Is Capitalism the Problem, or Is It Something Else?

by Rita Jacobs, GPMI

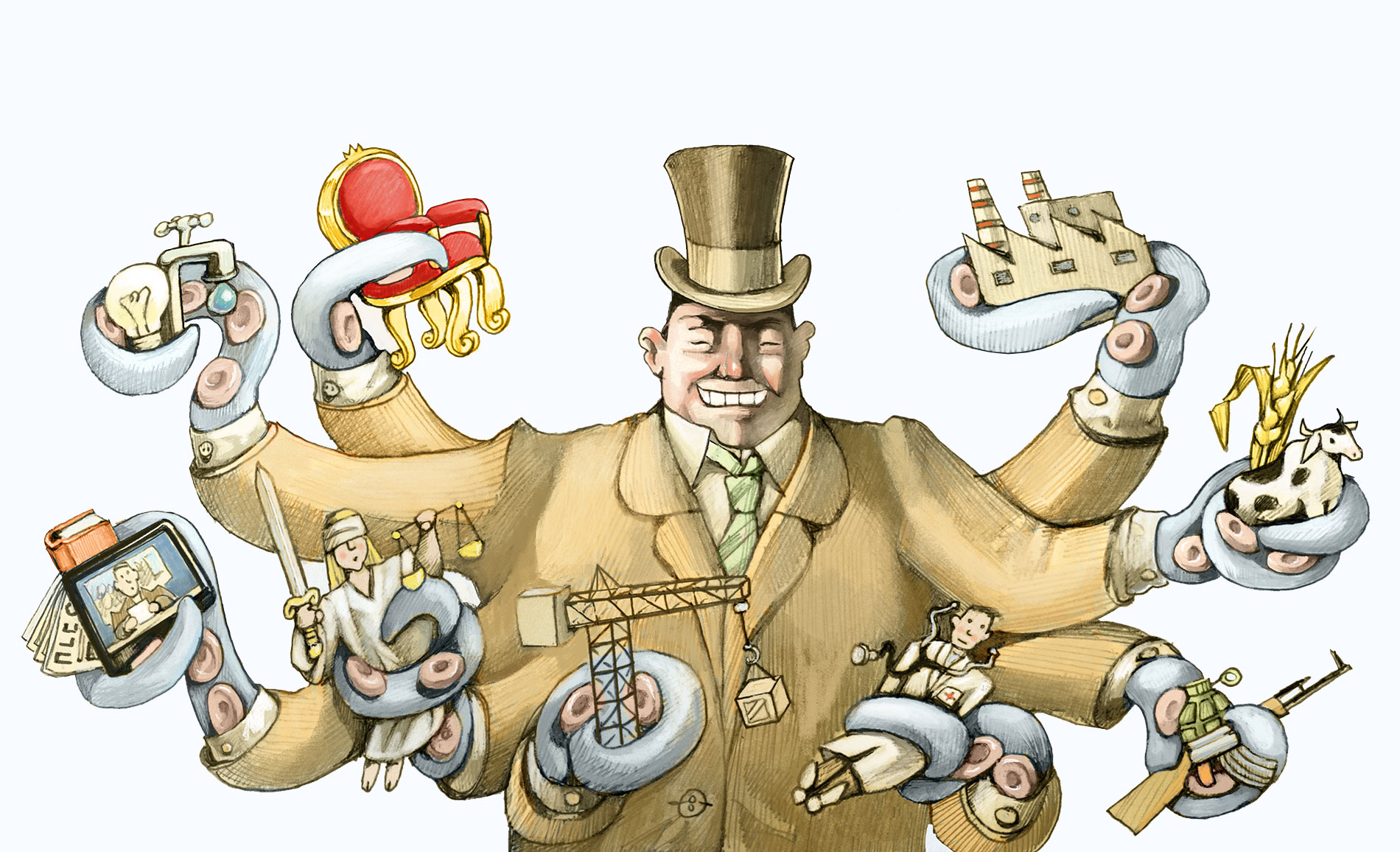

There are some basic underlying reasons for the present state of the union. Many critics of government policy blame the problems on capitalism – pointing out that the underlying system causes profits to be the driving force of all business. The actual needs, safety, and security of the citizens are not given adequate consideration in business decisions. Capitalism is part of the problem, but one of the underpinnings of capitalism is the system that automatically causes wealth to accumulate in the hands of a few, and allows the few to decide what to do with that wealth. Wall Street has partnered with corporations to fund the election campaigns, controlling their outcome. It is well-known that the candidate who spends the most money during their campaign wins 90 percent of the time. Politicians know that if they do not support the legislation requested by Wall Street or corporations, they will lose funding for future campaigns. Military funding continues to rise each year in order to feed the demands of the weapons corporations for profits from government contracts. One can easily come to the conclusion that the government exists now for the purpose of increasing the profits of the banks and corporations.

