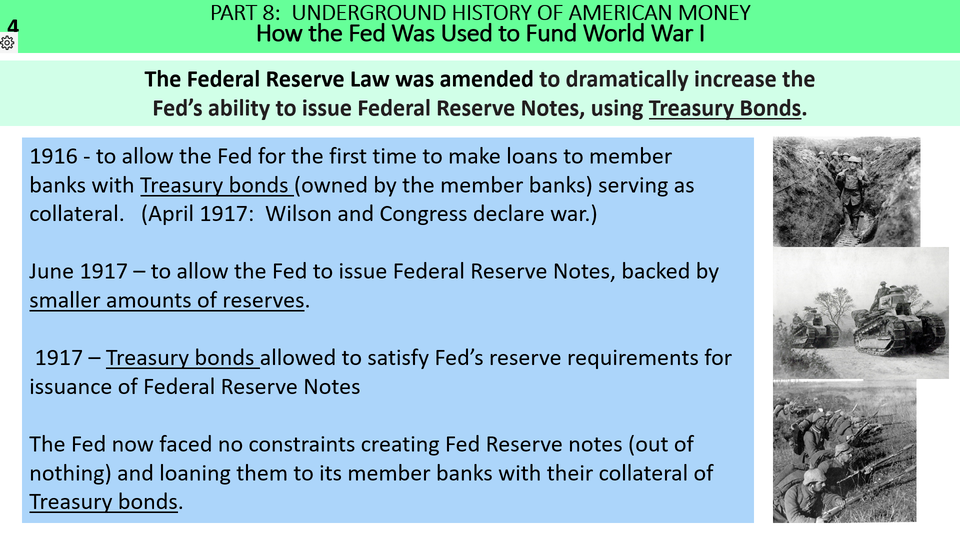

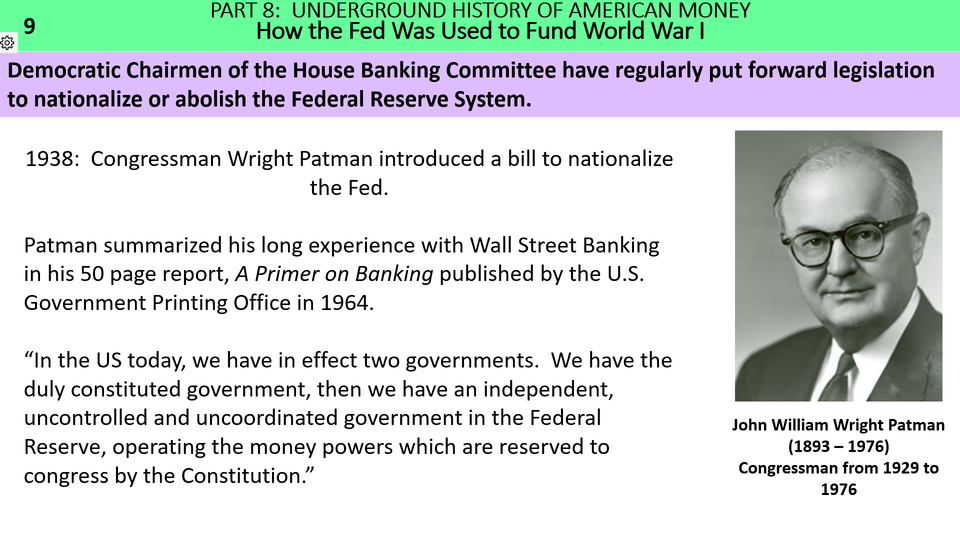

Part 8 the Underground History of Money: How the Fed was Used to Fund WWI

by Sue Peters, GPNY

WHAT IN THE HELL HAPPENED TO OUR WAY OF LIFE?

by Rita Jacobs, GPMI

As you know, our country has been going through many changes in the past few years that have affected most of us in a negative way. We are faced with growing debt, financial problems, unaffordable health care, declining life expectancy, and the highest rate of poverty of the developed countries. Although we are supposedly a country that champions democracy, we find that voting has not helped the outcomes of these domestic problems. While the cost of housing is increasing, rent becomes unaffordable, homelessness continues, and the percentage of Americans who own their own homes continues to go down.

