The Incentive for War

By Howard Switzer

The Green Party’s Peace Action Committee (GPAX) hosted a panel discussion on March 18th: A 20 Year Retrospective on the War on Terror. The BMRC was asked to present on “the financial incentive structures inherent in post 9/11 war on terror”. The panel consisted of Ajamu Baraka, our 2016 Green Party nominee for Vice President of the United States, an Associate fellow at the Institute for Policy Studies, currently serving as the national organizer and spokesperson for the Black Alliance for Peace, Michael McPherson of Veterans for Peace, Madelyn Hoffman the GPAX co-chair, Howie Hawkins, our 2020 Green candidate for President and yours truly. Cindy Sheehan was scheduled as well but a family emergency called her away. It was a good discussion on the historical details as well as experiences both in war and organizing in opposition to it. More than 80 people attended.

The Incentive

The justifications for war, as we have all learned, are often fraudulent constructs designed to instill fear and demonize the targeted enemy. The mass media, run by the military intelligence community, projects this onto society to manufacture consent for war. The incentive for war however is, as it has been for hundreds of years, enormous profits. I shared a number of links on this calling attention to two of them; a research paper by NY committee member Sue Peters titled Debt Drives War, War Drives Debt (download pdf). Her paper covers the relevant history and how the system works. The other an article by Christian Sorensen titled Who Are the Ultimate War Profiteers? U.S. Air Force Veteran Removes the Veil, exposing the corporations though which the war profits flow to the financial industry.

"If you control the oil, you control entire nations; if you control the food, you control the people; if you control the money, you control the entire world.“ —Henry Kissinger

All this should help the peace and social justice movements to clearly articulate their demand for democratic governance. We envision an emancipatory, non-violent, democratic movement with clearly defined goals leveraging systemic change by targeting authorities who control institutional policy while educating on tactics, strategies, and goals and expanding constituencies. There is a parallel to the civil rights movement beginning with the end of the Civil War we might call the Greenback Movements, Farmers Alliance, People's Party etc. These movements failed to attain their goal of a public monetary system that would support broad based prosperity over concentrated wealth. Money is a social power now in the hands of war-mongering authoritarians. A movement is beginning to build that should be sweeping up a diversity of constituencies united for a just money system. Money is power which is why it must be a public function for public care, not a private one for private profits.

Monetary Reform is an International Problem

By Rita Jacobs

Many of the articles in our Newsletter focus on the debt problems caused by the monetary system in the US. While our own debt problems are important, it is also important to understand that the debt-based monetary system exists not only in the US – but in almost every country on the globe. The influence and power of bankers is far-reaching. If you have an interest in learning more about what is happening in the European Union (EU), you can sign up for a newsletter from Germany.

Our Committee (BMRC) seeks to establish a working relationship with foreign organizations that have monetary reform as one of their goals. One such organization is Monetative, a registered organization in Germany that maintains a website and issues a monthly newsletter. It is obvious from the home page on the website that it seeks to educate the general public about the monetary system, with the following questions boldly printed across the top of the main page: "How is our money made? Who makes it?"

The newsletter has information and links to articles of interest – mainly pertaining to European countries. The newsletter comes by email and has a link (Im Browser ansehen) at the top of the page that allows you to view the newsletter online. This particular link will direct you to the March newsletter. I use my Chrome browser to view the newsletter, as I am able to instantly translate it into English using the google translate function (the same functionality is available in Firefox). [ed. note: There is also a Translate drop-down menu at the top of the webpage. You might then still have to click the link that says Translating...]

It is interesting to note that some links in the newsletter take you to articles that are published in English, as the European Union (EU) generally uses English as a common language.

Some Common Issues

The March newsletter focuses on the debts that have mounted in the EU caused by the covid pandemic, and links to an opinion article signed by 100 economists, politicians and campaigners. The article calls for the cancellation of debt that is owned by the European Central Bank (ECB), and points out that "[c]itizens are discovering, some with much shock, that about 25% of the European debt is now held by their own central bank."

A link to a research publication by the Canadian library of Parliament explains how money is created in Canada, and further explains that the Bank of Canada (its central bank) is allotted 20% of the bonds and treasury bills that are sold at auction, which it buys at a set price without competing with the other government securities distributors. It summarizes that "[b]oth private commercial banks and the Bank of Canada create money by extending loans to the Government of Canada and, in the case of private commercial banks, lending to the general public." This is similar to the creation of money in the US under the Federal Reserve System. However, the Federal Reserve Banks in the US are owned by private commercial banks - not by the government. Certain commercial banks, called primary dealers, create money and buy debt directly from the US Treasury, and sell it in turn to the Federal Reserve Banks and the public. The commercial banks also create money when they make loans to the general public, similar to the Canadian Banks. The newsletter points out that the Canadian system is better than the EU system because the European central bank has to buy the government bonds on the public market at the market price.