What we are witnessing in government policies today is the gradual build-up of power by banks and corporations during the last century caused by their increasing wealth. Most of the expenditures to relieve the effects of the 2020 pandemic went to banks and corporations through loans – with the Fed as the lender of last resort. Only a small portion of relief was provided to the people in the country who have suffered loss of income, jobs and housing. Congress no longer makes excuses for its decisions to provide funding for the rich, while neglecting the poor. It is not the poor people of the country who fund their re-election.

What is the system that causes wealth to accumulate in the hands of the few? We need to look no further than the Federal Reserve Act of 1913, which gave private commercial banks the privilege of creating nearly all the new money that is spent into the economy. They have the legal right to do so every time they make a loan. Congress, through the passage of this Act abandoned its responsibility enumerated in Article I of the Constitution to create money. At the time this Act was passed, the various private banks that were issuing their own bank notes had already created a network of private connections with corporations by having bank officials serve on corporate boards. The banks also had the ability to decide where to make loans. Banks have little difficulty gaining control of corporations when the corporations are dependent on the banks for necessary loans for the expansion of their business interests, and the banks own an increasing percentage of shares in the corporations. This interconnection between banks and corporations has grown stronger and stronger over time until now Wall Street banks and financial institutions own controlling shares in nearly all of the largest corporations. Of course the banks are always working with the corporations toward the common goal of profits without regard to the needs of the rest of society. We all know that with vast wealth comes great power.

What is not understood by the general public and most economists, is that the system needs to be changed in order to implement many of the new programs that are needed right now to correct the problems facing the people. Banks and corporations are not going to do this unless it is profitable. The Constitution is meant to provide for the general welfare of all the people, not for the general welfare of a powerful wealthy class. Our money system is debt-based, meaning that every time a dollar is created, a corresponding debt is created. Over the course of time, debt has built up to an unsustainable level. And under the system, no extra money is created to pay the interest. Payment of interest alone on the debts is reaching an unsustainable level.

The government could reverse these problems by simply creating its own money and spending it directly into the economy through guaranteed basic income to citizens or by funding of programs necessary for infrastructure and new solutions to combat the climate crisis that looms large in the near future. President Lincoln used Greenbacks—government created money—to fund the civil war. This was the last time that Congress exercised its authority under the Constitution to create money. With the banks and corporations owning our representatives in government, the necessary changes are not going to happen unless people rise up and demand an end to this special privilege and subsidy granted to private banks. There should be no reason why Congress needs to ask the question, "How are we going to pay for that"? Congress has the ability to pay for whatever is needed.

Just a few statistics (Dollar amounts are in trillions):

| US government debt | $27.6 |

| Personal debt | 20.9 |

| Student loan debt | 1.7 |

| Credit card debt | 1.0 |

| State debts | 1.2 |

| Local government debts | 2.1 |

| US corporate debt | 10.5 |

Green Party 3 Point Plan for Public Money

by Mary Sanderson

-

US Congress will create all US Money in amounts necessary to maintain stable purchasing power. This debt-free Public Money will have the power to pay down debts to private banks.

-

All banks will stop creating and allocating new money. Banks would no longer create money to fund loans. Banks would lend from a revolving fund, investment account deposits, or their own capital.

-

The twelve regional banks of the Federal Reserve System will be bought out. Member banks' shares will be reimbursed with the new US Money.

Imagine big results from this trio of changes.

- Growth Imperative:

-

What really drives our suicidal dependence on fossil fuels? Universal debt creates the 'economic growth imperative' which is the vain attempt to service debt by producing and borrowing more. Think a minute about how debt-free Public Money could help us shake our addiction to fossil fuels.

- Fruits of labor at home:

-

People and businesses can gradually pay down their debt when we use interest free US Dollars for money instead of Federal Reserve Notes. Less wealth will be sucked away into the financial sector via interest payments. More wealth can stay home to support regional commerce where it is produced.