We have seen an increase in the effects of climate change that are ever-more prevalent and devastating, while our government fails to take climate change seriously, and has no meaningful programs to assist people who are displaced from their homes. Meanwhile, President Biden has signed 6,430 permits for oil and gas drilling on public lands during his first two years in office, exceeding the number that were signed by President Trump in his first two years in office. There seems to be no concern at all for all the problems at home. Meanwhile wealth inequality has risen to a rate that exceeds the gilded age of the 19th century.

But equally disturbing is the bipartisan support of constant increases in the military budget, which already usurps more than half of the discretionary government spending. And the national debt has now increased to $32 trillion, and the interest payments will continue to rise at a faster rate than the military budget. We are constantly reminded that the government can’t afford free education, universal health care, adequate public housing, child care, and other necessary assistance for families. Twenty percent of children in the US are living in poverty.

There is an underlying reason for the changes that have occurred in our daily living and the reason why they continue to worsen. We are never taught certain things about our economic situation because those powerful corporations and wealthy elites who control our government do not want the average person to know anything that will affect their ability to continue to extract all the wealth from our society. Money does not grow on trees, and little thought is given to how it gets into circulation and eventually is used to pay living expenses and saved for retirement, while a large chunk of it ends up in the hands of billionaires. I will try to shed some light on this riddle.

The first millionaire in the US was John Jacob Astor, who lived from 1763 to 1848. He made his fortune in the fur trade. The first billionaire was John D. Rockefeller. His personal wealth was estimated at $900 million in 1913. We now have 770 billionaires in the US. Somehow trillions of dollars has been created over the past 100 years in order for these people to have accumulated so much wealth. In the meantime the US has borrowed $32 trillion, and where does that come from? Who created that money?

The Constitution in Article I, Section 8, gives Congress the authority to create money. Knowing this, do you wonder how the government can be $32 trillion dollars in debt? Do you wonder where money will come from to pay that debt? These are logical questions.

