The Debt Limit Threatens the Economy. Is There a Better Way?

by Howard Switzer GPTN - published previously on Medium

That was a "The Sunday question" in the New York Times.

The question sadly reveals the institutionalized ignorance of our political leaders, our economists and our sycophantic mass media who do not really seek the answer to that question. The reason? Debt is profitable to the lender, our bloated banking system, whom they all serve despite the Biblical warning in Prov 22:7: The rich rule over the poor, and the borrower is slave of the lender.

Our world is rife with problems despite its great wealth because our civilization has prioritized generating wealth over solving problems. It doesn’t make anyone rich to address the root causes of crime, sickness, war, poverty or ecocide. Promises to fix these things are used to garner votes but once elected those problems are not ignored but are in fact made worse because they are profitable for the few billionaires on top of this steaming pile of wealth extraction. There are no morals among our sold-out political/economic leadership. If there were these problems would be history instead of an existential threat.

The answer is not all that hard to find today for those willing to look but it also requires opening one’s mind and setting aside their programmed incredulity. As Canadian philosopher Marshall McLuhan wrote in his groundbreaking book, The Medium is the Message, Only the small secrets need to be protected. The big ones are kept secret by public incredulity.

You will find the answer in the forgotten corners of our American history known by certain activists and academics who, for pointing it out, are labeled cranks and crackpots by the establishment which works to prevent the answer from getting out of the bag it has been kept in for centuries. Indeed, the entire schooling and media system was designed partly to keep it a secret but today it is quite out of the bag. In a word the answer to "is there a better way" is greenbacks, a term that most Americans do not understand. They rightly understand that it means money, but they assume it is the same cash money they depend on and use every day, which is not true.

The Greenback was sovereign money issued by the Lincoln administration to pay for the Civil War. The banks had refused to lend the government money to defend the nation, which they still viewed as a threat to the wealthy’s dominance, so one of Lincoln’s friends pointed out that the government has the Constitutional power to create money, so they did, using green ink to set them apart from the bank notes being used for money. Many assume that the government creates the money, having seen photos of the printing presses at the Bureau of Printing and Engraving cranking out dollars, Federal Reserve Notes, but this is only the currency, a representative of money, which the government sells to the banks for their customer’s cash needs. All our nation’s money, in fact all the money in the western world, is created by the banking system in the process of making loans, be it to households, businesses, or governments.

The fatal blind-spot that most thinkers on the left, center or right have when it comes to money and banking, is that they all assume that banks lend savers’ deposits to borrowers, when in fact this never happens, and so the banks not only lend the money, they create the money by typing numbers into their electronic ledgers making the whole economy and political system entirely dependent on them. They not only create the money, but they also control its allocation. This gives them the upper hand over everyone else; we the people, industrialists, unionists, media, and politicians, and it is "a hidden hand" because of the general ignorance of the basic fact that banks create money when they make loans and destroy it when loans are repaid. Thus, the entire money supply is rented from the banks. The banks are the ultimate rentiers, not landlords, not industrialists. The landlords and industrialists are all in debt to the banks too, making us all slaves to the system.

So, is there a better way? Yes, there is. In fact, the solution was proposed by prominent heterodox economists to end the Great Depression in 1933–39 and again in 2011 legislation was introduced to the House in response to the 2008 economic crisis that would solve the problem permanently with these three reforms:

-

Require Congress to be the sole creator of all U.S. money as an asset, not a debt.

-

End the privilege of commercial banks to create money.

-

Transfer all remaining operations of the Fed to the U.S. Treasury.

Such a system would remove the parasite of debt and empower politicians to actually address the problems plaguing society, it would allow the funding of a public healthcare system, a 21st century energy, transportation and food production system. It would be permanently circulating money, ending the scarcity most people experience and empowering a new prosperity. The terrible costs of crime, sickness, war, poverty, and ecocide forced upon us by the current system would come to an end. Of course, the power of the banks has kept the proposal from seeing the light of day.

Americans have been imbued with mistrust of the government and rightly so, as those who hold its debt, the wealthy bondholders, make sure the government only pursues policies that maximize profits for the few at the expense of the many. Why do people make the mistake, as the famous economist Henry Simons pointed out, of "fearing money but trusting debt?" Perhaps it is a testament of the psychological engineering employed by the establishment schools and media to maintain a compliant workforce and obedient soldiers and police.

So, the question then becomes how do we implement this historically proven better way? The American colonists revolted and went to war against the Bank of England and its corporations who had outlawed the prosperous state sovereign money systems they had painstakingly established. They won that war militarily, but they lost it monetarily in the post war power struggle between Jefferson and Hamilton over who would control the money system. Hamilton convinced the already corrupt Congress to turn it over to his friend’s private bank. Lincoln defied the establishment, issuing debt-free sovereign money and was assassinated for it. Thus it is made clear that the establishment intends to hold onto this power at any cost.

