The Money Power Revolution

The BMRC presentation to the 2020 Green Party ANM was a success!

You can find the recording also on you_tube.

Over time, whoever controls the money system, controls the nation.

| Subject: | GREENING THE DOLLAR | |

| From: | GREEN PARTY BMRC | |

| Date: | September, 2020 |

The BMRC presentation to the 2020 Green Party ANM was a success!

You can find the recording also on you_tube.

So, last week we determined what money is - itself a national social agreement, in our case, constitutionally provided for among our citizens and businesses. And, if money pretty much serves as the national economic lynchpin in determining all forms of social, environmental, commercial, wealth and income outcomes, then, is it Important to consider and to know whose money it is – or put another way, whose money system is it?

The best way I can think about achieving comfort in our personal literacy about the money system of the United States, the money system that uses the $US unit of account for its money, and the money system that is further legally founded in the U.S. Money Statutes — as enabled by the Constitution — the best thing we can do is to full-on embrace this reality — that, first, it is OUR money system. Funny thing that.

Yes, we the people were given, and today we still own and have the power to control everything about the national money system of the United States of America. That $US Currency. We the sovereign people of our nation have the national money power. We can’t give it up, except, on purpose.

But before demanding planetary-peace, ecological sustainability, economic equity and prosperity, and our national pursuit of happiness from our money system, there’s a little wrinkle afoot. More than one, actually. But there’s one major — problematic — issue. Monetary Autonomy. The actual complete control of our money systems operations, and any possible profits.

We gave that up. Remember ?

Although more countries use the $US money unit standard than any other, a generation ago countries throughout Europe gave up their monetary controls to another form of money — the European Monetary Union’s ‘Euro’.

Importantly, none of the countries in the European Monetary Union gave up their sovereignty over money. They exercised their sovereignty to join the Euro-currency Union. They remain sovereign. At any time, any of those countries can use their monetary sovereignty to reject the Euro, and to rejoin their monetary autonomy with their monetary sovereignty using their sovereign currency unit.

Just like every sovereign nation, we in the USA can abdicate our monetary autonomy to foreigners and corporate citizens alike. Likewise, we can also decide to become the users of somebody else’s money system.

Herein lies the silent ‘rub’ of American 21st century political-economics — vis-à-vis our money system.