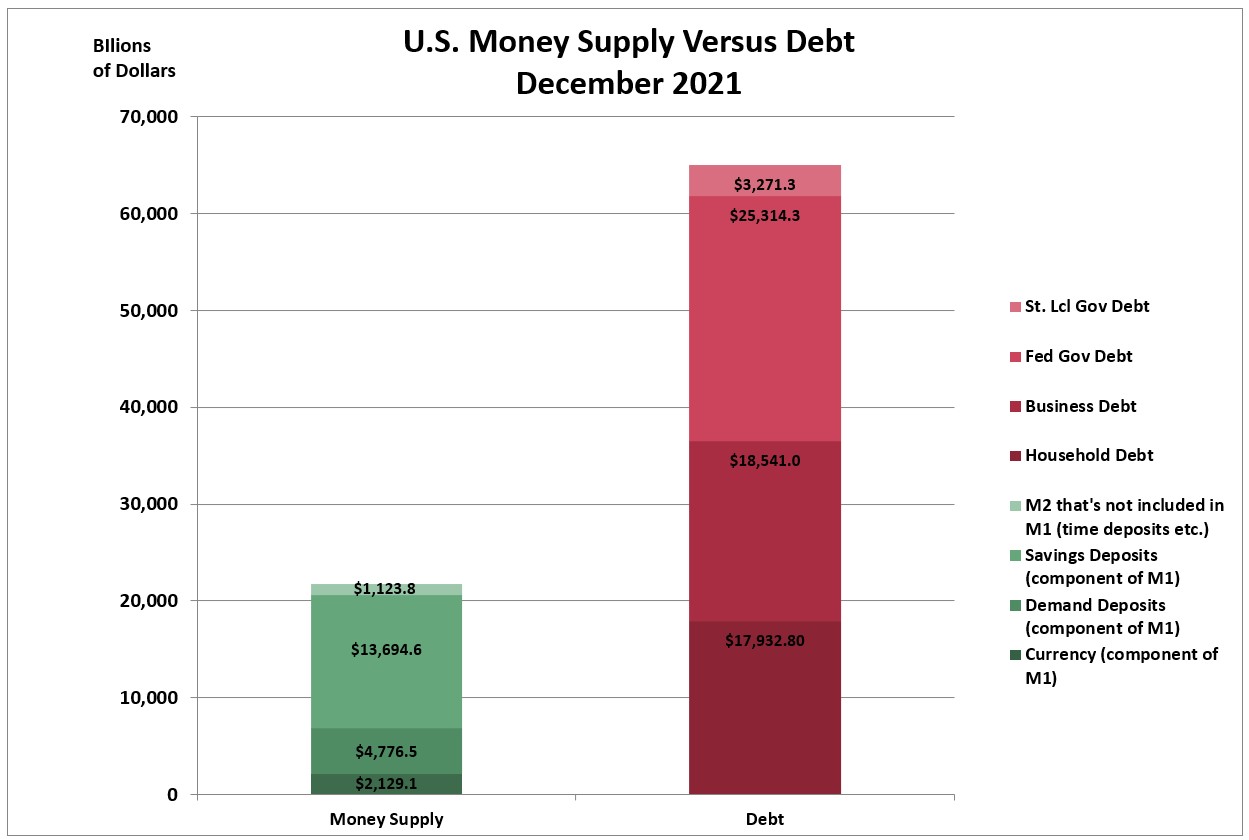

Congress passed the Federal Reserve Act in 1913 — the same year that John D. Rockefeller was estimated to have almost a billion dollars. This act set up the Federal Reserve System that gave private banks the privilege and power of creating all the money in circulation — except for coins. About 97% of the money that circulates is created by private commercial banks. These banks create electronic money when they make loans by simply adding it to the borrowers account. They do not loan money they have on deposit. This is a difficult concept to grasp, as it doesn’t seem to make sense. These banks not only create money, but they also decide where to loan it. They loan billions of dollars to corporations. Primary dealer banks create money out of thin air to buy the bonds and Treasury notes that the government sells when it needs to borrow money. The bonds are an agreement to repay the face value of the bonds with interest when it comes due. Yes, the government collects taxes, but that money exists because a bank created it by making a loan, or buying government bonds and notes. We call that debt money. It entered into circulation because it was loaned somewhere to someone, and may have been used by an employer to pay wages to his employees. This is a very complicated system, but can be somewhat understood by understanding that we rent money from the banks. This allows the banks to create great wealth. They are collecting interest on all the dollars in circulation.

From workableeconomics.com

More Debt than Money

by Howard Switzer, GPTN

The world’s money supply is currently 82.5 trillion dollars, the world’s debt is 305 trillion dollars, I repeat, the world’s money supply is currently 82.5 trillion dollars, the world’s debt is 305 trillion dollars, and that debt is climbing very fast, by the way. Just a few short months ago world debt was just 302 trillion. One might rightly ask; how can this debt ever be paid off in this system? The answer is that it cannot which is why we need to change the monetary system.

It is probably true that most people have more debt than they have money, in fact this is true of every nation in the world. This being the case one would think there would be a huge conversation about this fact and yet outside of a small circle of monetary reformers it seems to be a non-issue. Despite knowing debt is a form of slavery, as even the Bible noted, this is accepted as normal. It took 300 years to accomplish this, using force, psychologically engineered media and suppressing monetary history.