This practice of the central bank holding the government debt seems to be rather consistent in the Canadian, European and US monetary systems. The government debt held by the Federal Reserve System in the US is between 20 and 25% of the government debt held by the public.

Why do we even need to talk about debt? If we had a different monetary system that did not use debt as a basis for creating new money to put into circulation, we would not be having this discussion. Personal debt levels in both the US and the EU have risen to levels that are oppressive to the citizens. When governments depend on creating more debt to meet the needs of citizens in a crisis, it only creates greater obligations on the citizens to pay interest on the debts. The ultimate results under the present system in the US are the shifting of wealth to the already wealthy, and the ensuing social problems of poverty, lack of health care, and homelessness. It will be interesting to watch how this debt-based global monetary system will play out in the future, as the system becomes unsustainable at a global level.

International Movement for Monetary Reform

Constitutional Tools for Transition

By Howard Switzer

Our Nation’s Constitution, despite its many flaws, has been an inspiration to other nations over the last couple centuries. Efforts are afoot to change it both for the better, by groups like Move to Amend, and for the worse by authoritarian conservative Republicans. However, there are several tools provided in the Constitution as is that could be employed to help bring about positive transformation of our unjust, brutal, and racist system, to pursue justice, tranquility, freedom, and a better life for all. I will briefly review three of them here: the money power clause, the appropriations clause, and the domestic violence clause.

Article I, Section 8 Clause 5, (the money power clause):

“The Congress shall have Power … To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;”

We all understand why weights and measures must have uniform standards or there would be chaos in the economy and the same applies to money. Money that constantly fluctuates in value is more like an investment than money and makes financial planning difficult if not impossible. Money, as Aristotle pointed out long ago, plays two roles:

-

An exchange medium for facilitating economic activity (it is just money)

-

An instrument of power capable of dominating the market (the hidden hand)

The point here is that money is the source of power for governance. The ancient Greeks recognized this 10 centuries before the Common Era. The Founding Fathers were aware of this too and despite winning a revolution militarily and despite including it in their Constitution, We the People have been unable to wrest the Money Power away from the big capital holders and their private banking cartel. Due to our accelerating circumstances driven by their system that is fast becoming a priority. We are not supposed to talk about the second role of money it seems which may be why there are no courses in Monetary Science or even a genuine Political Economy Department for that matter. Thus, changing the money system from the current system of institutionalized usury issuing money as debt to a public utility issuing money as an asset, gives We the People the power to govern. Technically it is merely making banks adhere to International Financial Reporting Standards wherein assets and liabilities cannot be created, they can only be recorded and reported, that is, it cannot be the transaction itself. Like the government, the accounting industry has been servile in that regard, turning a blind eye to this usurious and fraudulent practice, not to mention the usurpation of national sovereignties.

Article I, Section 9, Clause 7 (the appropriations clause):

“No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.”

As you can see there are two parts, the Appropriations clause and the Statement and Account clause. The Appropriations Clause is the requirement that Congress approve spending, the Statement and Account Provision is the requirement that they tell us how their approved money was spent. The Appropriations Clause and the Statement and Account Clause place a crucially important mandate on Congress–to account to the public for how, where, and by what authority the government spends money. As such the government is in gross violation of the Constitution here too, and on steroids since 2008 having further changed the rules in favor of the big banks who dominate the FED. For much more on this check out The Appropriations Clause—A History of the Constitution's (As of Yet) Underused Clause, written and edited by Michele Ferri and Jonathan Lurie of The Law Offices of Lurie and Ferri for use by the Solari Report.

Article IV, Section 4 (the domestic violence clause):

The United States shall guarantee to every State in this Union a Republican Form of Government, and shall protect each of them against Invasion; and on Application of the Legislature, or of the Executive (when the Legislature cannot be convened) against domestic Violence.

Environmental activist lawyer, Michael Diamond brings our attention to this, “Excluding extraneous words and substituting “the people” for “each of them,” in accordance with the 1868 Supreme Court case of Texas v. White, we have the following simplified directive:

On application of the [state] legislature[s], the United States shall protect the people against domestic violence.

