How do banks steal the fruit of the people’s labor?

by Mary Sanderson, GPWI

How does that happen?

A couple questions have dogged me since 1958 when my Dad started warning us kids that we better get an education, because the farm would sooner or later be lost to the bank. It was an all too common story for millions of farmers.

My kid-mind questions: Can a bank simply take away the fruit of people’s labor? How does that happen?

In 2017 I learned it happens because banks are the ones who create the money, when they lend their only purpose is to become big and powerful by skimming away the fruit of everyone’s labor all the time. Guess what? GPUS is the only party, maybe in the world, to promote a sane money creation system in its platform. I’ve been a member of the Banking & Monetary Reform committee since 2018. The historically grounded NEED Act, existing legislation introduced in 2011, makes it possible to heal ourselves and stop wars! Indeed, it is a big goal, but big problems require big solutions. We have multiple crises converging and this has the potential to fund all of them.

My dad used to say money is like manure. It’s only good when you spread it around! In this bizarre world where money and wealth constantly flow from the edges to the financial centers, I invite you to two human-scale money projects aimed at spreading wealth around - The TimeBank and local currencies movement and Public Banking

Local currencies and Timebanks are hands-on projects that let people create wealth and exchange services locally, outside the dollar system. With Timebanks we can compensate caring, even while the dollar system beats us down.

Learning how monies, by design can serve or exploit and designing your own local currency today is an important regenerative practice, like preserving food and protecting water. Two great resources on local currencies are the work of Silvio Gesell and the movie Shillings from Heaven which is the true story of WORGL Austria’s amazing stamp scrip in the 1930’s.

Public Banking is more political. It works to legislate state and regional banks that would try to turn that same, dominant, bank credit system to public purpose. Today there are strong campaigns in Massachusetts, Pennsylvania and California.

Both these projects nurture citizens’ agency in problem solving and creating the world we dream.

Here are 3 ways your participation makes a difference.

-

Local currencies and public banks both REQUIRE widespread participation, like everything related to true self-governance. Joining with others to create something helpful is a valuable practice.

-

Working to design a Timebank or to capitalize a public bank are experiences that raise everyone’s monetary literacy.

-

Public banking, local currencies and The GPUS sovereign money campaign all complement each other’s work.

Together we can create some happy future scenarios for humans on earth; less fire and pain, more caring, laughing and music.

SPREAD IT AROUND

Links: Timebank.org

Timebank wikipedia

Shillings from Heaven

The Money Fix clear clean picture of the money problem, except for the barter history nonsense near the beginning.

Film predates ’08 crisis, Graeber and the NEED Act.

Public Banking Institute

Lyla June history shows people can be keystone species enhancing the web of life

Silvio Gesell

To get back on a path to self-governance, and realistically imagine futures of fairness and healing, we humans need to identify root problems and participate in fixing them. Please consider that a big root problem that needs our attention is the extractive bank money system. It is the financial basis for capitalism, which the Marxists/Socialists so far ignore.

Besides the GP Greening the Dollar structural change, I’m here to invite your participation thru two other popular movements, that work more locally to challenge King Bank Money. They are the Local Currencies/Timebank movement and Public Banking.

The Green Party Green Dollar, sovereign, like Sue said, besides nurturing our undying dream of self-governance by requiring participation, besides helping everyone learn how money works vs how it needs to work, besides specifically serving the common good, not any faction, besides spreading itself around naturally rather than flowing to financial centers, Green Dollars can work with other strategies for stopping the inequality and destruction we humans have almost become accustomed to.

To see the money problem in a larger frame I’m going to talk about two other strong challenges to bank money and invite you to engage wherever your heart says. We all DO need to learn about the underlying money problem, though, if we mean to have even a prayer of healing planet, stopping wars, and re-circulating all the wealth and power hoarded among a tiny few guys worldwide.

A larger money problem sandbox to play in with your friends and neighbors.

Conclude:

We Invite you all to engage to replace the parasitic money system in any of these ways, but I must add here that The Green Dollar can also reasonably promise first of all to end war, and give us the ability to protect water, land and species. It deserves our attention.

Monetary Reform is a Foundation Issue

by Kevin McCormick, GPTX

A monetary system accomplishes three objectives: 1) the creation of money (a law designating the token), 2) the issuance of money (the political question of who gets the money first), and 3) the circulation of money (the economy that is mediated by money).

How these functions are accomplished is very important to the nature of society. The workings of the monetary system indirectly shape social and economic policies by making particular actions more or less feasible. Activities that are more easily funded will tend to exceed less easily funded activities and the nature of society is altered according to the monetary system design.

The Green Party monetary reform Greening the Dollar platform position makes Green Party policies such as environmental restoration, free or low tuition education, Medicare for all, and universal basic income much more feasible than under the present Federal Reserve system. By creating money without debt, the economic merits of programs will be determined by their systemic and social benefit and not by their ability to support interest payments and banking cartel profits. With the money system under the control of Congress it becomes a possibility to serve the public interest instead of the banking cartel agenda.