We need a new revolution, one that will minimize the use of violence in favor of great numbers of people demanding this system’s change. The current system is built on usury, the abuse of monetary authority for personal gain. Usury was once considered by all religions the sin of sins, promulgating the 7 deadly sins, a crime punishable by death. Today usury has been institutionalized and dominates the world.

So, spread the word, only a broad awareness in society of the root cause of our life-threatening money system will bring about the necessary change. As Tom Paine wrote in his revolutionary pamphlet, Common Sense, "We have the power to begin the world over again." We do, but we must first recognize that we do and then we can begin to create an Economics of Care that would transform the world.

The Casino Phase of the Federal Reserve Banking System is at an End: We are Entering Uncharted Territory

by Rita Jacobs GPMI

I have written about John Titus in the past. He has the YouTube channel "Best Evidence." His videos are an excellent source of documented information about what is going on with our money under the Federal Reserve System. The Federal Reserve Banks are private banks. While much of their information is available to the public, they often do not comment when unusual events occur in the management of the U. S. money supply. Titus follows these unusual events, spotlights them, and shares his opinions about the underlying causes of the unusual events. His newest video is titled "Why is the Federal Reserve Provoking a Financial Crisis?"

Some of the information in this video is derived from the FDIC Quarterly Banking Profile, published by the Federal Deposit Insurance Corporation (FDIC), the agency created by Congress that insures depositors’ funds in banks and financial institutions that are insured through the agency. Titus’ analysis is made from information for the third quarter of 2022, made available on Dec. 1, 2022.

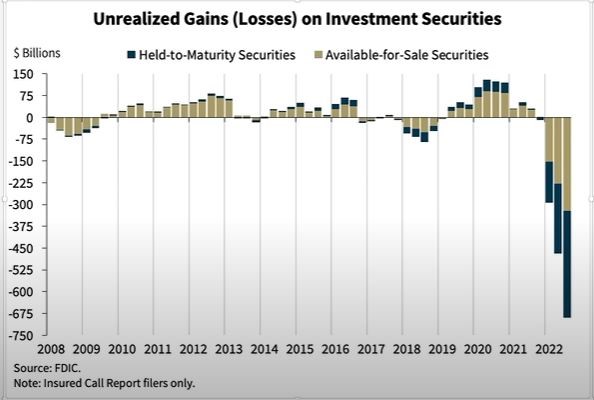

You can see that something looks wrong when viewing this chart of Unrealized Gains (Losses) on Investment Securities held by the banks during the first three quarters of 2022:

Most of the investment securities are government securities and mortgage-backed securities. These have lost market value because of the rise in interest rates by the Fed during 2022. These securities are worth less because securities that pay higher interest rates are preferred to those that pay very little return on investment. This is one of the effects of the Fed’s raising the interest rates. As can be seen this caused a loss in value of bank investments by almost $700 billion (35%). You can watch the video (46 minutes) for more information about losses in bank equity. The conclusion drawn from this and other information explained by Titus demonstrate, in his opinion, that the banks are clearly insolvent. Banks are $3 to $4 billion under water — "dead broke."

Looking at what the banks are doing about insolvency, Titus covers the unusual borrowing by the banks. Banks have increased borrowing from the Federal Home Loan Board (FHLB), which he describes as panic borrowing. Banks also use these loans to hide the fact that they are in financial trouble. The panic borrowing increased by $250 billion over two quarters. The Fed is not helping, but is selling assets, which decreases liquidity. The Fed has helped the banks in the past, but now the Fed is hurting the banks.

Our present phase of banking is a casino phase. It has been so from the end of the manufacturing phase to the present. Titus calls this the "unfettered credit emission system by insiders." This system is now at an end. We are now leaving the casino phase and entering the "snake eating its tail" phase. We are into uncharted territory.

Summary: The US banking system is bankrupt. We should expect something big from the Fed but there is no way of knowing what that might be. I urge you to watch the video to better understand what is happening.

Who Will Buy $3.5 Trillion Per Year in Treasury Bonds During 2023-24 Recession?

by Eugene Woloszyn GPCT

How long will we put up with the crimes of Wall Street & its controlled FED?

US Fiscal Deficit for 2023 projected by CBO equals $1.5Trillion, not counting weapons for Ukraine. This deficit will go up to $2.85 Trillion in 2033, probably an undercount.

Current business 2023 projections are at least 3X at least .25% FED FUND RATE jumps. This will trigger a recession in 2023-24. Since both stocks & bonds were down 2022 & probably 2023, federal income taxes from top 40% will be way down in 2023-24. In 2008-09, Deficit jumped $954 billion. In 2019-20, Deficit jumped $2.148 Trillion. Reasonable guess = Deficit in both years 2023 & 2024 will increase by $2T to $3.5T.

WHO WILL BUY THIS GIGANTIC AMOUNT OF NEW TREASURY BONDS?