This one may be the most likely candidate for a legal challenge. Certainly, with all the violence from the police murdering citizens to chemical pollution killing citizens, a case can be made. Poverty is killing citizens too. Michael writes: “Ensuring our safety and survival by using the domestic violence clause is a duty entirely consistent with the original intent of the framers. We have made our world toxic. They specifically used the generic term violence, which at that time and at this moment is consistent with harm as a result of toxicity. In the words of Gordon K. Durnil, we are experiencing an “insidious invasion of our bodies by harmful unsolicited chemicals,” which ought to be considered “the most flagrant violation of our individual rights.” As Michael notes “These protections for the people are sacrosanct and are guaranteed above all else by the federal government. Senator Charles Sumner (R-MA), during the Lincoln administration, referred to it as the “sleeping giant in the Constitution.” It is time to awaken that sleeping giant. “

For more, see Ending Corporate Tyranny: Solutions to the Plague that Afflicts Us All

It's Time to End Monetary Violence

By Rita Jacobs

So what do I mean by monetary violence? I'll start with a simple Merriam-Webster definition of monetary: "of or relating to money or to the mechanisms by which it is supplied to and circulates in the economy." That's seems simple enough. In other words, it means having to do with money or the way it gets into the money supply and moved around. And I think everyone has a basic concept of what money is. It's what you use to pay for things, or save to spend in the future, or use to invest in stock, real estate, or other investments. In its simplest form it is a means of exchange that has a value that is understood and accepted by the society in which it is used. People have trust in it because it is generally defined by their government as a legal means of exchange, and must be used to pay taxes to the government.

The World Health organization (WHO), in its approach to violence prevention, defines violence as:

the intentional use of physical force or power, threatened or actual, against oneself, another person, or against a group or community, that either results in or has a high likelihood of resulting in injury, death, psychological harm, maldevelopment, or deprivation.

Referring back to the definition of monetary, it includes relating not only to money, but also "to the mechanisms by which money is supplied to and circulates in the economy." Further discussion will include how the mechanism by which money is supplied to the economy (our monetary system) has resulted in an intentional use of power against a group or community, that has resulted in and continues to have a likelihood of resulting in injury, death, psychological harm, maldevelopment and deprivation.

Our current monetary system was set into motion by the Federal Reserve Act of 1913 which gave private commercial banks the power to create new money by simple entries in a borrower's account when loans are made. As the loan is paid back, the bank keeps the interest on the loan as its profit, and the principle is then destroyed in the bank's accounting system. I will not go into a lot of detail here, as it has been covered extensively in many articles relating to money creation.

Intrinsic in this system is the private bank's ability to choose those individuals, corporations, or other entities who are then the recipients of its loans. Missing in this system is the creation of additional money to pay the interest on borrowed money. The only way additional money enters into circulation is through the creation of more loans (debt-money). The boom-and-bust cycles in our economy are easily controlled by the amount of loans that are made by commercial banks. If the banks loan out less money, the money in circulation shrinks and can create a recession. If the banks increase the amount of money loaned out, inflation can occur.

What we have here is a system of legal institutionalized usury. A general definition of usury is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. Usury has been condemned throughout the centuries by many religions and philosophers. Dante referred to usury as "An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort."

At the time the Federal Reserve Act was passed bankers and financial institutions were major shareholders and controlled the largest corporations doing business in the US. This is not surprising considering the wealth of the banks and their ability to provide financing to those corporations they controlled. I do not want to spend a lot of time covering the history of what has happened since. Considering the power the banks have had for the last century, it is not surprising that today they control the largest corporations that are inflicting damage on the people and the planet.

A recent article by an Air Force veteran who has done the research shows that commercial investment banks and asset management firms hold most shares of every public war corporation. The banks and financial institutions are also the biggest contributors to political campaigns. Research has shown that the politicians who spend the most money on their campaigns win 90% of the time. Here's a recent example from the article cited above:

"Biden’s campaign received over $9 million from Donald Sussman, CEO of Palmora Partners, a multi-billion dollar hedge fund, which has more than 260,000 shares in Raytheon, a preeminent weapons manufacturer and supplier of weapons to Saudi Arabia, which recently won a $100 million contract for Afghan Air Force training."

Is it any wonder that Congress continues to use the military budget to fund these contractors even though the weapons they are building are outdated or unnecessary? These weapons do nothing for the citizens in this country except provide some jobs and allow the financial institutions to increase their wealth. Since weapons are the biggest export business for the US, the citizens receive no benefit from their production. They are only used by the US and other countries to kill, maim, and displace citizens in the countries where these weapons are used.