In contrast, the Federal Reserve System is designed around the agenda of the banking cartel. As noted, banks create money by creating debt and deposits. Banks issue money by deciding to whom and for what purpose they will make a loan. Circulation is partly accomplished by requiring repayment of the loan with interest and the resulting drive to acquire money to make those payments. Bank loans are made where there is collateral or to the wealthiest and government spending is required to circulate money to the lower economic classes.

The two quotes show the implications of the banking cartel debt-money system:

| Alexander Hamilton |

Frederick Soddy |

Every loan, which a Bank makes is, in its first shape, a credit given to the borrower on its books, . . The Borrower frequently, by a check or order, transfers his credit to some other person, to whom he has a payment to make, who, . . . [can] either convert it into cash, or pass it to some other hand, as an equivalent for it. And in this manner the credit keeps circulating, performing in every stage the office of money, . . .

Second Report on Public Credit |

The more profound students of money . . . have realized the enormous significance of this money power or technique and its key position in shaping the course of world events through the ages. . . . To allow it to become a source of revenue to private issuers is to create, first, a secret and illicit arm of the government and, last, a rival power strong enough ultimately to overthrow all other forms of government.

The Role of Money - Preface |

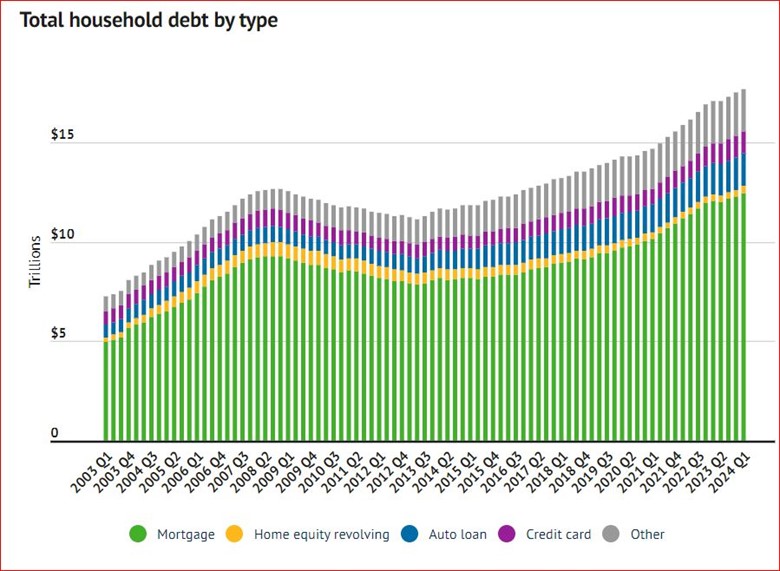

The banking cartel is perhaps the best organized special interest group in U.S. history. The nature of banking promotes organized and concerted actions. The “payment system” constantly coordinates bank accounts in all the banks in the system. Banks work together to promote economic activities that promote debt: mortgages, auto loans, credit cards, student loans, imperial warfare, etc. The banking cartel organization is so strong because its participants are paid with the very money the banking cartel creates. The corporations it finances provide career and investment opportunities, and supporters of the banking cartel agenda are rewarded with loans.

The privilege of creating loans funded by deposits which act as money is the central element of banking cartel power. I describe our society as the “banking cartel culture” because we are under the Federal Reserve Monetary System in which commercial banks create loans and deposits, with the deposits serving as the money supply. The banking cartel has created the consumer economy with planned obsolesce, excessive consumption of natural resources, pollution, and social inequality. To fully exploit this privilege the banking cartel structures its lending activities to create and sustain this constant fixation on money. Everything in the banking cartel culture is oriented around money. There is a constant emphasis on “economic growth,” continuous monetary inflation, and the monetary growth imperative. Everyone always needs more money. Since bank money (deposits) are created with debt there is always a shortage of money. This drives much of the behavior in our society.

It is not only the U.S. domestic society that is shaped by the banking cartel. The need for constant expansion likewise drives imperialism and the quest for dominance of resources around the world. The book Confessions of an Economic Hit Man by John Perkins details how the banking cartel creates an empire by usurping foreign governments and trapping them with debt. Alexander Hamilton also noted the critical link between a banking cartel monetary system and imperialism in his letter of September 3, 1780:

The invention of banks on the modern principle [creating loans and deposits] originated in Venice. There the public and a company of monied men are mutually concerned. The Bank of England unites public authority and faith with private credit; and hence we see what a vast fabric of paper credit is raised on a visionary basis. Had it not been for this, England would never have found sufficient funds to carry on her wars; but with the help of this she has done and is doing wonders. From Alexander Hamilton to James Duane

Just as the British empire was a project of the Bank of England and English financial royalty, the United States empire is a project of the Federal Reserve banking cartel and Wall Street corporations. An informative history is presented in the video series Origins of the US empire and deep state

It is important to realize that the nature of the monetary system is a foundational or fundamental political issue. The Green Party platform policies are quite unlikely to be achieved under the Federal Reserve monetary system. This is due to the Green Party platform policies being oriented to the overall wellbeing of society — people over profits and environmental restoration. It is quite difficult or impossible to imagine these policies in terms of loan collateral and income streams designed to support interest payments, which is required under the Federal Reserve system. Therefore, it is important for every advocate of Green Party platform policies to understand that the present Federal Reserve system is a major obstacle to progress on social and environmental issues.