- Bubbles and Busts:

-

In the present system, bank creation of debt-money for speculation is the root cause of economic bubbles and busts. These will end with a debt free Public Money supply, created by Congress and monitored by a new Monetary Authority within the US Treasury Departme

- Corruption:

-

As wealth circulation improves, won't the big money power to control politicians be weakened?

- Racial and Gender Justice:

-

Money scarcity makes our current 'bank money' system a real live musical chairs game, where there must be losers. Discrimination rigs the outcomes against certain groups. What might become of discrimination if there was enough money available for everybody to do their business? Thoughtful reparations would be possible to First Nations and descendants of slaves when our money system supports fairness over usury. How much healing could reparations bring to us all?

- Resources available for public use:

-

Universal health care, publicly financed elections, bridge repair, renewable energy systems, high quality education, all become POSSIBLE with a stable, unburdened currency.

- Regulation:

-

Thick layers of regulation can be shed from the Finance, Insurance and Real Estate (FIRE) sector of the economy, when private lending no longer creates and destroys the money supply.

- My bank account:

-

A worker: Re-building bridges, providing health care, growing healthy food could afford me a productive, living wage job. I could pay down my own debt, then choose if I wanted to borrow again.

An investor: fifteen and twenty percent returns on investment would dry up, but so would the anguish of crushing losses.

- Future Generations:

-

How can Public Money end our reckless squandering of resources? When usury no longer forces production of weapons and silly gadgets, won´t we be able to use resources more deliberately with consideration for the climate, the rights of nature and the rights of future generations?

- Rural decay and food security:

-

Is our food supply safer in the hands of independent farmers and merchants, or controlled by heavily indebted monopolies? What part does the 'bank money' system play in forcing farmers off the land and killing small towns?

- Social instability:

-

The Three Point Monetary Reform for Public Money would slow down the relentless income stream from the many to the few. Our stunning wealth gap can begin to close. How might this affect rates of homelessness? Mental illness? Violence?

Our current money system grew up as the darling child of war and profit.

For humans to outgrow the stupidity of war, Public Money is a pre-requisite.

Check out: How We Pay For a Better World and Alliance for Just Money

Green Sovereign Money vs MMT

by Howard Switzer

previously published on Medium

Recently MMT (Modern Monetary Theory) proponent and member of the Green Party of Washington, Derrick Miles, posted an article inviting us to join him in an exploration into the differences between MMT and Green Party of the United States monetary policy. We wholeheartedly agree that “realizing where our money actually comes from is paramount to administering the Green Party’s progressive agendas.” We on the Banking and Monetary Reform Committee (BMRC) of GPUS are happy to explore the differences because it is a question we have often been asked, and this article provides a welcome opportunity to make the distinctions clear.

The basic difference between Greening the Dollar and MMT is this: Greens are proposing that we change the existing monetary system to a sovereign money system and MMT claims we already have a sovereign money system, so it does not need to change.

Thus, regarding the relationship between the Green Party and MMT, it seems that we agree a sovereign money system is the best way we can address funding solutions to the convergence of catastrophes coming down on us all. The question then is: what is a sovereign money system and do we have one?