A study by the National Priorities Project shows how the military is a major contributor to climate change, and needs to change its priorities in order to deal with future effects of climate change. Not only that but the Department of Defense is the world’s largest institutional user of petroleum, and therefore the largest producer of greenhouse gases. Its military excursions are generally done for the benefit of the oil industry since the commercial investment firms and assets management firms also own most of the shares in the largest oil companies. Their concern is for profits, without any regard for the common good.

Banks and financial institutions control our government, our military investments, and are the largest contributors to climate change. With their vast privilege and power of money creation and distribution, they are able to direct money to those businesses that are most profitable to the banks and financial institutions. The result has been the creation of a vast amount of social problems at home and around the globe. It is clear that the banks make unethical or immoral monetary loans that unfairly enrich the lender.

The standard of living in the US has deteriorated to the point that 45 million people are living in poverty, and a half million people are homeless. Wealth inequality has risen to the highest level in the history of our country. Household debt, student debt and government debt are at unsustainable levels. There is a major health crisis in the country with more than 27 million people with no health insurance, and medical bills account for more than half of the bankruptcy filings in the US. Thousand of people die every year prematurely because they cannot afford medical care.

The funding of military excursions results in hundreds of thousands of deaths every year, and displacement of millions of people. Intervention in the political affairs of other countries have caused countless deaths and financial instability in those countries. The use of economic sanctions against countries (enforced through the use of banks) has resulted in tens of thousands of deaths by cutting off access to necessary food and medical supplies.

Banks were the major cause of the economic crash in 2008 from which the economy has never completely recovered. Despite the widespread massive fraud that created the crash, not one banker was jailed because of it. This current control of the government by bankers has created a de facto immunity of bankers from prosecution.

Congress is well aware of the state of affairs in this country, and allows it to continue. Congress is complicit in this intentional use of power against a group or community, that has resulted in and continues to have a likelihood of resulting in injury, death, psychological harm, maldevelopment and deprivation. This is what WHO calls collective violence - violence committed by larger groups of individuals and can be subdivided into social, political and economic violence. Because the monetary system is at the heart of this violence, I prefer to call it "monetary violence." It's time for Congress to regain control of the creation and issuance of money and end this violence.

THE MOST IMPORTANT HISTORY IS THE HISTORY YOU DON’T KNOW:

By Howard Switzer

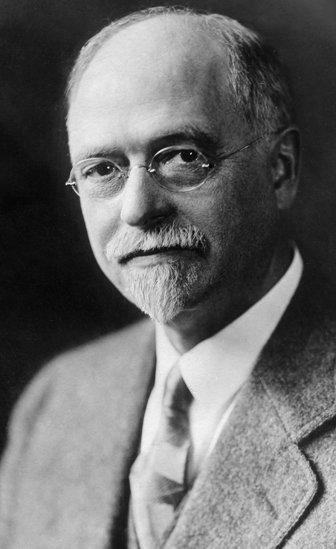

Irving Fisher

Irving Fisher (1867 –1947) was an American economist, statistician, inventor, and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. He was regarded by many as "the greatest economist the United States has ever produced”.

Fisher made numerous important contributions to economic theory and has several concepts named after him which include the Fisher equation, the Fisher hypothesis, the international Fisher effect, the Fisher separation theorem, and Fisher market.

Fisher was perhaps the first celebrity economist, but his reputation during his lifetime was irreparably harmed by his public statements, just prior to the Wall Street Crash of 1929, claiming that the stock market had reached "a permanently high plateau". To his credit he set about figuring out why he was wrong, authoring The Chicago Plan and his theory of debt deflation as an explanation of the Great Depression, as well as his advocacy of full-reserve banking and alternative currencies based on Silvio Gesell’s ideas incorporated in the wildly successful Wörgl currency. He produced a book on stamp scrip to help municipalities issue successful currency as an emergency measure, a plan that could have ended the Great Depression in a couple weeks had it been adopted.

Fisher was one of the foremost proponents of the full-reserve banking. Most importantly he was one of the authors of The 1939 Program for Monetary Reform where the general proposal is outlined. The proposal was supported by 235 economists from 157 universities world-around. Had it been adopted we would be living in a vastly different world today.

- Our current monetary system is institutionalized usury.

-

- Usury:

- The abuse of monetary authority for personal gain.

- The great religions and philosophers condemned usury.

-

Dante described it as

An extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.