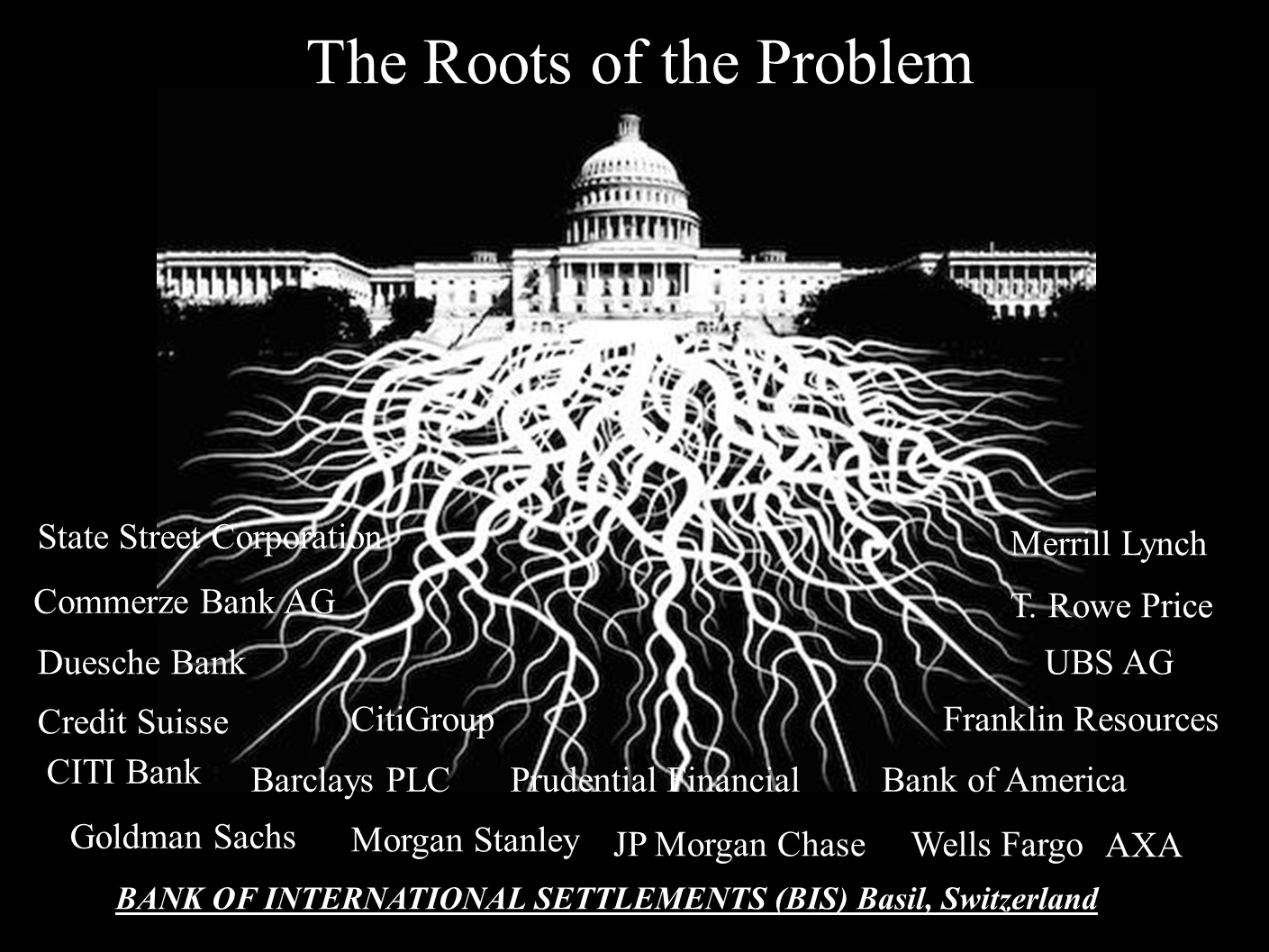

As did the European sovereigns, the United States has also, already, given up its monetary autonomy, and the complete control of our money system, to another power. As are the European nations, we the people are today using the money system of another power. In our case it is not another ‘supranational’ power, rather an home-spun economic power. Back in 1913, this country turned the complete control of our monetary system over to the American banking syndicate known as the Federal Reserve Banking System(FRBS), a privately organized and operated institution.

No conspiracy theories needed. Straight out, legal takeover. With a pen. Done.

It was a business decision. A good one to make for the bankers. A $54 TRILLION error for the government, who now must borrow from the private banking syndicate in its own money unit, and for the people who own the system and must repay that public borrowing.

SO, in sum, we the people are still the sovereign owners of the national money system. It is still, ours. But we have tendered it out to a private cartel for its operation. Most importantly, we empowered that FRBS cartel with the legal use of, and the ability to profit from, our money unit of account, the so-called U.S. Dollar – denominated as ($US). So, what now?

Next Time : Is $54 TRILLION enough ?

Joe Bongiovanni -The Monetary Apprentice - July 22, 2020

I was inspired to write this article after listening to the interview "Summer Special — Deep Dive into the U.S. Dollar with Jeff Snider" Jeff Snider is known for his "eurodollar university" and his commentary on the international eurodollar finance, which is lending in U.S dollars outside the United States. We hear of this with reference to foreign borrowers whose debt must be paid in U.S. dollars. A longer interview on this topic is at Jeff Snider: Eurodollar System Overview

The interview tries to address the question: "What is wrong with the monetary system?" The discussion is about the “eurodollar” system, which is a vast sum of unregulated U.S. dollar bank credit in international finance. The given answer is that banks are not participating in this worldwide dollar creation and management program in the way they used to. Thus, credit-created dollars are not as available as they should be. This interview is one of the few of this type which sheds some light on the banking cartel and its control of money through debt creation and its payment system. As Mr. Snider says: "Banks and modern banking are the big problem." (20:50) and "The bank centered approach is not how the monetary system should work." (39:10)

First, I suggest we skip over the first minutes to avoid the typical apologies for the status quo and affirmations of establishment doctrines. We then come to the vital concept of a working financial system. (8:30) The yet unresolved 2008 financial crisis was not due to "greedy bankers" and "subprime mortgages," but rather to a dysfunctional financial system. (9:00) Ben Bernanke was right when he said: "If we stabilize the financial system adequately, we will get a reasonable recovery. . . . If we do not . . . we are going to founder for some time." Of course, despite (or because of) the QE bailouts and zero interest rate policy, we have not stabilized the financial system.

Recall that the major part of the 2008 bailout, exceeding $13 Trillion, was secretive funding to international banks. Now, the current “repo” crisis has required over $9 Trillion in aid to global finance. over $9 Trillion in aid to global finance.