When most of the wealth created by those who labor goes to those who don’t labor, those who labor are slaves to those who don’t. It is a not-so-modern form of slavery where there is no slave master with a whip. The whip is the debt, and the threat of losing what you have if you do not labor to pay that debt to the faceless corporate owner of it. We protest vigorously against human slavery of the overt kind but tend to ignore the covert slavery of indebtedness, that debt is just accepted as business as usual.

Yes, business as usual, a business that is destroying our ecological life support system, a business that has created massive poverty and economic inequality, a business that criminalizes good science to profit from bad science, a business that seeks profits from war, illness and misery, a business that must grow or die because that is how the money system works. How on Earth could humankind have allowed such a destructive business to exist? We don’t care. This business is normalized, and we don’t care. Considering the existential threat and magnitude of the problem isn’t it surprising that so many do not care? Well, no, not if you know how the money system works and what its physical and psychological effects are.

“Since the dawn of times, monetary systems have been shaping the flows of human activity in every realm of endeavor; food production, education, health, business etc., by determining how we value, apply and exchange our creativity, and the fruits of our labor. It is for this reason the most influential of all human-made systems.” — Bernard Lietaer

While this should be obvious you will find many arguing that money is not the problem and of course money is not, not having money is the problem. To learn why we have more debt than money in the world we must look at how the monetary system works, how is money today created and allocated?

Risking more confusion, the monetary system we have does not really create money, it creates credit/debt which we use for money. Since the Fed, our privately owned central bank, was established in 1913 the commercial banks create what we use for money in the process of making loans. When a loan contract is signed a deposit is created in the borrowers account merely by entering the number, the principal amount of the loan, into the bank’s electronic ledger. That deposit, what we use for money, can then be spent into circulation in the economy. It can be done with a check or card, or it can be withdrawn from the account in cash, physical currency.

That currency is printed and minted by the government, which is why so many wrongly believe, and no one tells them otherwise, that the government creates our money. Unfortunately, it does not, despite that being one of its Constitutional responsibilities. Instead, it sells the currency to the banks, to be used for their customers cash needs. Cash, and the money in your account from your paycheck etc., is a current asset and is the first line-item on a company's balance sheet. Cash is the most liquid type of asset and can be used to easily purchase other assets, but it all originated as a debt and that debt must be paid or one defaults on their loan and loses their collateral.

Without collateral we would not be able to get a loan. Collateral is something of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses. Mortgages, car loans, and business loans are the collateralized loans we’re most familiar with.

However, there is more to the debt than just the principal that was created. The debt also includes the interest charged for loan. The principal created by the bank loan is what we use for money, it is how money is created in the system, so the interest we must pay must come from the principal of a loan and new loans must continually be made to pay the interest on the loans being made. This is the systemic driver of economic growth. When a loan payment is made the principal of the loan is reduced. That is money destroyed, it is no longer available for circulation, it no longer exists. The interest part of your payment goes the bank for profit and expenses. In this system when loan payments (money destroyed) exceed loans being made (money created) the system falters and crashes. This is happening every 10 years or so. However, the economy can also be crashed if the banks agree to not make any loans and instead choose to seize the collateral for pennies on the dollar.

Greening the Dollar changes the first cause of money to care, money issued as a debt-free, permanently circulating asset for the common needs. The act of creating money to spend for the common welfare makes it a care-based system which would have profound psychological effects on society and governance. What we have now is a system of usury, the sin of sins, which also has profound psychological consequences, but they are negative. Changing the money will change the way we live by replacing the profit-based system with a care-based system. It is not complicated, the first cause of money now is profit, it is issued as debt for private gain.

Monetary reform is not the end in and of itself, it is the tool we need to do the things we need to do.

If you want to dig a hole it is better to pick up a shovel than to scratch at the ground with your hands.

So, we have an urgent project, the first thing we must do is pick up the tool we need to fix it.