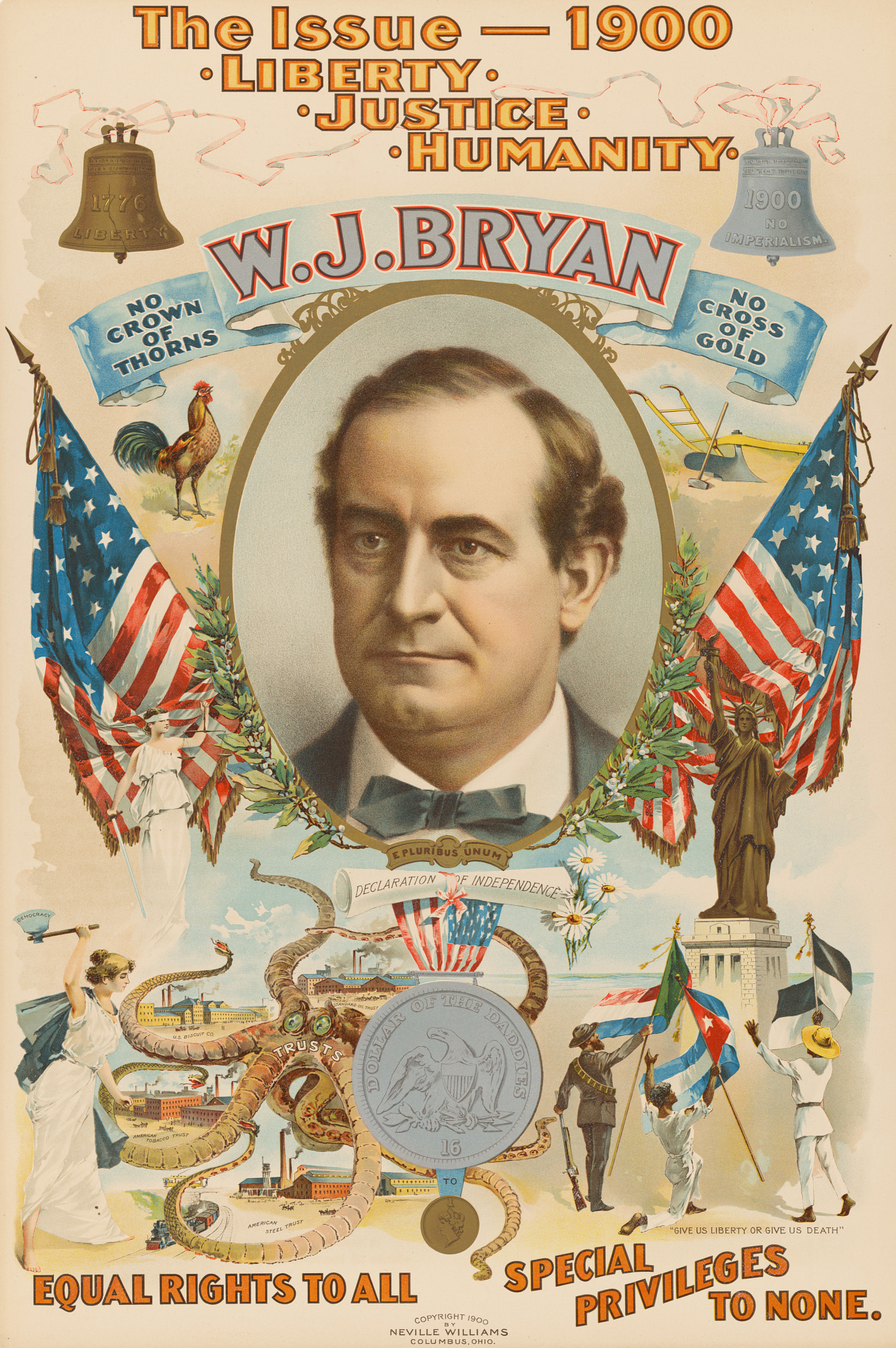

History tells us we have never had a sovereign money system in this country. Jefferson proposed sovereign money, but Hamilton convinced Congress to give the monetary authority to a private bank instead and that remains true today. Despite the revolution having been funded by sovereign money issued by the Continental Congress, and except for nearly a half billion in debt-free Greenbacks (sovereign money) being issued during the Civil War, a permanent sovereign money system has eluded the U.S. throughout our history. Consider, too, what hundreds of economists from around the world recommended to end the Great Depression, The Chicago Plan which became the 1939 Program for Monetary Reform. This is what the NEED Act, HR 2990, introduced in 2011 by Dennis Kucinich is based on. Even before that, in the late 19th century, our money system was recognized as a serious problem requiring change. Numerous political parties had it at the very top of their platforms. The Green Party supports a National Monetary Commission of Inquiry to explore alternatives to this unjust and archaic system.

Our money system today is still controlled by the private for-profit commercial banking system issuing their own credit denominated in our precious unit-of-account, the U.S. dollar, as interest bearing debt, which is used for money in a system dominated by the richest people in the world. That is not a sovereign money system. It is a financial Plutocracy. Is this what MMT is defending?

A sovereign money system is one in which government creates and issues all the money, something MMT believes we already have. However, if that were true, there would be no federal debt.