The three basic elements of monetary reform are:

-

Nationalize the Federal Reserve System, by the government buying all shares of the twelve Federal Reserve Banks, from the private member commercial banks. This makes the Federal Reserve Banks part of our government, precisely what most of us mistakenly believe it is now.

-

End bank creation of money. Banks will only lend money that already exists, exactly what most people mistakenly believe happens now.

-

The federal government creates and spends money into the economy. This is the new US Money, issued without inflation or deflation for the needs of the nation and its people. Again, what many mistakenly think is now happening.

Modern societies require a monetary system to enable coordinated activities among people with different locations, skills, affiliations, etc. We need to advocate for reform of the monetary system to enable the transformation to a just and sustainable society.

Our Unsustainable Debt-based Monetary System

by Rita Jacobs GPWI

Sinking under the weight of debt.

Let’s pretend a government body has the right to create money as part of its Constitution, and instead delegates that authority to some private enterprise. However, it does not allow the enterprise to keep the money it creates, but only allow it to loan out the money. And when the principal money is paid back it must be destroyed, but the enterprise may retain the interest income. The government makes little or no restrictions on where that money can be loaned.

How might the members of that enterprise carry out this delegated privilege. They begin exercising their new power by making large interest-bearing loans to their favorite corporations that they have helped to build, and also by providing mortgage loans to citizens to assist them in buying homes. They require a mortgage that would allow the enterprise to take and keep the property if the borrowers default in their payments.

The money that the enterprise is creating eventually circulates in the economy and is used as a means of exchange for those persons within the country who buy and sell things to one another. And some of the circulating new money must of course also be used to pay the interest on the earlier loans that the enterprise has made, as no one in this system seems concerned about where the money comes from to pay the interest on these loans. Eventually the debt that has built up is about four times the amount of money in circulation.

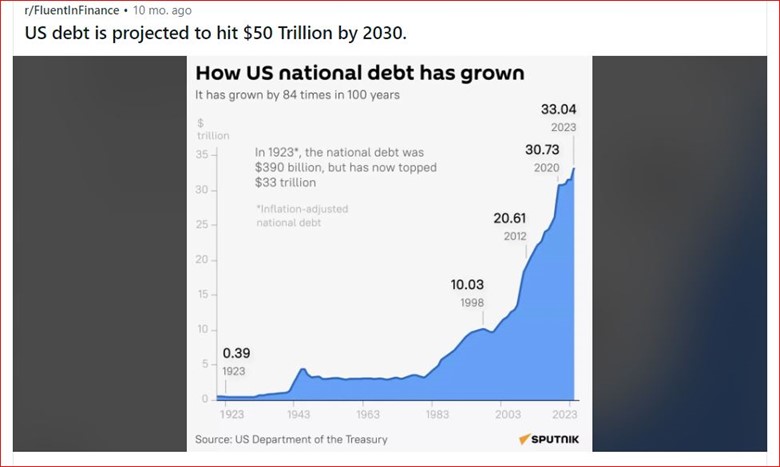

So, as this system remains in effect for a century or so, the debts keep stacking up, and the amount of new money in the form of loans must be created in greater quantities to make money available to pay the interest on the accumulated debt. Debt and interest expenses just keep growing.

Yes, I’m talking about our own money system. Where has this system put us today?

Besides the government debt of $35 trillion, personal debt in the form of past-due medical bills, back rent, student debt and other debt. amounts to about $17 trillion. This debt-money system is global, and global debt has reached about $315 trillion.

So how does that affect the present circumstances in the US? Right now the situation is worse than it was before the crash in 2008. The foreclosure crisis resulted in 3.8 million foreclosures between 2007 and 2010. It is estimated that 8 million people lost their homes.

The minimum wage in the US has remained at $7.25 per hour since 2009.

The median price of a starter home is $420,000.

The birth rate in the US has fallen.

Life expectancy has fallen.

Millions of Americans have no health insurance. The US spends billions on military aid and equipment, dropping bombs daily on multiple countries. Yes we have an immigration problem — that mainly stems from our own government interference in Latin American countries under the pretense of spreading democracy.

Our government has left young people with crippling student debt, low-paying jobs, unaffordable rent, a crumbling national infrastructure, in addition to a national debt now at $35 trillion dollars. The government did this so big corporations would have more access to resources in the countries where the government claims falsely to be spreading democracy. The policies of the government funnel wealth to big corporations, elected officials and the billionaires it created. All the while the banksters were given a privilege of creating money out of thin air on which they collect compound interest. It’s time to wake up folks. Money is power and has overtaken any semblance of morality in those who run this country.

The country has never recovered from the crash in 2008, referred to as the Great Recession. The next crash that comes will not be called a recession. It will be far worse.