China dropped peak Treasury holdings from $1.4T to $.87T, falling 17% in 2022. China printed a 3-1-23 document on its website in English that is combative but a truthful assessment. It stated the high cost paid by the rest of the world for US dollar hegemony & dollar as reserve currency for the world. China bluntly stated that “seigniorage” enabled the US to buy for 17 cents worldwide goods & services worth $100. Other large major countries have little eagerness for US Treasuries, eg India, Germany, Brazil. Japan has decreased Treasuries from $1.4T peak to $1.08T & has its own economic problems. Only sidekick Britain may add to its $646 Billion (3rd highest) when prodded. But Britain GDP is contracting after Brexit mess & high fuel prices.

In the past, the FED “monetized” the debt by buying & holding it on the FED’s BLOATED balance sheet of $9Trillion, which was only $4 Trillion in 2-2020 before COVID. However, in order to combat the inflation mess that the FED created by encouraging the money supply to quadruple (4X) after COVID, now the FED is trying reverse course again. The FED claims it is changing from Quantitative Easing to Quantitative Tightening & thus will decrease its balance sheet & lower the money supply to combat inflation.

WHY CAN’T THE FED JUST SELL OFF THE 67% OF THE TREASURIES IN ITS BALANCE SHEET & THE 33% OF MORTGAGED BACKED SECURITIES (MBS)?

This is impossible because the current 4.75% Fed Funds Rate would create huge losses on the bonds if sold. Thus, the FED can only wait for the bonds on its books to age out & expire.

WILL THE FED GET OUT OF ITS OWN CREATED MESS? HOW MANY PEOPLE WILL SUFFER IN THE RESULTING RECESSION?

On 3-2-23, Sales Force CEO Marc Beniof (along with many other corporate leaders) warned of a crash like 2008 or 2020. He claims his company is shifting from sales & deals to efficiency & profitability. Most companies are trying to lay off about 10% of their work force to show Wall Street they are hard nosed to increase profits so their stock price will not be hit in the recession to come.

PS: Complicated Words like seigniorage & quantitative easing are used by Wall Street & the FED to keep us in the dark & pretend that financial conniving is too complicated for working people to understand. In order to protect our livelihoods & family futures, we will have to wrestle with these ideas to block their greed & lies.

Ending the Supreme Immorality of Capitalism

by Howard Switzer GPTN — Published previously on Medium

This is an article from another of my favorite writers on Medium, D.K. Blaire. As she notes, it is a rant on the immoral human behavior of our corporate masters. She writes:

Democracy in these freedom-loving, liberal-touting states is merely theatrical. Having been hijacked by kleptocrats who shape public policy and discard regulations meant to protect the vulnerable, politics itself is an unabashed charade — one that often turns exhausted, weary populations against each other in a desperate bid to vent frustration.

Frustration, I would argue, from trying and survive in this intentionally unjust economy. I have to laugh at those carrying on about Russia being a kleptocracy now without any awareness that they themselves live in one. It is the nature of profit-motivated rulers and I am not referring to what we call "our government," which is the thuggish minion of global capital. The governing factor is money, it has been pointed out many times and yet people will talk all around it never hitting the nail on the head. Money controls what happens and those who control the money control what happens, they control public and corporate policy.

The Princeton Study by Gilens and Page nailed it, finding that from 2009 to 2014, the 200 most politically active companies, corporate profit centers for the banks, in the U.S. spent $5.8 billion influencing our government with lobbying and campaign contributions. Those same companies got $4.4 trillion in taxpayer support — a 750% return on their investment.

In fact, the banks learned long ago, as far back as the 1600s, that by far their most profitable investments were in governments. Using war debt, the banks gradually got governments to give them control of their monetary systems, giving up their sovereignty. They set up a central bank for each country for management purposes. The wars are all banker’s wars, have been for a long time. When you control a government you can send it to war, very profitable for the banks.

A conspiracy? Not at all, they are merely pursuing their economic interests which is maximizing profits and they are ruthless in their pursuit of power which makes them dangerous. But in protecting and extending this power, there have been many conspiracies. Money is more about power than it is economics.

So, what is the root of the immoral human behavior of our corporate masters? This has also been revealed through research on the psychological consequences of money, referring to the usury-money we all use, the privately controlled monetary system that has been in place for over 300 years. One of the most revealing experiments was one in which two classrooms of students were given a quiz full of ambiguous questions. On the wall of one classroom was a picture of a Federal Reserve Note, a dollar bill. In the other classroom was a photo of a Cowrie shell, a seashell. In the room with the dollar bill, they found students with heads down diligently taking the quiz, did not ask for help and were unfriendly if asked for help and stayed far apart. In the other classroom they found students had moved closer together and were laughing and discussing the quiz questions.

Note that both the dollar bill and the cowrie shell have been used as money, as an exchange medium. The difference is in how, by whom, and for what, they are issued. Are they issued for the benefit of free economic exchange or are they issued for private profit and control? That is the difference. And it reveals that we can change the world in a positive way pretty fast if we were to change the money system. In fact the legislation required to change the system has already been written and was introduced to Congress in 2011. Now we need to elect a government dedicated to the public interest that will pass this legislation and begin to restore our ecology and heal our society, all of which is possible. All we lack is the broad based understanding of the problem/solution and the agreement that we must change the system.