Dennis Kucinich could not have spent three years with the Office of Legislative Counsel getting the NEED Act legally vetted to change the laws so that government could be made the monopoly issuer of the nation’s money. He wanted to fund the many things he saw that the people of this nation need. Things like a decent livable income, healthcare, education, a 21st century food, water, energy, and transportation infrastructure and do it all without incurring debt to big banks and capital holders. Enabling a key quality of sovereign money — the government spends it directly on its Budget.

The NEED Act bans the commercial banks from creating money and gives that power to its rightful owner, the government. This was recognized by the ancient Greeks ten centuries before the Common Era; the most vital prerogative of democratic self-governance is to issue the money. This is because any government that does not issue the money is controlled by those who do. Why does MMT oppose changing the law so that government would in fact be “the monopoly issuer” of the money? The Green Party stands by this revolutionary economic policy in our platform. GP monetary policy is rooted in history thus it is not an outdated old idea (recency bias) rather it is an idea whose time has come.

MMT claims that it is “the only lens to truly recognize and understand how the system works.” Is that true? Let us look at some of their key concepts.

1. “The U.S. government is the monopoly issuer of U.S. currency.”

Here MMT relies on the myth that government creates our money, but notice they do not say “money” they say “currency.” This is a clue that you are being gaslighted. Yes, the government prints and mints the cash “currency”, but the government does not issue it into circulation, instead the government sells it to the Reserve banks for cost of production, to be issued for their commercial bank customers’ cash. Cash (currency) is less than 3% of the money supply. Our nation’s money is created by the big, private banks who make multi-billion-dollar loans to their big corporations. They also lend to government through a convoluted system where government sells bonds and securities to the Primary Dealers, agents of the big banks, who then can sell them to whomever, yes, even China which today holds over a $Trillion in U.S. securities.

The fact that this can be easily researched reveals MMT does not present an accurate “non-partisan description of our current economic reality.” MMT’s description of the system is steeped in jargon, myth, and misinformation. Today the commercial banks create our country’s money. This is provable and commands a debate for Green Party edification.

One might ask why we are not taught about money in school at any level? Why is money so shrouded in mystery along with all the subconscious biases, normalcy bias, recency bias, confirmation bias, etc.? Could it be because it is an extremely profitable business? Banks have been creating money in this world for well over 500 years, before they were even called banks.

2. “Federal taxes do not fund the Government’s spending.”

Well certainly taxes do not fund all of it, that is what “deficit spending” is all about, borrowing money to cover the shortfall. One can simply look at the government’s financial statement to discover that taxes go into the general fund and are most definitely spent.

3. “We do not need to tax billionaires and corporations, nor cut military spending to fund federal programs.”

Well, then WHO do we need to tax to fund spending programs? The lower middle class?

Greens know taxing and redirecting that money to the needs of the people only makes sense. Borrowing the money to fund a bloated military and give billionaires tax breaks as we do now is ludicrous. We would not need to borrow money if we had the sovereign money system we propose. A sovereign money system could fund a Green New Deal and all the needs of the people. However, we do not have a sovereign money system, instead we have a privately controlled for-profit system that creates our country’s money as debt which concentrates wealth systematically to the wealthiest, our nation’s oligarchy. It is a system of institutionalized usury and oppression.

Hoarded wealth allows one to dominate not just a market but entire industries. This was proven in 1912 when the Pujo Committee investigations revealed that the big wealthy banks controlled every industry in the nation through interlocking directorates. They even created huge diagrams to show the connections which you can find online. There you will discover some familiar names at the center of it all like JP Morgan. JP Morgan/Chase is today the majority owner of the New York FED, the main Federal Bank.

The Pecora Commission investigation of 1933 also showed the banks ability to control and manipulate the economy. It is this planet-plundering, private, capitalist, for-profit money system that GP monetary policy proposes to change at long last to a sovereign money system as the Constitution calls for. The American Revolution was fought over the issue of private vs public control of the money and while we won it militarily, we lost it monetarily in the post-war, power struggle between Jefferson and Hamilton. As Salvador Allende would say 200 years later about his own, “We won the revolution, but we did not win the power.”

4. “When the U.S. Treasury sells Bonds and Securities, they are not borrowing money, it is not a debt, instead it is a surplus for the private sector.” that it “represents a receipt for every dollar that has been created and issued by the U.S. government.”

Again, one need only look at the governments annual financial report to discover that bonds and securities legally represent interest bearing debt due to government borrowing. The fact that MMT tries to obfuscate this fact should raise Green’s concerns about whether the MMT "lens" clarifies or obscures our government’s Fiscal and monetary reality.