The claim is made that banking itself is broken, banks have actually been shrinking (16:30); and banks are not motivated to participate in lending or to maintain the payment system. Following the 2008 financial crisis, banks stopped expanding international credit creation and have just maintained or even reduced this activity since then. (22:58) A change that occurred in 2014 is noted — a reduction in correspondent banking, which translates to a reduction in the payment system capacity. (34:20) The payment system requires nearly universal participation, so a reduction in participating banks will have a negative effect. It is the lack of increasing bank credit, denominated in U.S. dollars, which lies at the heart of the current financial malaise.

The interview notes that the monetary system is not taught or understood by economic academia (30:00). The monetary system is actually a complex inter-bank accounting system — money is accounting entries in a payment system controlled by international banks. The U.S. dollar is the unit of account, and hence the "global reserve currency." This is as much a bank cartel creation as a reflection of U.S. national status. (34:00) In international finance, the SWIFT system, a “financial messaging service,” transmits payment notices between banks. Apparently the system is not working because it is not sufficiently profitable, or alternately, too risky, to motivate the banks to participate. (36:00) The "risk" is that a bank will make a payment that cannot be offset in a customer account, creating a loss in the bank's own account. In this bank credit created monetary system the debts will always exceed the money for payment. Without an exponential increase of dollar denominated debt there will be chronic insolvency, reflected in a seeming “dollar shortage,” and recurring episodes of financial crisis, such as the 2020 "repo" crisis.

After establishing that banks are not creating sufficient credit, the interview moves into a discussion of the possible revolutionary change sometime in the future. (45:00) While I appreciate the discussion of future change, I cannot give credit for their sense that the only option is for the banking cartel to be replaced by a new set of corporate predators extracting wealth through bitcoin-inspired digital payment apps. Given that the present payment system is already digital — intensely computer and internet-dependent — it is difficult to see what another encryption algorithm would add.

There is little or no reference to resource constraints, environmental degradation, or monopoly power in the subject discussion. As is typical of economics discussions, the monetary system is treated as if it exists independently and separate from society and the environment. So what effects might fossil fuel depletion, increased droughts, floods, and wildfires, and ever more concentrated monopoly control have on bank credit creation?

Why are banks perceiving a lack of profit opportunities and an excess of risk in the financial system? As noted above, debts owed will always exceed the money available for payment. It is only when debt-money creation increases at a sufficient rate that it appears there is "economic growth" and enough money. With resource constraints it is more difficult to justify new debt or to make payments on existing debt, so it follows that bank credit creation would fail to grow or even decrease. Similarly, the rise of cartels and monopolies reduces the number of borrowers able to make payments.

There is another alternative which, in my view, makes more sense. That is to move away from money dependence and the concept that every aspect of life must be mediated through money payments. We know that basic human needs can be met quite adequately through systems such as health care, public transportation, public education, and human and environmental oriented housing and agricultural policies. If the essential things that money now buys are provided by society, then the status of the international eurodollar system or hacking bitcoin is not such a pressing concern.

Why is it necessary to dig the hole deeper by maintaining a system of usury and monopoly economic domination? Instead, money could be created by government and issued directly to the public through a universal basic income. Money could also be issued through spending on social programs such as health care, education, transportation, and a parity based agriculture system. Banks could continue to offer credit, but only through lending their own capital or a government created revolving fund.

Yes, the problem is banks and the modern banking system. By giving control of money to the banking cartel, we have placed an authoritarian corporate cabal, driven by greed and a need for ever more power, at the center of society. I am afraid Mr. Snider is pursuing a hopeless quest. The banking system will never be fixed or stabilized because it will never be containable so long as banks are permitted to create money.

The pandemic has exposed and made clear the realities that our nation's entire political and economic system serves only the interests of billionaire profit-making. Profits for their empire's military industrial complex, their mass media operation psychologically manipulating people with vicious and self-serving lies to guarantee their minions hold the reins of power world-around. We the People have been harnessed to this system by law, by Congress betraying the nation and our Constitution. As John Adams said, "There are two ways to conquer and enslave a country; one is by the sword, the other by debt." We and our political economy are steered with reins of credit; their money system, a private for-profit operation creating money as interest bearing debt (credit), guiding all economic activity and public policy to systematically transfer wealth to the wealthiest. We all know it is happening, do we all know how? Haven't we had enough?