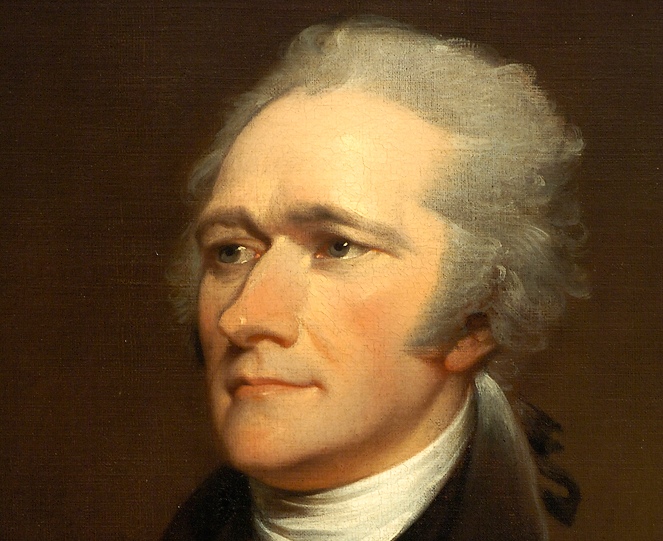

The Most Important History is the History We Don't Know

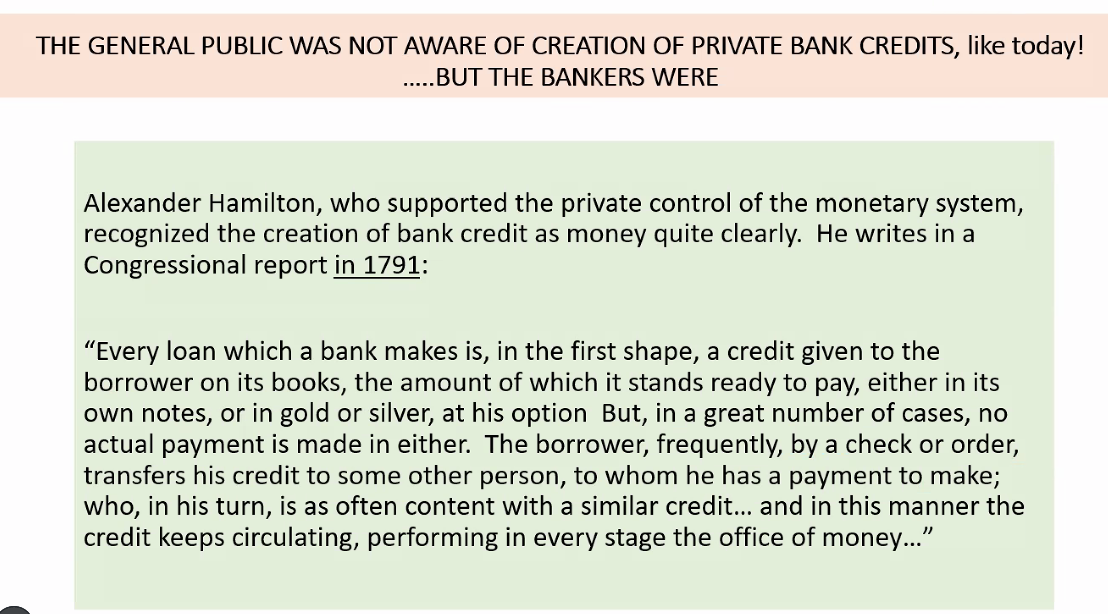

Alexander Hamilton

by Howard Switzer GPTN

Alexander Hamilton was the first US Secretary of the Treasury. He convinced congress to turn its own power to create money over to a privately owned bank. He said, "The United States debt, foreign and domestic, was the price of liberty.” But of course debt is a form of slavery and soon the whole nation was in debt. Certainly he was aware of that.

- Our current monetary system is institutionalized usury.

-

- Usury:

- The abuse of monetary authority for personal gain.

- The great religions and philosophers condemned usury.

-

Dante described it as

An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.