5. “Federal taxation comes in as a means to incentivize the use of the U.S. dollar as a currency.”

This is a fantasy as the incentive is the fact that the U.S. Dollar is legal tender and by law an unconditional payment system. Taxation is important in that it can recirculate money, be a control against hoarding, or to take it out of circulation as an inflation control. Money is not “destroyed” by taxation. Rather, it is “recirculated” back into the economy.

6. “There is no constraint to the amount of money that can be created to run the progressive programs we desperately need as long as we can continue to maintain the real-world resources and employment that are tied to the creation of these programs.”

While rhetorically promising, this claim is laughably false, demonstrated by the reality that, were it true, the government would have absolutely zero need to borrow from the private sector in order to finance our deficits — which must be financed in order to pay for spending.

Since the Green Party adopted its monetary sovereignty ‘Public Money’ plank in its Platform in 2010, the amount of our national Public Debt has almost exactly doubled to $27,855,095,022,203.36 today. That is nearly 28 trillion dollars!

If any Green MMT proponent or any MMT Economist anywhere on this Planet has any verifiable position or opinion on why every CENT of that US Public Debt does not have to be paid back to the current holder/owner of these Debt Securities (yes, by taxes) then please say why that is. Does MMT not honor contracts?

MMT proponents wanted to rewrite the Green Party’s national platform in April 2018 but, after extensive debate, were prevented from doing so by a vast majority of the National Committee. Here is an eye-opening PowerPoint by Sue Peters, member of both the Green Party of New York and the Alliance for Just Money, on that history and an article on GP.org by Rita Jacobs on why Greens should look beyond MMT.

The RP article contains some mischaracterizations of Greens, AMI, and Monetary Reform such as, we use “scare tactics” about the national debt. While we do address the debt, Greens are more concerned with helping people see how, by changing the money system, we can more easily fund the needs of people and planet.

Here are some key concepts for sovereign monetary reform:

-

Sovereign money is a public utility not a private for-profit monopoly business.

-

Sovereign money makes anything that is physically possible, ecologically wise, and socially desirable, financially feasible.

-

Sovereign money provides enormous psychological benefits to society. The numerous benefits now flowing to the few would be reversed and flowing to the many, allowing the creation of steady state prosperity and joy for all.

Money is a “leverage point” in the economic system, that point at which one small change changes the entire system. This is why we are focused on the money. Clearly any government that is not the monopoly issuer of its money can be controlled by those who are, and cannot claim to govern an economic democracy. The BMRC and most Greens, I think, acknowledge that we are ruled by a financial oligarchy that controls the nation’s money and thus public policy as the Princeton Study showed. This is the economic hierarchy that MMT defends, the Status Quo from which Greens seek change.

Shall we openly debate these points? Glad to oblige.

THE MOST IMPORTANT HISTORY IS THE HISTORY YOU DON’T KNOW:

By Howard Switzer

People’s Party Platform of 1896

The People's Party, assembled in National Convention, reaffirms its allegiance to the principles declared by the founders of the Republic, and also to the fundamental principles of just government as enunciated in the platform of the party in 1892.

We recognize that through the connivance of the present and preceding Administrations the country has reached a crisis in its National life, as predicted in our declaration four years ago, and that prompt and patriotic action is the supreme duty of the hour.

We realize that, while we have political independence, our financial and industrial independence is yet to be attained by restoring to our country the Constitutional control and exercise of the functions necessary to a people's government, which functions have been basely surrendered by our public servants to corporate monopolies. The influence of European moneychangers has been more potent in shaping legislation than the voice of the American people. Executive power and patronage have been used to corrupt our legislatures and defeat the will of the people, and plutocracy has thereby been enthroned upon the ruins of democracy. To restore the Government intended by the fathers, and for the welfare and prosperity of this and future generations, we demand the establishment of an economic and financial system which shall make us masters of our own affairs and independent of European control, by the adoption of the following declarations of principles:

The Finances

1. We demand a National money, safe and sound, issued by the General Government only, without the intervention of banks of issue, to be a full legal tender for all debts, public and private; a just, equitable, and efficient means of distribution, direct to the people, and through the lawful disbursements of the Government.

However, the private money power won that election and the people lost. The money power monopoly remains privately controlled today and dominates the economy and public policy.