The solution to this Crime of the Millennium has been in the wings all along, a solution that We have been intentionally kept ignorant of. Our Constitution says that We the People are the sovereigns but our national sovereignty, won through revolution, was stolen out from under us at the very beginning due to elite corruption and a profound ignorance of credit and money. A "sovereign" is one who controls the creation and issuance of money and according to our Constitution; it is all to be issued as an asset, not a debt, for the general welfare. Today, more than ever, the people need their sovereign power over the money back.

While this might sound like pie in the sky, the legislation to do this has already been written and vetted by the office of Legislative Legal Counsel; it is The NEED Act HR2990. It would end the suffering and enslavement of the people by injecting debt-free permanently circulating money into the productive economy, 25% of which would go directly to local governments, on a per capita basis, and in a couple months would usher in a period of permanent prosperity for the people.

The wealthy who have been benefitting from the current system, managing and protecting this operation owe most of us a massive debt, especially to those in communities the system has most oppressed and left most in need. Because of the careless destruction caused by their system of wealth extraction, and the part we've all played in it, we owe the planet a massive debt as well. That is a debt in which foreclosure is mass extinction. So a rebellion has begun where the system's wheels most brutally meet the road. We the People need to shed our harnesses, mob the system, take its wheels off and end the Empire's war on the world. Then righteously take control of our own elections, claim our right of self-governance, and claim our sovereign money power to take care of one another and our world.

"The solution is not to “reform” our debt-based money system, but to replace it with a system where money is created debt-free.”

John Kenneth Galbraith

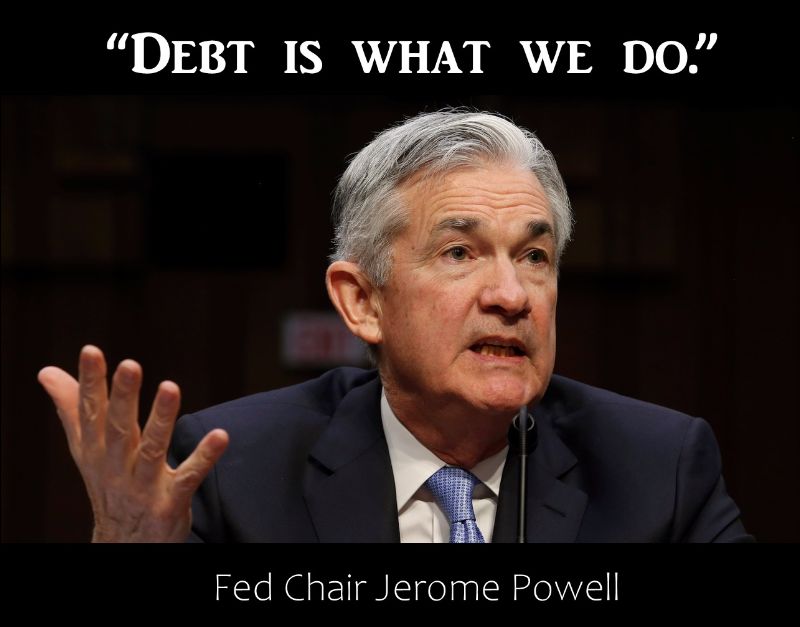

US Rep. Gregory Meek (NY State) to Federal Reserve Bank Chairman Powell:

"...small business can’t qualify for debt. They need equity, not debt."

FED Chairman Powell: “More debt may not be the answer, but debt is what we do."

(6-30-20, Congressional hearing)

Elbridge Spaulding may have seemed an unlikely American hero, however, he is largely responsible for winning the Civil War and keeping the US from being broken up. He was an American lawyer, banker, and Republican Party politician from New York. After becoming a lawyer he got involved in politics, was appointed City Clerk and was later elected Mayor of Buffalo, NY. He was also a member of the NY State Assembly and served 3 terms in the U.S. Congress. He opposed slavery and in 1860, Spaulding delivered a speech denouncing the Democratic Party and its pro-slavery views, urging Republicans to support Abraham Lincoln for the U.S. presidency. He also supported the idea for the first U.S. currency not backed by gold or silver, thus helping to keep the Union's economy afloat during the U.S. Civil War.

In 1862, he drafted the Legal Tender Act, and the National Currency Bank Bill (Greenbacks). At the time, the only circulating paper money was notes issued by banks. Those notes were supposed to be convertible into gold, although the banks had been forced to suspend such conversions at the end of 1861. There was no central bank. The bill passed Congress not because it was thought to be good policy absent a crisis, but because it was absolutely necessary.

Today we are in the greatest economic crisis the world has seen. Greenbacks are what our nation and the world needs today, right now, to take us through the pandemic and into a brighter future.